If you are looking having an enthusiastic FHA mortgage for the Houston, you will want to comment brand new agency’s restrict home loan limits for Harris County, Texas. In the 2022, you could potentially remove a keen FHA mortgage when you look at the Houston off up to:

- $420,680 getting an individual-home.

- $538,650 getting a-two-house.

- $651,050 for a good around three-house.

- $809,150 to own a four-home.

Mortgage Insurance rates Standards

The original variety of, called an upfront financial advanced (UFMIP), is actually included in the quantity of your loan. UFMIP means step one.75% of home loan matter or $step three,five hundred towards the an effective $two hundred,000 FHA home loan.

These types of costs depict element of the closing costs, which can soon add up to six% of home loan. You must pay closing costs during the settlement, but the FHA makes you have fun with a seller advice offer as high as six%.

The brand new month-to-month mortgage premium (MIP) is focused on step one% of one’s loan amount. It fee lasts for the life of the mortgage if you don’t put down at the least ten%, then you need to pay an MIP to have eleven many years.

Conventional fund require also financial insurance coverage getting a down payment regarding lower than 20%. At the same time, these businesses may charge highest financial insurance coverage if you have a reduced credit rating.

Extra FHA Financing Criteria

FHA consumers need certainly to are now living in the us legally. Your lender will need proof a legitimate social safety amount.

To use the latest FHA program, you should propose to inhabit the home since your number one residence. The house at issue shall be one-house, townhouse, condo, or quick apartment strengthening that have around five devices. Once a couple of years regarding expenses your own FHA mortgage, the lender can allow you to definitely convert your house so you’re able to a rental otherwise travel property.

Into the home loan underwriting procedure, you really must have an assessment of the house accomplished by an enthusiastic FHA-acknowledged professional. She or he must approve your house match the fresh new agency’s conditions to possess structural soundness, safety, and cover. The vendor may need to create repairs in advance of shifting having their give based on the result of the fresh FHA assessment.

Condominium equipment are at the mercy of special FHA criteria. Particularly, you should prove one a certain portion of the building’s equipment was occupied by the owners in the place of clients. The lending company may also opinion the condo association’s instructions and work out yes the organization is financially solvent.

Almost every other FHA Applications

If you find yourself these conditions to have an FHA loan connect with the latest agency’s standard domestic purchase program (a paragraph 203(b) loan), you can also imagine other sorts of FHA mortgage loans. Popular solutions tend to be:

- The latest FHA streamline re-finance. This option allows consumers just who have an enthusiastic FHA mortgage so you can re-finance with an increase of beneficial loan terms, such as a lower rate of interest. The application form needs limited documents if you has a good reputation of into-day payments on your existing home loan. Yet not, you simply cannot capture cash-out with this specific kind of refinance.

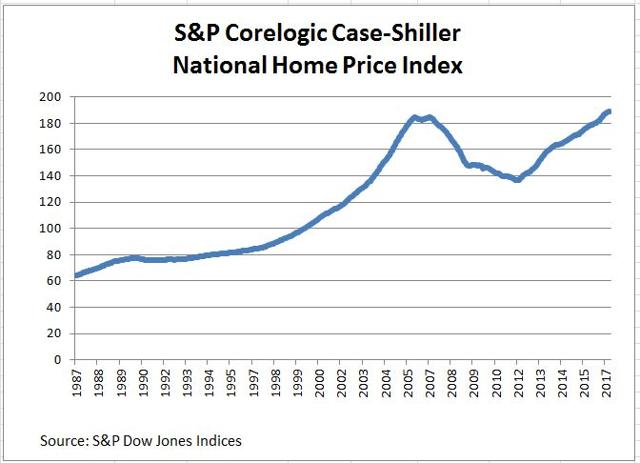

- New FHA opposite mortgage. This one allows individuals many years 62 and you may earlier to receive cash having a portion of their home equity. Eligibility for this equipment, titled property guarantee sales mortgage, depends on the speed of your latest mortgage additionally the appraised property value the home, which should be most of your quarters.

- The power-productive financial program. With this particular program, you could loans the cost of green home improvements, including solar panel systems together with your FHA home loan.

- The FHA 203k mortgage. Which mortgage brings together a purchase and you can renovation financing. You are able to this type of financing and also make doing $31,000 into the improvements to help you an eligible property.