The newest Government Homes Government has grown the fresh financing thresholds for its Title We Are designed Mortgage Program within the a bid to unlock the available choices of sensible property.

The fresh FHA’s decision to boost the latest constraints aims to better line up having economy rates having are designed land, known as mobile land, in addition to accompanying plenty. It adjustment is expected to prompt significantly more loan providers to increase loans to people trying get manufactured homes.

It financing restrictions just like the 2008 that will be element of President Joe Biden’s effort to compliment the new access to and you will using are created home given that an inexpensive homes provider.

New upgraded methods to have deciding and you will revising new program’s constraints are in depth from inside the a final code put out towards Feb. 31, given that in depth when you look at the a news release by FHA.

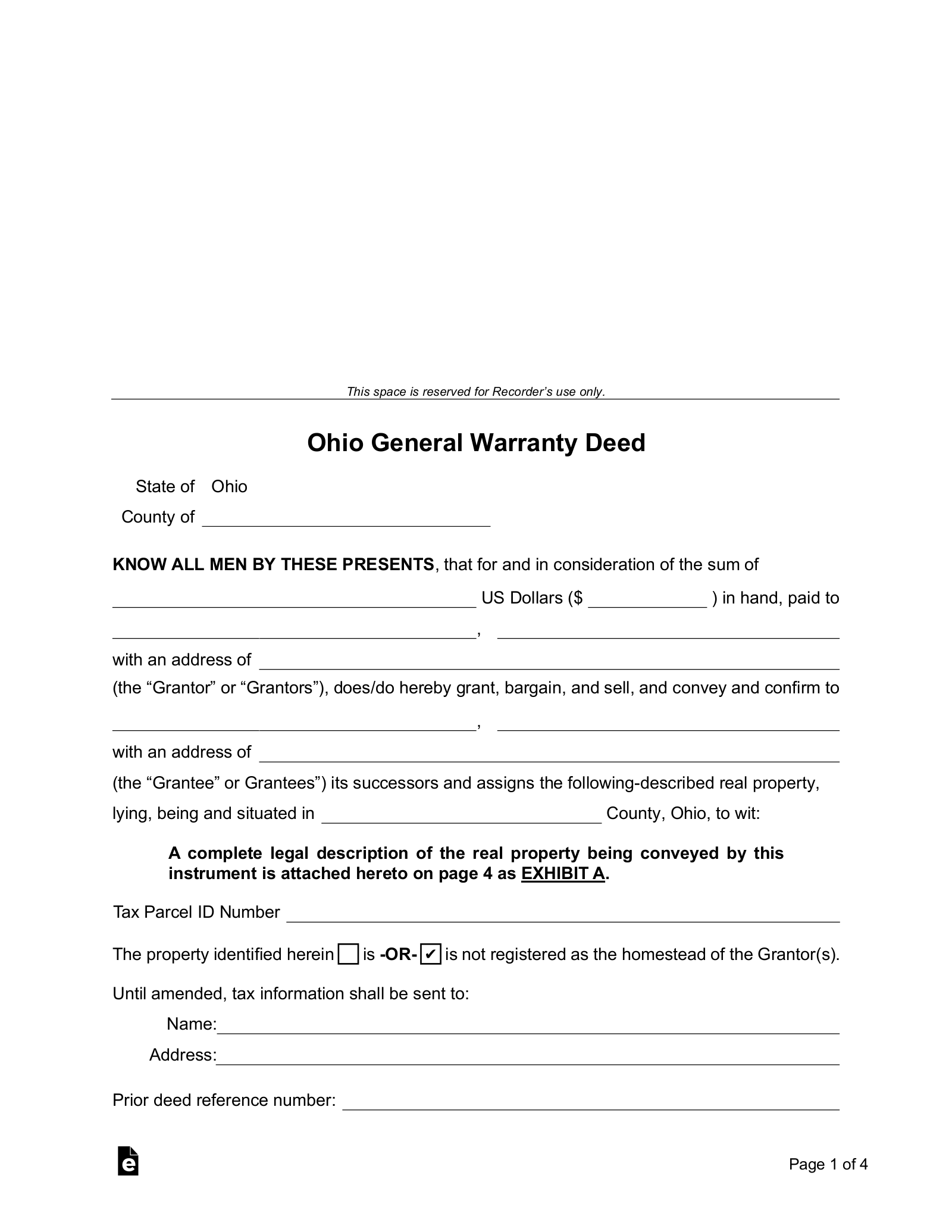

The latest changed are manufactured mortgage restrictions are listed below:

- Combination mortgage (single-section): $148,909

- Consolidation loan (multi-section): $237,096

- Manufactured home loan (single-section): $105,532

- Are available financial (multi-section): $193,719

- Manufactured family lot loan: $43,377

Julia Gordon, Government Property Administrator, emphasized you to updating the new Title I mortgage limitations means a vital step up ongoing jobs to compliment the new Term We Are available House Financing Program’s capability to own lenders and you can homeowners. She expressed promise these particular adjustments would remind even more loan providers in order to contemplate using new Name I system to 2400 dollar loans in Shelton CT satisfy the financing need of customers to shop for otherwise refinancing are created homes.

Specific unique credit businesses promote Fannie mae mortgage loans from the MH Virtue system for folks seeking money to own a manufactured house. Meeting specific qualifications criteria is essential, that has starting our home with a driveway and you can a linking pavement on the garage, carport, otherwise detached driveway.

So you can qualify for this program, the newest are produced family need certainly to conform to particular design, architectural design, and energy show conditions just like people for webpages-created home.

It financial software offer 29-year money, and it’s possible to help you safer all of them with a down payment since reduced given that 3%. In addition, MH Advantage mortgages have a tendency to ability straight down home loan pricing versus of numerous antique fund to own are produced homes.

Fannie mae Practical MH: Which financing option serves belongings which do not meet the qualifications standards of your MH Advantage system, close antique single- and you can double-greater are created homes.

However, except if its within a co-op otherwise condominium venture, brand new borrower need certainly to very own the fresh property where in actuality the home is oriented. The new are designed house should be constructed on a permanent frame, mounted on a long-lasting foundation on belongings belonging to this new debtor, and you may called while the a home. These types of financing might have fixed- or varying-price formations, that have conditions extending around thirty years (360 weeks).

Believe a beneficial Freddie Mac Are manufactured Mortgage loan

This type of mortgages to own manufactured house try easily obtainable in extremely claims, offering each other fixed- and adjustable-price possibilities. The newest land have to be into a permanent foundation and certainly will end up being wear personal property belonging to the brand new debtor, into the a well planned innovation or investment, otherwise, that have composed permission, for the rented land. When you yourself have credit problems rather than sufficient money to have an effective down-commission, think a rent having financing.

Do i need to rating a house Security Mortgage on a made Home?

Sure. There are lots of financial firms that offer HELOCs and you may guarantee fund to help you individuals employing are produced home while the security. Many of these next mortgage brokers tend to anticipate one to has actually no less than 20% guarantee of your house and then have a good credit score score as well. Inquire about family security financing and no credit check. Consumers need to know, Should i rating a beneficial HELOC into the a produced home?

Take advantage of the lending partners that provide household collateral funds and an effective HELOC towards are created property. The fresh new RefiGuide will help you to come across this type of lending companies making sure that you could go shopping for HELOC fund rate now.