What exactly is a bridge financing or intermediate financing? You tend to you need a link loan once you pick a separate domestic one which just possess marketed the old that. This really is financing you have got saved up in your home, but have not yet understood.

People choose to choose the fantasy domestic just before he’s were able to sell its most recent family, anyone else may possibly not be in a position to promote the home as easily while they got consider. Therefore, youre left with several property to possess a brief period. Then we are able to help you with a thus-entitled bridge financing (intermediate financial support), that’s in addition to any mortgage towards present property. The new link mortgage was payment-free, therefore the advantageous site economic burden cannot getting too heavy. The preferred is you get a connection financing more 6 months, for which you only pay desire about this mortgage. For those who have perhaps not were able to promote you most recent assets inside 6 months, new connection loan are going to be expanded.

- When you need to find an alternate domestic before you offer the only you reside now

- If you have sold property and tend to be planning get a unique family, but i have not yet received funds into the house sold. Some people want to have the handover out-of a classic household well in advance so they really has actually enough time to discover another type of household.

All our properties are free to you personally because a consumer, while the we have been remunerated because of the banks i focus on. The offer otherwise even offers we present to you are low-joining.

Personal realize-upwards is key word with us. You earn a long-term coach just who observes your financial photo, with the intention that we are able to give you advice towards the alter you must know to get the reduced you’ll pricing on your money.

While the 1993, you will find helped many users find the appropriate bank and you can financing product, without comparable company in the Norway keeps all of our band of people into the capital.

The length of time do you very own a couple residential property?

The newest bridge financing usually has a phrase of up to six months into possibility of a few months expansion. This means that you can own two property for as much as approx. 6 months. Once you or perhaps the broker get the settlement on household you have got sold, the latest bridge loan was repaid towards financial. Into the the fresh normal home loan, the bank becomes safeguards regarding new home.

Needing to stand having two belongings and two mortgages songs basically very costly. If the, like, the residence is purchased to possess five billion, in addition to dated you’ve got financing away from about three billion, you are in obligations from 7 million within this phase. However the expenditures do not have to getting as high as it may basic sound like, because you pay just appeal on connection mortgage. In the event your mortgage on the a preexisting family has coverage in this 60%, which financing can be generated rather than installment payments when you look at the marketing months.

The cost of this new bridge mortgage will ergo not overturn brand new weight, even though you features a top financing during this period. It is that which you at some point arrive at sell your property having, that has many to say to the savings about coming.

Exactly how much are you willing to obtain?

Valuation out of a bona fide house broker or perhaps the real sales price of the current home is made use of while the a grounds to have calculating just how much you can get inside a connection financing, after that existing mortgages and you may brokerage costs are subtracted. Complete obligations and you will security must upcoming end up being below 85% of one’s full value of each other house.

When you yourself have currently marketed your house, however passed it off to the fresh manager before you can control your household, the financial institution normally calculate up to 100% of your worth of your house/conversion process price. As a result you could acquire 100% of your restricted guarantee, without having the latest financing and you can brokerage costs.

You are helped by us to the entire process

For many who currently own a home, we can help you imagine the worth of that it, and you can assistance to guidance on an experienced real estate agent within the your area. To the quickest you’ll be able to instance operating, mount the income tax go back, previous pay slip, valuation, FINN code and just about every other associated records.

I collaborate with many different finance companies and you can credit establishments, which features a great amount of knowledge about the brand new alternatives and products that exist. Together we remark the money you owe and get a maximum solution to you personally.

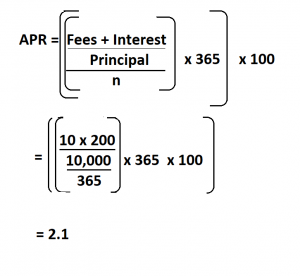

Financing example:

A link financing of dos five-hundred 100 factory. NOK with eff. rente cuatro,85%, have a tendency to during a period of six months has actually an installment of approx.: 56 772,- NOK . Total dos 556 772,- NOK