The interest roll-up. However the Santander lives financial costs are very reduced however during the . One of many troubles is the state pros could well be impacted. You’re omitted out of some form checked-out gurus.

This new Santander existence mortgage rates are step 3.21% fixed for lifetime to your safeguards of your zero negative collateral make certain as well as the capability to build voluntary costs.

Who qualifies for life financial Santander?

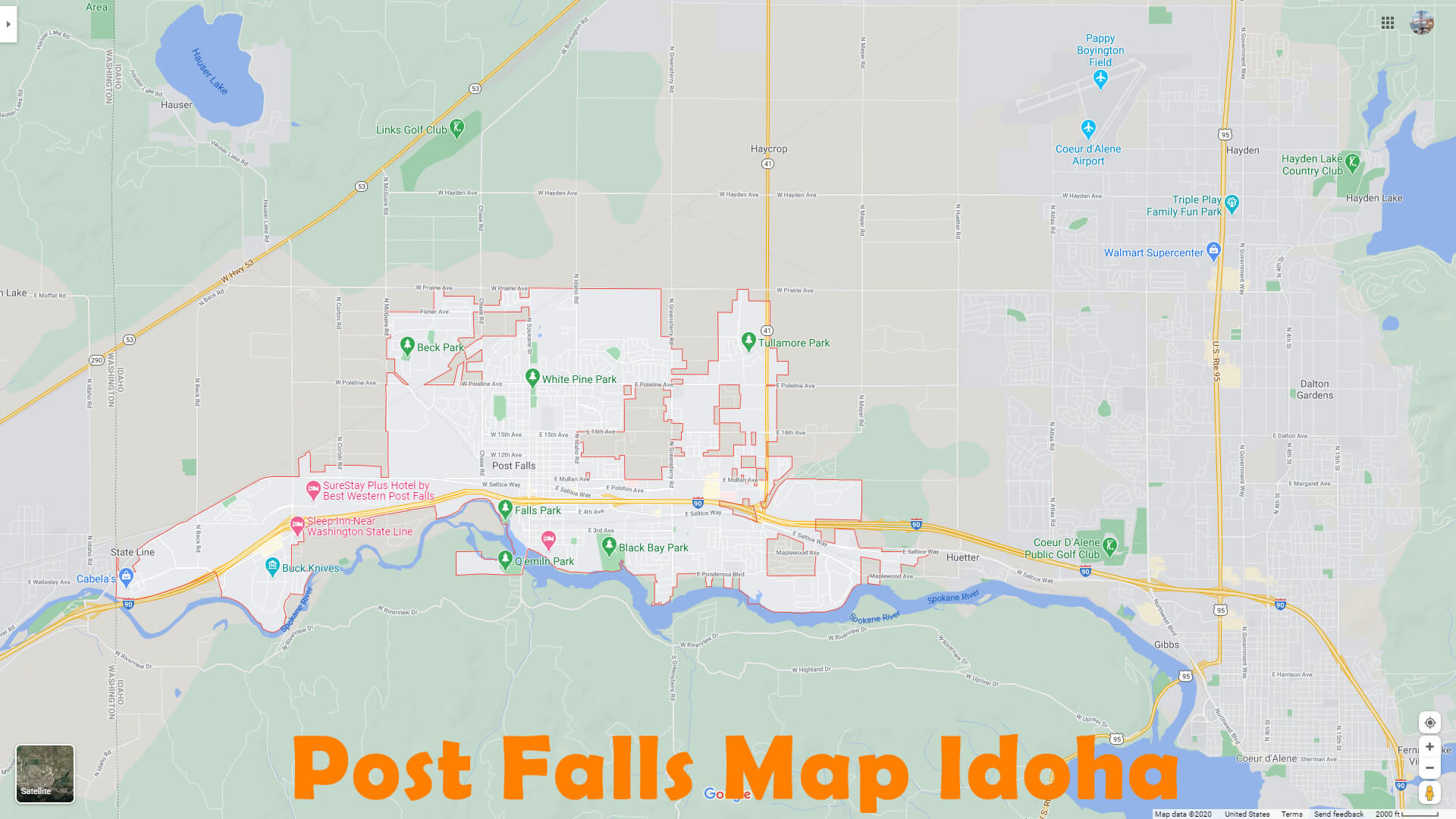

This new Santander lifestyle mortgage calculator will assist you to find out if your be eligible for a life mortgage or any other Santander later years mortgages.

Really does Santander Perform Security Release?

Yes, Santander lives mortgage loans is actually a variety of collateral release and no very early fees charges. Plus, a beneficial Santander drawdown existence financial is additionally offered at a fixed interest rate.

Is Santander Security Launch Safer?

Yes, its an entirely safer flexible life financial that’s authorised and regulated by monetary conduct expert features oversite from later on existence credit pros such as the security release council.

Must i spend my personal current financial having lives mortgages Santander?

Sure, the initial lump sum will pay regarding an existing lending company. Martin Lewis lives mortgage loans apparently speak about settling your own dated appeal only mortgage.

Guarantee discharge has been an ever more popular economic technique for people approaching old age or already within their later years. Santander provides arranged in itself as the a distinguished institution contained in this easy payday loans Foley stadium, getting a spectral range of mortgage products which cater to older individuals.

Santander RIO Mortgage loans getting early tax-free cash

Santander’s Retirement Attention Merely (RIO) mortgage loans try something targeted at those who work in retirement wishing to release equity from their property while maintaining normal desire money. This method preserves the equity in the home to own coming need and inheritance.

Santander Equity Launch Calculator and you will Santander Bank guarantee launch faqs

An important product for any possible borrower is the Santander security discharge home loan calculator. Santander provides for example hand calculators, allowing individuals estimate the amount of security capable discharge from their property, helping all of them decide if collateral release is the proper choice for all of them.

Lifetime Home loan Santander Interest levels for those who have little financial

The interest prices used on Santander’s guarantee discharge items are good important foundation getting borrowerspetitive pricing are very important during the making certain that the fresh new obligations cannot develop too quickly and that the rest equity in the home try managed whenever you.

Santander Attention Only Mortgage loans for launching bucks quickly

In the event you desire to provider the financial obligation instead of eroding the brand new financial support, Santander’s attention-just mortgage solutions render an effective way to manage monthly outgoings when you find yourself staying the borrowed funds harmony static.

Santander Pensioner Mortgages having independent legal advice

Santander acknowledges the initial monetary circumstances out of pensioners, offering financial products that check out the fixed income characteristics from senior years and also the possibility minimal monetary liberty.

Santander Old age Mortgage loans with accredited economic advisers

Santander’s retirement mortgage loans are formulated on retiree planned, delivering alternatives that echo what’s needed and economic prospective of them no longer in full-day work.

Santander Later years Desire Simply Mortgages for a cash lump sum

Combining the concept of a pension home loan into fee design out-of an interest-merely mortgage, Santander also offers products which is minimise month-to-month costs having retirees, a switch consideration of these into a predetermined money.

Santander Mortgages for over 50s to over 75s that have a free of charge economic adviser

Santander acknowledge you to definitely economic needs change in general progresses compliment of other values regarding after lifestyle. Which, they supply various mortgages for those old more than fifty, 55, sixty, 65, 70, and even more 75, per having certain terms and conditions reflective of one’s many years group’s typical conditions.