Of giving eligible homebuyers a decreased 30-seasons repaired rate of interest available to permitting individuals purchase a property, the advantages of the new cannot be simple.

The loan system, Maryland is an initiative on the county towards the goal of helping homebuyers in the off homeownership. The newest was created to make to find and you may home ownership significantly more reasonable since it affords aiming people which be unable to complete the ultimate desire homeownership by higher downpayment criteria the opportunity to deliver the date-to-go out will cost you of homeownership.

They offer very first time virtue which can be financing made to bring qualified home buyers a low 30-year repaired interest rate.

Depending on the , a first-date home client is considered to be anyone who has not had a house any place in the final 36 months or individuals to shop for a house inside the Maryland Targeted Town otherwise an experienced using their exception to your first-time.

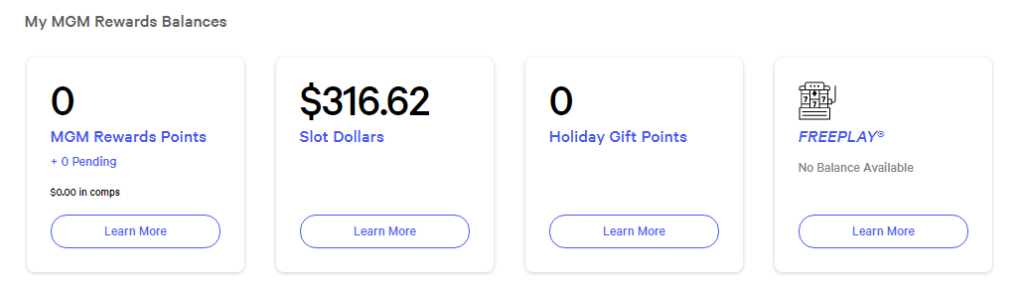

income limitations

Here you will find the earnings constraints ranges. Household income limits are different with regards to the number of people for the a family group. The money limit having a family measurements of step one-2 is $145,560 when you are regarding children size of 3 or maybe more is $169,820.

There are specific qualification requirements homebuyers need fulfill in order to manage to get home loans through the ong new qualifications conditions ‚s the money restrictions. earnings restriction is known as the complete family earnings homebuyers should be on or less than certain constraints, that limitations rely on two things: The place that the possessions in question is being available in Maryland together with home dimensions, with individuals 18 years of age or higher who happen to live in that domestic.

targeted elements

Per state into the Maryland have their laid out household income limits. You will find targeted elements in a few counties that cover part of the new jurisdiction. These focused elements are included in payday loans online AK Maryland, being during these section helps it be slightly easier to end up being eligible for the brand new MMP financing. not, domestic money restrictions was much more higher whenever you are buying a great possessions in a targeted area.

rates

The fresh provides financial assistance to own homeowners in Maryland. Regardless if you are ready to pick otherwise refinance, the fresh new prices assume you may have a very good credit score and you may that the financing is actually for one-home as your pri also provides a step 3.058% price on your own 29-seasons repaired loan price.

One intending homeowner with a home loan regarding the MMP normally submit an application for a down-payment Guidance program, that’s financing possibility as high as $5000 to greatly help homebuyers satisfy escrow expenses, buy settlement costs, otherwise create a deposit.

There are more available assistance from partner matches applications which provide qualified consumers that have assistance to summarize can cost you and you can off repayments. This type of money from companion programs is and thus matched thereupon from the in the way of a no-appeal, deferred mortgage that is paid back when the house is transported or ended up selling, otherwise in the event that debtor pays the initial financial.

lenders

To shop for a house needs acquiring mortgages for many homeowners. However, there are numerous variety of mortgages designed to suit species of people each person’s economic situation. If you find yourself there are many brand of mortgages, certain financing was to own restricted people (such as experts an such like.), anybody else ensure it is certified men and women to provides faster off costs or perhaps to renovate the freshly bought property. Although not, the fresh fund has actually unique eligibility standards and these conditions can only just end up being given of the authorized loan providers. Performing loan providers on are properly coached ahead of he is signed up so you’re able to originate, process and you will intimate on money.

Lower than is a list of examined loan providers inside Maryland that may support you in finding a loan package particularly readily available for both you and your debts.