As draw period finishes, the latest cost several months begins. During this period, you’ll have to shell out attention and principal on the amount of the credit line which is a great. When you have paid back the new personal line of credit by the time new draw period closes, you might not need to pay something.

However, so long as have the ability to accessibility the newest line of borrowing from the bank during this time. Most HELOCs has actually a cost term of twenty years, many loan providers might have quicker (or lengthened) words.

What’s a profit-away re-finance?

An earnings-away re-finance, likewise, is a kind of mortgage refinancing enabling you to definitely convert a few of your house’s guarantee with the dollars. You are fundamentally replacement the brand new financial with a new financing and getting a much bigger matter https://availableloan.net/payday-loans-wi/.

An element of the arises from the dollars-away refinance loan is employed to pay off people an excellent home loan equilibrium on your own current financing. The other matter are paid off to you personally in direct the proper execution from a lump sum payment. Like with a beneficial HELOC, there is no maximum precisely how you can use the bucks.

This is why, brand new guarantee you have of your property commonly drop off, but you will features money on hand without having to take-out a personal loan otherwise start another type of personal line of credit. A profit-away refinance differs from a classic home refinance, what your location is basically merely getting a different mortgage locate an effective greatest interest rate or extended installment months. If you’re looking to own a straightforward conventional re-finance plus don’t you want currency initial, here are a few our selections to find the best financial re-finance solutions.

Why does an earnings-away re-finance functions?

When you get a finances-away re-finance, the lending company requires a special house appraisal to choose their house’s well worth as well as how far equity you’ve got. Most mortgage lenders will demand you keep at the least 20% security yourself once you re-finance, and therefore he’s prepared to accept a finances-aside number to all in all, 80% of your own collateral. This really is called with that loan-to-worthy of ratio regarding 80%.

Back once again to the previous analogy, what if the person with $150,000 inside the equity inside their $250,000 would be able to get a max cash-aside number of $120,000 (80% off $150,000). When they expected simply $50,000 inside the cash to possess an emergency medical expenses, they’d have the ability to re-finance and possess $100,000 remaining in household collateral.

It is essential to remember that choosing an earnings-out re-finance does not mean the old mortgage is actually modified. Alternatively, the mortgage was substituted for an entirely the latest loan. In the event the interest levels has actually grown because you shielded your previous financial, you will likely end up paying alot more monthly than simply you probably did ahead of. Whenever you are a timeless refinance normally lowers your own monthly mortgage payment, a money-away re-finance tends to have the opposite impact.

Still undecided hence choice is best for you? If you’re an effective HELOC and cash-aside refinancing both make use of domestic collateral, they might be organized most in a different way and get other categories of masters and you can disadvantages. Here is that which you to learn about the distinctions ranging from an excellent HELOC and you will a cash-away re-finance.

Mortgage framework

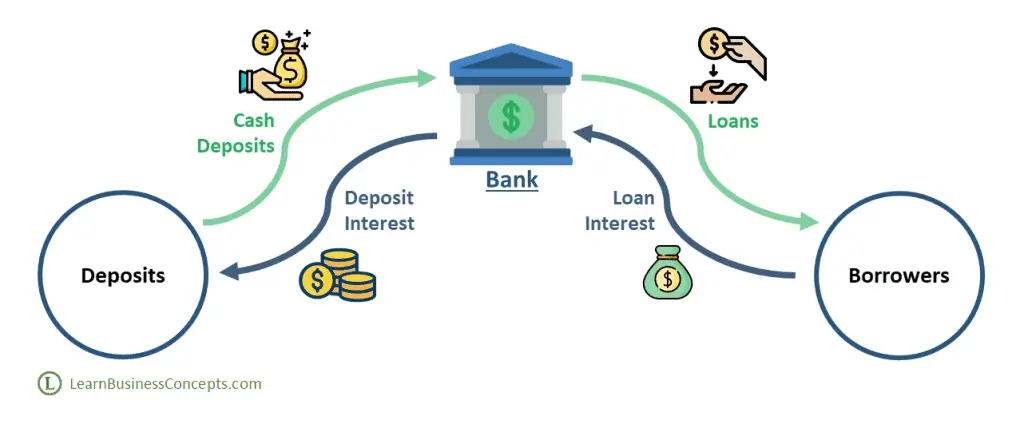

If you’re HELOCs and cash-out refinancing may appear complicated at first, once you understand the fundamentals, the essential difference between the two is fairly easy. A great way to compare a HELOC and money-aside refi should be to think about credit cards versus. debit cards.

An effective HELOC operates particularly a credit card, giving you a line of credit with a limit, and obtain as much as you to limit normally just like the you’d like on assented-on identity. HELOCs and credit cards try one another rotating personal lines of credit. A great HELOC doesn’t alter your top home loan but is believed a beneficial brand of additional financial.