The fresh Aggregator

Financial brokering boasts of a lot legislative and you can conformity criteria. Broker costs are higher. Hence, of numerous agents efforts not as much as an enthusiastic aggregator.

The latest aggregator ‚s the intermediary anywhere between loan providers and you will agents in control off publishing this new percentage. They just take a portion of your own payment just before handing it more with the representative. Basically, its a management rates and will differ according to aggregator. Usually, it is to 5% 50%.

What if walk profits try blocked?

The fresh Australian authorities felt banning walk profits on the brand new loans inside . This may have designed brokers charging you people an initial payment having their functions. Individuals could have imagine twice throughout the refinancing home financing if the they want to shell out an upfront fee to have home financing broker’s features again. At the same time, consumers have encountered a lot fewer home loan services lenders.

Can there be a conflict of great interest?

In case your bank pays the fresh new broker so you can organise that loan with them, how can you trust he is in your own favour? Well, don’t worry; lenders must keep a keen Australian Credit License and you can follow brand new National Credit Cover Act. It means he or she is bound by rules be effective throughout the owner’s needs.

Additionally, some major banking companies, particularly Westpac and Commonwealth Lender, have completed studies that demonstrate no link between the new payment and you can mortgage issues. This means that, financial institutions compete with rates of interest rather than growing mortgage broker earnings.

Hardly you are going to actually need to pay mortgage brokers for their attributes if you don’t need certainly to. The only real times a broker can charge a fee is:

- Some one having a complicated condition

- Quicker finance lower than $three hundred,000

- Industrial and you can loans

- Finance paid off or refinanced contained in this two years

No payment home loans

Although not, a few agents charge a fee in lieu of earning fee out-of the lender. Rather, the fresh new broker will pay straight back this new initial and you may behind fee each month towards borrower since the home financing rebate otherwise cash return. Yet, it is really not as nice as it looks. These business model isn’t really financially viable. Fee-created brokers face slim profit margins.

Hence, for those who pick a charge-centered broker, you may find they aren’t in a position to provide you with a good financial broking techniques. Also, should your organization happens breasts, they won’t bring a continuous mortgage service regarding loan identity.

Will i spend less on my home loan which have home financing representative?

Lenders which have a keen Australian Borrowing from the bank Permit rescue people some time and effort. They will help you create massive cost savings on the mortgage device.

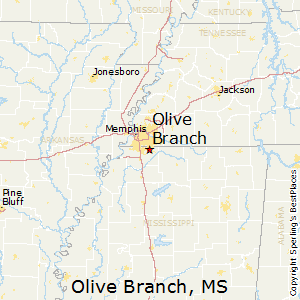

When you take part a broker, they’ll ask you about your private objectives and financial products. Might make use of the advice offered loans Skyline AL to figure out which lenders and you will house financing points work for you. Fundamentally, they actually do all legwork. The typical domestic client doesn’t have the sense needed seriously to browse countless home loans.

The agent will provide suggestions and you will explain as to why they could getting considerably to you personally. Inquire further towards analysis speed, interest, or other lingering fees. An effective broker can be discuss straight down rates, fee waivers, and extra professionals, like an offset account.

The mortgage agent will allow you to manage the home loan software when you select a certain product. Speak to a quarterly report financial representative concerning your options today.

Can i fool around with a large financial company?

Many homebuyers navigate the world of credit for the earliest date whenever providing a home loan. You might have a charge card otherwise education loan. But home financing is usually the earliest significant monetary creating just about everyone has. It’s intimidating to learn testing costs. Which have particularly an enormous decision, it’s wise to ask a professional for their pointers.