Are you fantasizing of purchasing your ideal domestic however, fretting about finances? Incorporating an effective co-applicant to your home financing could be the video game-modifying means you prefer. This simple but really effective disperse can get you higher financing qualifications, straight down interest levels, and you may increased tax advantages. It makes your path so you’re able to homeownership easier and much more affordable.

But that is only a few, there was significantly more to this partnership than just financial benefits. Keep reading while explanation we learn the greatest 5 reason and a great co-borrower would-be their smartest choice in the protecting the house loan you need.

Reason-step one Enhanced Loan Qualifications

Favor a co-applicant having a constant income and you will a robust credit rating so you’re able to enhance your mortgage qualification. As an instance, for many who secure ?fifty,000 30 days and you will be eligible for a ?31 lakh loan, adding a beneficial co-debtor making ?31,000 four weeks you are going to boost your eligibility so you’re able to ?forty lakh.

Imagine you might be eyeing property priced at ?50 lakh, however your current qualification is actually ?30 lakh. By the addition of an excellent co-debtor, you could potentially enhance your qualification to pay for entire cost or rating closer to it, letting you buy a far more suitable home.

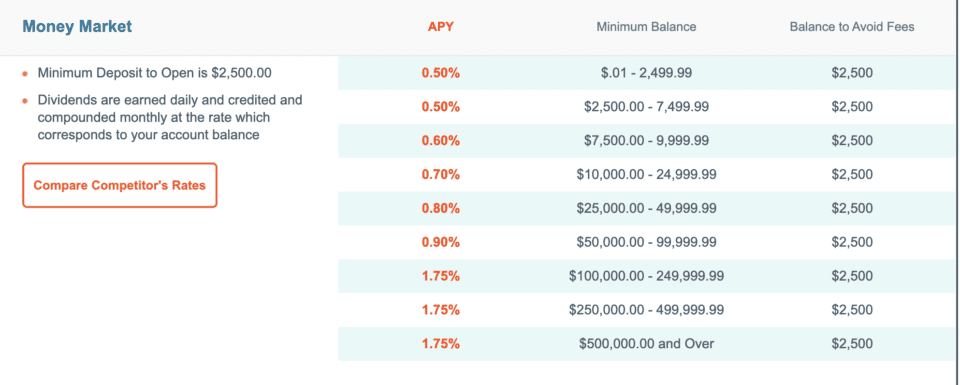

Reason-2 Down Rates

Discover a co-candidate with a high credit history in order to negotiate less focus speed. From inside the India, loan providers often offer best prices to help you candidates which have higher fico scores. In the event your credit history are 700 and your co-borrower score is actually 750, you can be eligible for a lowered rate of interest.

Should your newest interest are 8.5% plus co-borrower strong borrowing character helps you secure a performance off 8%, you could potentially conserve many along the lifetime of the loan. So it cures produces a hefty difference between your current financial relationship.

Reason-step 3 Highest Income tax Benefits

Influence tax professionals from the busting financial focus deductions anywhere between both you and your co-candidate. Around Indian income tax rules, you and your co-candidate is claim deductions into home loan attention under Point 24(b) and you will principal repayment not as much as Section 80C.

For many who spend ?step one.5 lakh from inside the annual focus, both you and your co-candidate can each claim as much as ?1.5 lakh, potentially increasing their income tax coupons than the a single candidate situation.

Reason-cuatro Shared Economic Weight

Express brand new monetary responsibility out-of month-to-month EMIs together with your co-applicant to ease debt loadbining income helps make their EMIs far more down and reduce the worries for each individual’s money.

In case the EMI is ?25,000 a month, discussing this amount with good co-borrower can reduce the duty to ?12,500 for each and every. It common responsibility guarantees timely costs and helps perform cashflow most useful.

Reason-5 Improved Borrowing from the bank Character

Maintain a credit character by the making sure your co-applicant generate punctual payments. Typical, on-big date money have a tendency to undoubtedly effect each of your own credit ratings. This helps to make upcoming economic purchases smoother.

Consistent to the-day repayments you certainly will alter your credit score from 700 in order to 740. This might help you secure better words on coming money otherwise borrowing organization, probably lowering your price of borrowing from the bank.

What’s a great Co-candidate?

An excellent co-applicant try an individual who applies to have home financing next to the key borrower. This person shares duty getting repaying the mortgage in addition to their money, credit history, and you will monetary stability are thought throughout the loan application procedure.

In the Asia, good co-candidate are going to be a partner, father or mother, otherwise sibling, and their engagement can raise the fresh loan’s approval odds, increase eligibility, and possibly safer ideal mortgage words. One another applicants is just as accountable for the loan, as well as their borrowing from the bank pages jointly change the financing criteria and you will payment loans.

If you find yourself obtaining an effective ?40 lakh home loan along with your co-debtor have increased money and better credit, your ount and higher terminology.