The entire process of buying a property is exhausting – you don’t wish to help you waste many time prepared for your representative who continuously comes up late to conferences or never output your own calls. So they are able become successful, agents need to be arranged. Since they handle loads of website subscribers into a regular foundation, they want to always keep arranged dates and to-create directories. You will not have to work with agents that do not enjoys a network positioned to arrange its duties.

Standard

Lenders are not right here to pledge you the globe. Instead, they should often be touching fact. Fundamental agents evaluate your existing economic criteria and help your determine by far the most probable selection. Good broker was logical – they must be in a position to explain aspects of debt fitness which can never be obvious for your requirements and provide your good advice on the best way to beat financial barriers.

Educated

You need lenders that are an informed during the what they would. They need to provides a deep comprehension of the market industry and you may how to navigate they. They understand not merely what they are selling but furthermore the other choices in the market. Brokers who will be constantly being unsure of concerning concerns you may well ask you will not be an appropriate lover in this travel.

Enough time

A home loan might be a lives-a lot of time commitment, therefore require an agent who will not see you since the merely a single-from package. Once you close their transaction as well as have one to stamp from acceptance, you want an agent whom claims to save in touch is your needs and you may requirements change.

Asking the representative just the right questions

Should you get a large financial company, you are, essentially, hiring them due to their services. And as with any job application, you need to question them certain inquiries to help you get understand them even more.

One of the primary things you need to inquire about their agents throughout the South Carolina personal loans is their network out-of lenders. This will make suggestions exactly how varied and large the options was probably going to be. In addition reveals and this lenders believe in them to provide its offerings to potential clients.

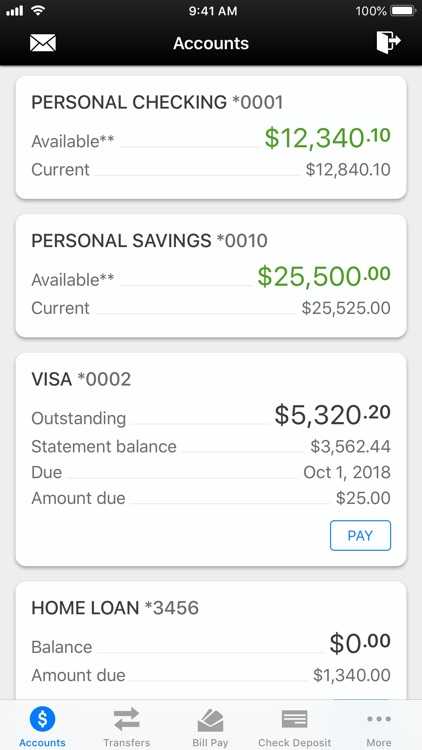

It would be best if you and additionally ask them on how he or she is bringing paid down. Fundamentally, extremely agents provide its services at no cost while others, specifically those below a company, might charge you having a fee.

Brokers get income of lenders. There have been two style of fee: initial and you can behind. An initial commission is actually a cost made by the financial institution in order to a broker immediately following a borrower seals the deal.

Brokers can still get paid immediately following finalizing financing price as a consequence of trailing commissions. Lenders will continue to spend the money for representative recurring commission as long because you stick to your existing contract, and you also dont belong to arrears.

This is how a prospective conflict of interest can arise. Agents you’ll render sorts of home loan situations or lenders without considering your own requires because of a substantial percentage that awaits all of them pursuing the deal. While it’s constantly vital to have brokers so you can prioritise your needs, there is a number of bad oranges who merely worry about the cash they would make out of your contract.

- Exactly how many decades could you be in the business?

- Which finance companies are you experiencing a certification having?

- As to why do you prefer to work at the system out of loan providers?

- What types of finance could you be offering?

- Are you experiencing a keen ASIC permit?

- Exactly what business teams are you part of?

- How can you begin researching rates?