The home Sensible Amendment System, or HAMP, try supposed to help countless property owners end foreclosures. It did not, and then it’s set-to avoid.

When President Obama announced the home Sensible Amendment System, otherwise HAMP, towards , during the Mesa, Washington, he promised it could help three to four million property owners so you’re able to tailor the money to cease foreclosures. Almost 7 decades later on, below one million have obtained lingering advice; almost one out of around three lso are-defaulted after searching inadequate variations; and 6 million family destroyed their houses over the same time several months.

Tucked away towards the webpage 1,983 of one’s omnibus paying plan, finalized to the law this past day, is the pursuing the language: The Making Household Sensible effort of Assistant of your Treasury, since the licensed within the Crisis Economic Stabilizing Work regarding 2008 … should cancel into the .

Which language shuts aside a series of actions initiated following overall economy to simply help home owners up against foreclosures, however, mainly, they comes to an end HAMP. Few indexed its passageway, however, progressives is ready to notice it go. Perhaps no program of the Obama era did more significant – and maybe irreparable – problems for the hope out-of an enthusiastic activist authorities which will help resolve the country’s dilemmas.

HAMP’s incapacity stemmed from its structure. Rather than an earnings-import system you to definitely hand coupons to disappointed consumers so that they can lower its home loan repayments, the federal government gives the currency so you can financial maintenance companies, to encourage them to modify the money. However, as the bodies establishes benchmarks to follow along with, the loan enterprises in the course of time choose whether or not to render assistance.

In order to comprehend why this might never ever enable it to be, you need to understand one to home loan servicers typically have no direct focus in the financing. He is glorified account-receivable divisions rented of the mortgage proprietors so you can processes monthly payments, handle day-to-day exposure to people, and you will distributed this new proceeds. And with short staffs regarding admission-level workers, they may only turn a profit whenever they never need to would people customer care. Approaching an incredible number of personal requests for rescue merely overloaded all of them.

Furthermore, servicers make their funds from a percentage out of outstanding dominant equilibrium on the financing. Forgiving dominant – one particular winning form of loan modification – eats towards the servicer profits, so that they bashful out of you to definitely, going for less effective interest incisions. And additionally, servicers gather planned costs – such as for example late costs – which make it winning to store a debtor outstanding. Also property foreclosure dont damage a servicer, because they build back its part of fees into the a foreclosure profit through to the dealers to possess which they solution the loan.

Having servicers responsible for modifications, they may shape the application form in order to stack far more crappy debt with the borrowers and you will press several a lot more costs out just before foreclosing. Servicers chronically destroyed borrowers’ money data to extend the brand new default period. It lengthened demo changes well past 90 days, so that they you will dish up late charges. They offered adjustment that folded servicer fees on the dominant of the borrowed funds, improving the unpaid prominent balance – which means their cash – if you’re pressing the brand new debtor after that under water. As well as trapped borrowers once doubting a modification, demanding straight back payments, missed desire, and you may late fees, on danger of property foreclosure once the a great hammer. It have a tendency to forced borrowers into the private variations which have worse terms and conditions versus updates quo. HAMP became a good predatory lending plan in the place of a help program, and also successful permanent variations ran bitter too often, with a high re-default prices.

With regards to the Special Inspector Standard into the Troubled Resource Save Program (SIGTARP), 70 % off residents who removed the applying was became off to have a permanent amendment. Even with 1st encouraging a $75 million dedication to HAMP, compliment of September for the year, government entities has actually spent just $10.2 million, with a supplementary $2 mil into relevant applications. Every using emerged adopting the initially many years in the event the property foreclosure drama was at their very intense.

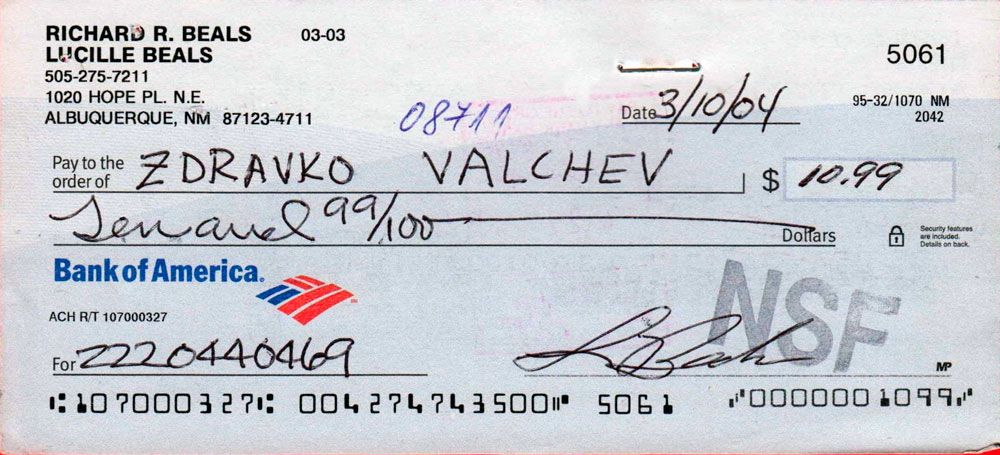

In the very damning revelations regarding servicer misconduct, personnel in the Financial out-of America’s home loan servicing product testified from inside the good class-step suit which they have been told so you can rest to help you people, deliberately lose the data, and refute mortgage adjustment instead of discussing why. For their jobs, professionals rewarded them with incentives – in the form of Target provide cards – having driving borrowers for installment loan Wisconsin the foreclosure.

Regardless of this, new Treasury Institution never ever forever approved an individual home loan servicer to possess HAMP abuses by clawing back extra payments. They never made use of their influence to force greatest consequences. Instead, former Treasury Assistant Timothy Geithner told regulators authorities, HAMP’s objective would be to lather this new runway for the finance companies. To put it differently, they anticipate banking institutions in order to spread out ultimate foreclosures and you can take in them alot more much slower, securing bank balance sheet sets. Residents are definitely the soap getting steamrolled because of the good jumbo jet inside the that analogy.

In recent years, the government modified HAMP, starting it up so you’re able to much more individuals and you will giving higher extra repayments to own principal avoidance. However, shortly after several years of nightmare reports, people fairly need nothing to do with the program, the way in which squirrels know not to eat the fresh toxic fresh fruits. Regarding newest SIGTARP analytics, thirteen,231 homeowners already been long lasting HAMP improvement about third one-fourth regarding the year, if you are 13,226 anybody else lso are-defaulted, making a websites boost in productive changes of simply four. Long lasting modifications possess diminished into the 16 of past 17 home.

However, HAMP, immediately following getting authorized by the statutes one to provided united states the bank bailout, was made and then followed entirely by Light Family

Treasury Agency spokesperson P from the selling the less amendment denials in the past several years, and that coincides having fewer residents harassing to utilize. Treasury and additionally alleges in latest accounts you to definitely 58 % from individuals refused good HAMP amendment obtained some choice modification off their servicer otherwise fixed their delinquency, in place of noting whether or not one to alternative generated brand new homeowners’ financial situation best otherwise bad.

This new small extra payments in the HAMP was no matches towards reverse monetary incentives for the foreclosure, in place of changing fund

Treasury’s allege comes from surveys of one’s servicers by themselves, who’ve incentives to declare that they help their customers. However, we all know that up to six mil family have forfeit their house due to the fact financial crisis first started in the , and you will unless of course handful of them ever tried to obtain an effective HAMP modification, it’s difficult so you can rectangular the fresh number.

You could excuse many of Obama’s achievements you to definitely did not come to its needs from the arguing that they sprung regarding a broken Congress, having supermajority difficulties guaranteeing Republican input. Congress signed up the latest exec branch so you can stop preventable foreclosures, and you may remaining the important points on it. One HAMP turned into the result is the latest finest indication of just how the newest administration prioritized the condition of loan providers more than property owners.

In addition, it needlessly bolstered the existing Ronald Reagan dictum your extremely dangerous terminology on the English words try I’m throughout the authorities and I’m right here to greatly help. Group just who searched for an authorities program to assist them within the a duration of you would like saw merely a home loan servicer who missing their files, installed collectively its requests, and you may hurt their financial safety. The brand new many who experienced which discipline can find it difficult to actually trust authorities once more.