Property security financing try an additional home loan taken out towards a house that utilizes the existing security about property just like the security on loan. Consumers play with house security loans while they permit individuals when deciding to take cash out of their functions as opposed to refinancing their very first mortgage loans and this is expensive, time-drinking and value thousands of dollars much more in total attract bills along the lifetime of the newest home loan.

In case there is a standard or foreclosure, the brand new holder of one’s first-mortgage try paid off first ahead of the latest manager of second mortgage or domestic security loan.

Borrowers are able to use the proceeds from a property collateral financing to possess numerous objectives also home restorations otherwise renovation, paying off high interest rate personal credit card debt otherwise buying an excellent second domestic or money spent. In fact, lenders dont lay restrictions on how you spend family security loan fund.

The interest rate into the a property guarantee loan is usually step one.0% to dos.5% greater than the present day business rate getting an initial mortgage, according to the name of your own financing. Brand new prolonged the borrowed funds title, the greater the interest rate. Additionally, the pace for financing that have a mixed mortgage-to-worthy of (CLTV) ratio more than 80% will be 0.5% – 2.0% higher than the pace toward that loan having a great CLTV proportion below 80%, with regards to the name of the mortgage. The speed for the funds to possess non-holder occupied attributes should be step 3.0% – 4.0% higher than the interest rate on owner occupied attributes as well as the lender also can limit the financing term so you’re able to below 12 many years.

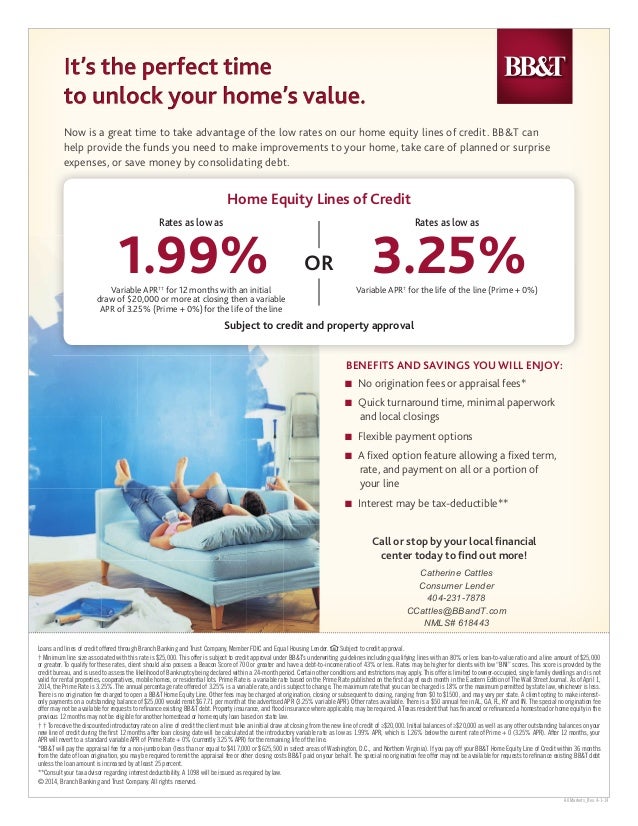

For a house guarantee mortgage, loan providers generally charge a processing payment and you will as well as the borrower was also necessary to shell out 3rd party settlement costs for instance the assessment payment. In some cases the lender often discount certain settlement costs very make sure you query loan providers regarding the potential discounts and rebates when you search for a house guarantee loan.

Funds are provided of the antique loan providers particularly financial institutions, home loan financial institutions, home loans and you can borrowing from the bank partnership which have borrowing unions giving particularly competitive terminology. We recommend that you get in touch with multiple lenders on desk less than to find the household guarantee financing into the lower interest rate and you can fees.

A house guarantee mortgage can be organized just like the a fixed speed financing, with the interest rate and you can called for monthly payment existence constant more than the word of loan. Lenders provide house security finance which have regards to 5, ten, a dozen, fifteen otherwise 2 decades that have 15 years being the popular identity. Though it can be a bit strange, some lenders also provide household equity financing that are prepared equivalent so you can adjustable speed mortgage loans, therefore, the rate of interest and monthly payment is subject to transform, and you can possibly raise, along the longevity of the borrowed funds. If you were to think rates are going to increase in the new upcoming its best if you get a fixed speed mortgage so that you eliminate the risk that payment goes up down the road.

In order to get a house equity financing, new debtor need adequate collateral in the assets to support the newest joint mortgage-to-really worth (CLTV) ratio of your own first mortgage while the domestic collateral mortgage. CLTV ratio translates to the total of all mortgage loans with the an excellent assets split up because of the projected worth of the house given that determined because of the assessment report.

Please be aware you to definitely borrowing unions possess subscription eligibility requirements thus perhaps not all consumers

Loan providers usually enable a maximum CLTV proportion out-of 80%, which is based on the a great prominent balance of basic mortgage plus the amount of our home collateral financing. Such as for instance, to possess a house that is valued within $two hundred,100 if for example the dominant harmony into borrower’s first-mortgage are $100,100000 together with borrower takes out an effective $sixty,000 household guarantee mortgage, this new CLTV proportion is actually 80% (($100,100000 (first mortgage balance) + $sixty,100000 (domestic security mortgage)) / $2 hundred,000 (worth of) = 80% combined mortgage-to-worth ratio).

The interest rate and charge to have family security financing vary by bank and business requirements

Although many old-fashioned loan providers use the 80% CLTV proportion limit so you’re able to family guarantee finance some banking institutions and you will borrowing unions bring a whole lot more competitive conditions in addition to rates around ninety%. On top of that, the speed to have a mortgage which have a CLTV ratio higher than 80% is generally more than a loan with a reduced ratio and you will the financial institution ount of the financing.

The newest CLTV proportion limit may will vary of the possessions form of. Some loan providers incorporate an excellent 70% proportion limitation to possess apartments and an effective 70% – 80% restriction having low-proprietor occupied properties (up to five products). Take note a large number of loan providers dont offer household security funds towards the non-manager occupied functions and lenders that do generally charge an effective large interest rate and you can reduce term of the loan.

You need sites such as for example Realtor, Trulia and you can Zillow to examine an estimated worth of your residence and you may lenders also can fool around with proprietary valuation products.

The house really worth quotes available with the web sites try unofficial however, are a good idea into the evaluating if you have enough guarantee in order to get a property security financing. Just after examining web sites, consult with your financial to decide in the event it makes sense in order to happen the amount of time and you will costs required to submit an application for the loan. Once you submit an application for a property security financing, the lending company purchases an appraisal statement out-of an official appraiser in order to dictate the genuine reasonable sector property value familiar with calculate brand new CLTV ratio. If for example the possessions appraises similar to or over the imagine worth of, you are in a standing so you’re able to be eligible for the borrowed funds. In case the assets appraises to have lower than the newest requested worthy of, your ount or you is almost certainly not recognized.

To be eligible for a property equity financing, the fresh debtor have to meet the lender’s qualification criteria. House equity loan criteria are like the qualification advice for home financing while focusing on a great borrower’s credit rating and obligations-to-income ratio. Debt-to-income ratio stands for why not try here the maximum appropriate percentage of a borrower’s monthly revenues which might be spent on full month-to-month property expenses, with the mortgage payment, domestic collateral financing commission, property taxes and you will home insurance in addition to most other monthly personal debt costs to possess auto loans, handmade cards, student education loans and you may spousal service. According to the bank and you will CLTV proportion, lender qualification recommendations typically ensure it is an optimum loans-to-earnings proportion out-of 55%. Loan providers may make it large debt-to-money rates in the event the CLTV ratio try less than 65%.

Loan providers plus opinion your credit score and you can employment standing once you sign up for property equity mortgage. Significant changes in your very own otherwise monetary profile, like in case the credit score refuted or if you changed efforts, get impression your ability in order to qualify, even although you is current in your financial or never overlooked an installment. People also need meet with the minimum credit rating required by this new bank.