Cost-of-life improvement (COLA): An annual change in workers’ spend to remove the outcome away from inflation into to shop for electricity. Good Cola might be a wage boost, according to the Individual Speed List.

Counterfeit: Phony, usually writing on fake money. The secret Service is in charge of exploring counterfeit profit the new U.S.

Credit: An appropriate arrangement where a borrower get anything of value now because of the guaranteeing to spend the lender because of it later. When the goods of value was a product or service, the fresh new consumer purchases they „to your borrowing from the bank.” (Get a hold of plus funds.)

Credit bureau: A pals one to details borrowers’ credit records. The three premier You.S. credit bureaus is actually Equifax, Experian, and TransUnion.

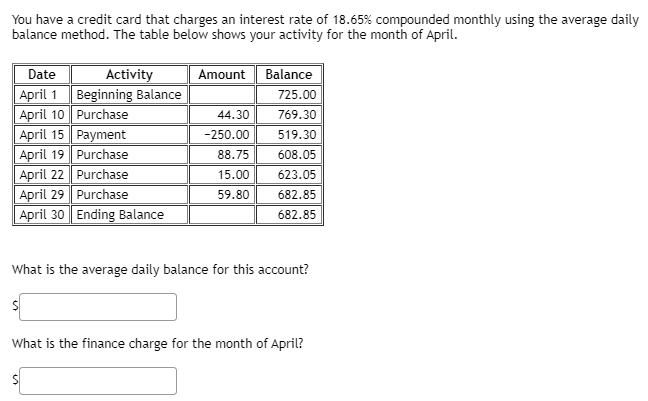

Credit card: A plastic card which enables one borrow money otherwise buy services into the borrowing from the bank. The lender one products the credit cards leaves a money restrict for the the have fun with, depending on their creditworthiness. (Compare to debit cards.) Bank card prices (rates of interest) are centered on creditworthiness.

Credit rating: An eye on financing fees. Financial institutions posting factual statements about the latest money they generate to numerous companies/credit reporting agencies to save as a reference having coming financing. Any time you sign up for that loan, the lender tend to check your credit rating with this organizations. Just like the a consumer, you have got certain legal rights to examine the listing and you may right discrepancies. A credit history is additionally named a credit record otherwise borrowing character.

Credit rating: A good lender’s guess out of exactly how risky it is so you can lend your money. Your credit rating will be based on the including issues as your earnings, their history of paying off debt, as well as your functions number.

Credit score: An effective around three-hand amount centered on a statistical formula that will help lenders choose whether to provide you money as well as exactly what price. The higher this new score, the much more likely you are to help you be eligible for that loan. Together with high the new score, the much more likely you are to acquire a far greater interest. Variants of your rating may also dictate whether you can get work or rent a flat, or how much cash you only pay for insurance policies. The fresh FICO rating is considered the most popular credit reporting model.

Debt: An accountability in the way of a bond, mortgage agreement, otherwise home loan, due to anybody else to your guarantee out-of fees by the an excellent particular day-the newest debt’s maturity

Credit relationship: A credit commitment is a no longer-for-finances monetary cooperative whose members have it. Every users have the straight to democratically choose a screen away from administrators. The board provides the borrowing from the bank union’s government and you will team general rules. Usually, borrowing from the bank unions remind thrift one of users and gives them with borrowing on the lowest speed.

Borrowing commitment affiliate: Somebody who meets the brand new qualification conditions getting signing up for a credit commitment and whom holds a necessary minimum coupons harmony. A credit union’s players very own the credit relationship.

Youre eligible to signup a specific credit commitment if you have the world of membership laid out with its constitution

Borrowing Commitment National Relationship (CUNA): A no longer-for-profit exchange association to have credit unions. To participate CUNA, borrowing from the bank unions spend dues. In return, CUNA represents borrowing from the bank unions’ appeal with national agencies and you will members from Congress. CUNA now offers information, public relations, elite group knowledge, and organization invention functions to borrowing from the bank unions.

Creditor: A person who gives money to some other individual, establishment, or business in return for attention to your their particular money.

Currency: Paper money. Discuss the fresh federal government’s Western Currency Exhibit online and get a great digital journey of your own Money Museum.

Debit card: A credit card which you can use such a credit card. The difference is the fact credit cards let you borrow funds having requests, if you are debit cards create fee instantaneously and you will electronically out of your Automatic teller machine transactions.