So how do you become a member? You will likely must be a member of a group to explore a cards union and its own functions, but it is much easier than simply it sounds. Some cater to staff who do work at the same business. While some user having churches otherwise universities. You may want to personal loan bad credit be able to signup if a family member is already a part.

Something you should bear in mind on the borrowing unions is the fact they’re smaller than of a lot banking companies. So there can be a lot fewer towns, ATMs, charge card alternatives and mastercard advantages apps. 1

The FDIC doesn’t guarantee credit unions, however, the Federal Borrowing from the bank Commitment Management (NCUA) supplies the exact same form of coverage to federally chartered borrowing unions.

Online-only banking Some banks now provide on the web services, there are even finance companies that exist only on the internet. That have all the way down working costs, people coupons can often be enacted with each other to consumers regarding variety of all the way down month-to-month costs or even more interest levels into the coupons accounts.

Cell banking Particular banks assist you the option of banking because of the cellular phone. For folks who phone call away from your bank’s regular business hours, you might have to explore an automatic program that simply take you through the steps needed to complete their purchases.

Banking services

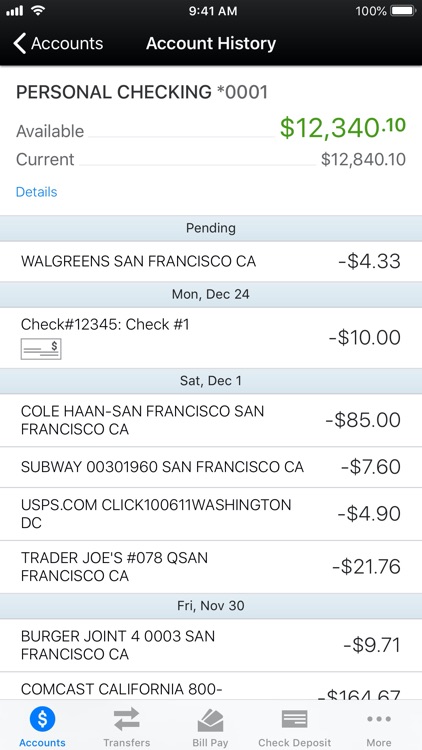

Checking account When you’re thinking about just what services banks offer, a bank checking account could be the the first thing you consider. It prominent brand of membership makes you shop and you can do the cash you employ having relaxed using. Immediately following establish, you can utilize an excellent debit card otherwise check, which takes money directly from your account, to cover everything from groceries so you’re able to energy to bills. You can also get dollars from an automatic teller machine or department using their debit credit and you may PIN, a unique password you decide to include your account.

Checking account A checking account helps you separate the cash we should conserve regarding the money you ought to spend. For the majority, it’s a better way to focus to your an objective, eg protecting getting renovations or building a crisis finance. Extremely discounts levels is also automatically move money from your own bank account into the bank account each month, you don’t have even to take into consideration doing it yourself. An added bonus would be the fact banking companies usually shell out your notice to your discounts account. That is 100 % free money that may help you reach your financial wants a little shorter.

Currency market account (MMA) A keen MMA is a type of checking account very often will pay higher interest levels than just a frequent savings account. The greater you devote aside, the greater amount of you might be in a position to secure. One thing to recall? There may additionally be limitations precisely how of several distributions you could build each month.

Certification off put (CD) A great Video game is a type of checking account where you concur to keep your cash in this new make up a certain amount of time. The amount of time can differ, however, words will start around only 6 months in order to provided 5 years.

Just telephone call an unknown number and you can keep in touch with a lender worker to do things like check your equilibrium, import currency, pay the bills otherwise handle other banking needs

The newest extended it can save you, the greater number of the new return. You can decide to withdraw your bank account very early. not, there can be a punishment getting withdrawal before avoid of your Cd identity.

Debit credit Which have good debit credit, you could pay for everyday costs with only a good swipe (and usually your PIN). The bucks may come right from the bank account so there clearly was need not hold cash if you would like never to. Along with, when your debit cards is actually lost or stolen, you might not be the cause of not authorized purchases for folks who declaration they regularly. Shed cash, sadly, might be lost forever.