11 Positives and negatives out of a teaspoon Financing

Thrift Coupons Preparations or Teaspoon are designed to help federal employees additionally the military to take some of the same positives the latest private field goes into an excellent 401 (k) package, even so they can borrow cash off their package. You can ask yourself in regards to the advantages and disadvantages of lending up against a tsp and should it be wise.

This article will lookup particularly at those individuals advantages and disadvantages to help you help you understand the positives otherwise drawbacks of getting a teaspoon financing.

Pro: Teaspoon Loan Rate

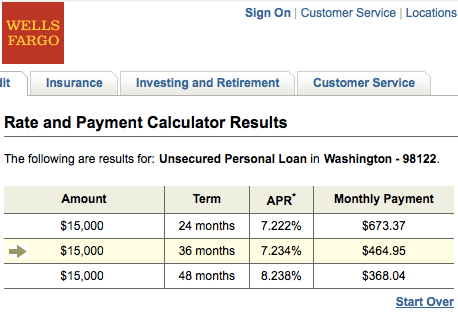

A tsp loan comes with the benefit of that have a low interest rate speed versus a great many other sort of funds. The interest rate can be lower than a couple of percent. Other unsecured loans readily available given that unsecured loans routinely have a keen rate of interest out of 2.49% so you can %.

Current Teaspoon Financing Interest

The present day Teaspoon financing rate was step 1.50%, the latest speed with the a grams Fund, that’s generally the interest based on the Teaspoon mortgage.

Pro: Mortgage Number

You can typically use any count ranging from $1000 and $50,000 for those who have adequate on your membership to pay for it. A good $10,000 Teaspoon loan at step one.50% more than five years would have payments out-of $ per month having a complete interest repaid out-of $.

The same $10,000 mortgage lent out of an alternate lender that have a speed out of %.99% might have costs away from $ monthly. It count is just about a great $20 change.

A similar financing more 5 years out of a loan provider at the large interest rate out-of % will have money out of $.

You could potentially check out a loan calculator at that webpages and go into the terms and conditions, and it surely will inform you the quantity your fee could well be: Loan calculator (calculatorsoup) . You may access a finance calculator at the Tsp loan webpages at .

Pro: Costs by the Payroll Deduction

An additional benefit off a tsp financing is you can provides the newest payment easily build you need to take out of your salary each shell out months.

Whether or not, you could establish repayments to be taken straight-out regarding your money at the most lenders otherwise arranged a monthly automated on the internet commission paid monthly.

Pro: No Penalty for Early Installment

You will find a couple positive points to using a supplementary commission on the mortgage. You to definitely, you could pay it back very early no expanded need to worry about the mortgage. Next, you can lso are-amortize the lower equilibrium and lower your own monthly installments.

Pro: No Credit assessment

An advantageous asset of a teaspoon mortgage is that there are not any borrowing monitors. Your meet the requirements as long as you meet up with the adopting the requirements:

- Provides about $1000 in your account.

- You don’t need to one court requests up against your.

- You are in productive pay condition.

- It’s been about two months from the time your paid down the history Teaspoon financing.

- Youre nevertheless currently employed by the federal government.

- About 1 year possess passed from when your past took a nonexempt shipment out of your Tsp account.

You don’t need to to add a lot of documentation, proof money, or any other pointers as you create other lenders.

Con: Software Fee

A drawback more than a number of other funds is that they fees a beneficial $fifty application handling payment yourself from your own loan money when you have made your loan loans. Many other loan providers dont costs a control commission when planning on taking the application for a financial loan.

Con: 90-Day Repayment should your Get-off Your job

Maybe among worst downsides of getting a tsp financing is if you log off your own federal solution occupations before settling the borrowed funds in full, you have just 90 days to repay the loan if you you should never exercise otherwise don’t meet up with the due date the complete mortgage was advertised toward Internal revenue service just like the money.

It 90-date cost causes a difficulty should you have to go or move around in or take too much time to obtain a separate position.

Con: Quick Financing Terminology

Generally speaking, a different sort of drawback of going a teaspoon loan is that the term lengths usually are 15 years or shorter to repay them. Towards larger loans regarding say $50,000, this can result in the payments apparently higher or take an enormous amount out of your month-to-month finances to live.

Con: Overlooked Income

While using a teaspoon loan, you borrow on your upcoming and you will scale back disregard the increases to have senior years. So it loss will most likely not look like a problem as you are younger nevertheless operating, however it might possibly be devastating once you retire if you fail to afford to pay-all their bills.

Con: Loan Restrictions

If you plan for the using the loans purchasing a property, you are not a lot of regarding matter you can spend while the restriction you might borrow on a teaspoon loan are $fifty,000 immediately after which only when you have got you to amount obtainable in your account.

It may, although not, safeguards their settlement costs and a down-payment into the specific homes. This new median house price in america is more than $350,000, and that means you will demand a moment mortgage or big deals to help you pick one ily normally.

Con: A teaspoon Financing Doesn’t Build Borrowing

Unlike very money, a teaspoon financing will not improve your credit score. Your payments aren’t claimed to the credit agency. If you would like generate borrowing, that is worthy of giving believe.

In conclusion

You can find one another advantages and disadvantages to adopt prior to taking out a teaspoon mortgage. You ought to carefully envision one another and decide based on what you think do you consider is best for your situation. Factors for example jobs balances and you may years are necessary points to consider as the cost try swift for many who get off their government employment.