Many people gets a traditional mortgage later in daily life, or become carrying its expenses earlier the working many years, causing strain more its requisite monthly mortgage repayments and you can absolutely nothing later years earnings. If that sounds like you roentgen client , a face-to-face financial may be a good idea for them to ease some of the load and allow them to enjoy thei roentgen old age decades.

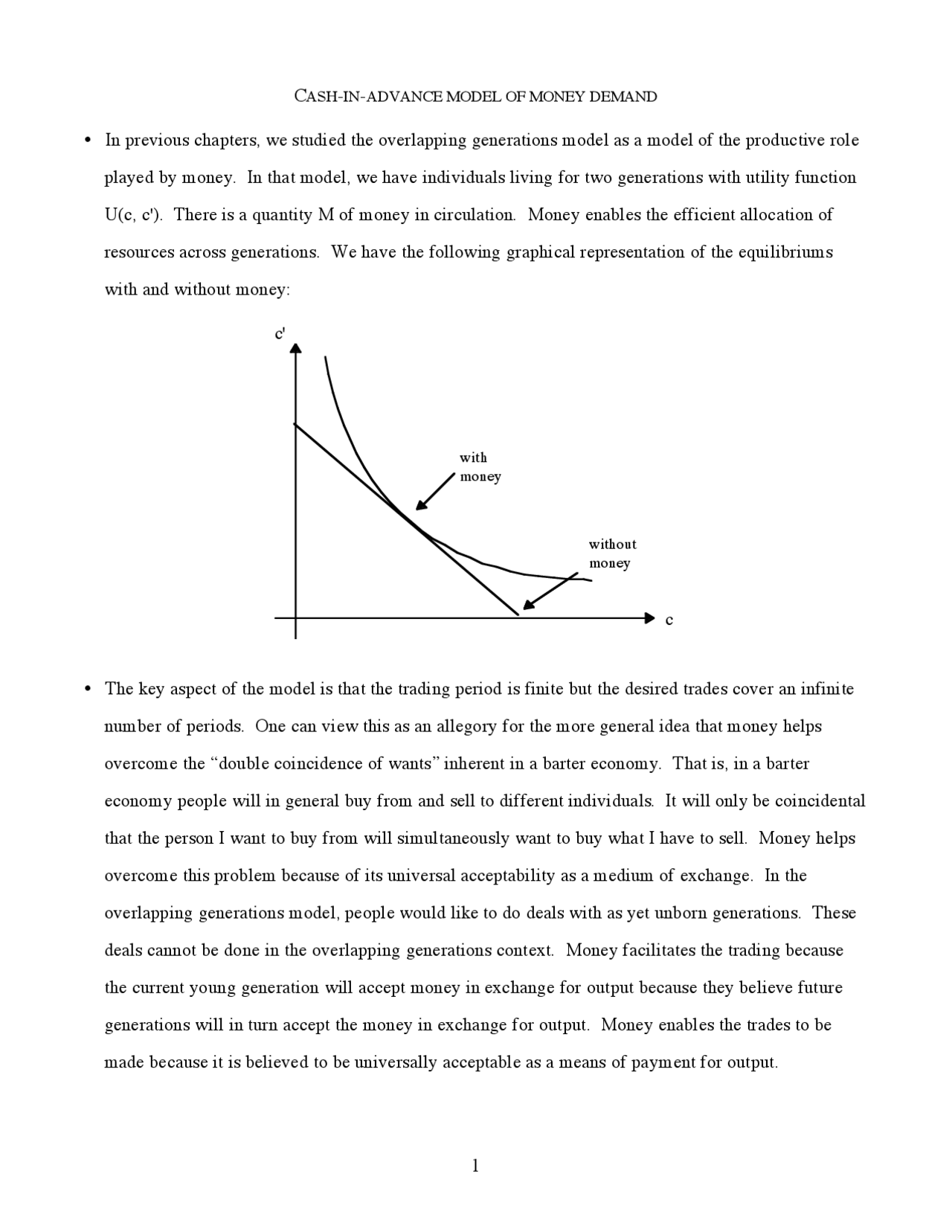

Reverse Financial

Unlike a normal financial, particular contrary mortgage loans possess backing regarding government establishments, including the Government Homes Government (FHA). Brand new FHA is only going to guarantee a property security transformation mortgage otherwise HECM loan. This type of loans make up over fifty percent of your contrary mortgage erica, once the old-age grows more high priced.

Opposite Home loan Standards

In the event your homeowner’s loans government service recommends them to get a good reverse home loan, they might already meet the qualifications. not, when they have to proceed themselves, why don’t we remark some standard criteria that must be found:

- The newest borrower have to be about 62 yrs old having a HECM.

- New borrower must be the titleholder.

- The fresh new borrower must have a lot of collateral within home.

- They have to be in a position to spend the money for ongoing possessions taxes, homeowners’ insurance rates, and you may any HOA fees regarding mortgage period.

- The debtor need to very own the house or property and you will inhabit it its primary household (definition it reside at assets repeatedly for 6 months and you will 1 day per year).

- They should receive an acceptable appraisal (done from inside the loan application process).

Style of Contrary Mortgages

Understanding which type of reverse home loan discover makes good distinction . Hundreds of lenders along side Us provide reverse mortgages, here are pair designs so you can acquaint the consumer which have.

Single Objective Opposite Financial

Single-objective opposite mortgage loans allow it to be elderly people to cash advance Terryville attract a lump sum payment number off their equity to have one, agreed-abreast of mission. They can make use of these fund for domestic fixes, mortgage insurance rates payments, otherwise fulfillment off property taxes.

When the individuals explore its reverse financial funds to possess a different purpose, they are accountable for ripoff. State government organizations and you will nonprofits straight back solitary-mission contrary mortgage loans, so borrowers see lower fees and you may rates of interest.

Household Equity Conversion Mortgages

A property guarantee sales home mortgage provides support on the Department of Houses and Urban Creativity, plus they are federally covered. This new debtor are able to use the funds using their HECM for goal.

The government demands some one obtaining property security conversion mortgage to undergo counseling having a tiny commission, that they will pay employing loan proceeds. These types of guidance training answer questions, for example How does an opposite home loan work? Was an opposing home loan smart? and Ought i find a great deal more costs-productive reverse mortgage solutions?

Whenever a lender approves the brand new homeowner’s HECM, they’re able to select from a variety of repayment choices. Such selection were a period percentage arrangement, in which the financial provides the borrower a concurred-on lump sum per month provided they real time yourself, and you will a term option that provides them cash commission s getting a beneficial pre-lay timeframe. Almost every other disbursement selection could be offered.

Proprietary Contrary Mortgage loans

An exclusive contrary mortgage helps people who have huge estates obtain house guarantee money one sidestep the newest $step one,149,825 credit restrict regarding HECMs.

If your debtor chooses which route, they don’t keeps government insurance rates, and therefore they’re in a position to borrow much more without paying home loan premiums. The facts with the opposite home loan utilizes the attention cost it rating, how old they are, in addition to their earnings class.

Speak with your account Manager doing a side-by-front side evaluation away from a vintage and you will opposite financial solution to assist figure out which mortgage is useful for the consumer.