Health care staff member home loan

- Home loans for Health care Gurus | Character Household Applications.

- Specialized Nursing assistant Nearby System.

- FHA Home loans to possess Health care Professionals – Homes to have Heroes.

- PPP Mortgage Analysis – Family relations Notice Household Fitness LLC, Newark, OH.

- Va Home loans Domestic – Pros Situations.

- Mortgage brokers to have Medical care Pros.

- Direction into the giving out-of passion funds – To have employees.

- Quick Self-help guide to Lenders Getting Health care Benefits.

- step 3 Lenders to own Healthcare Workers – Grants to own Medical.

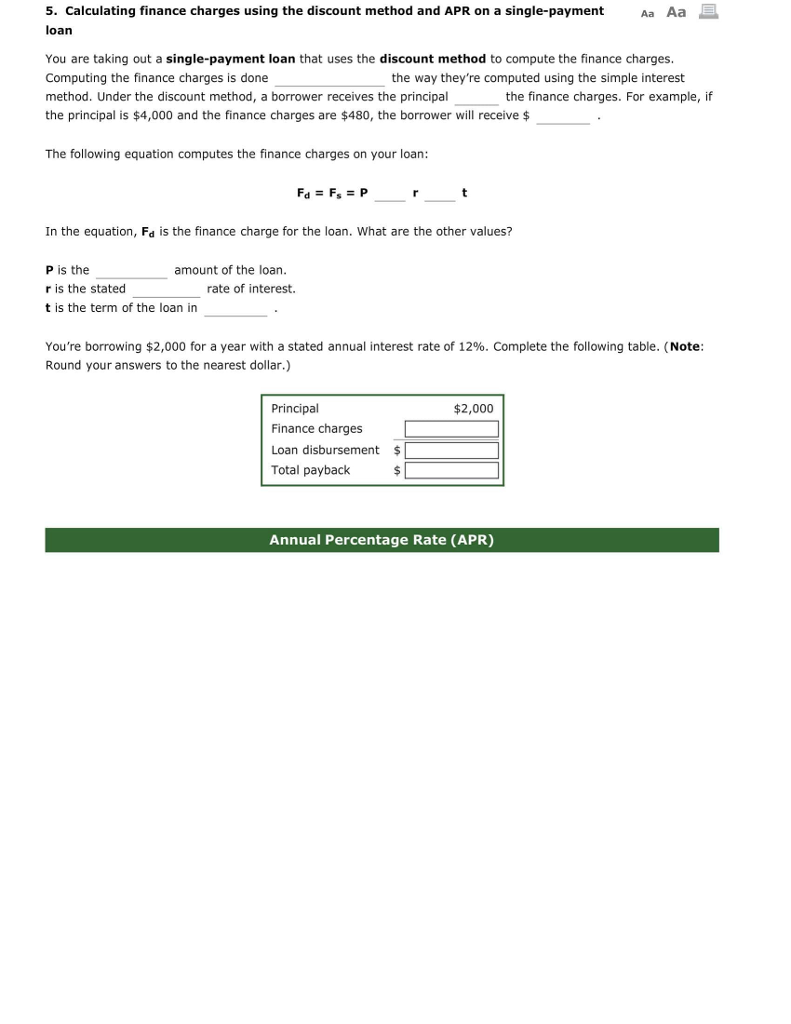

The most amount borrowed try $10 million. Sole-proprietors, independent designers and other self-employed folks are eligible. A loan is going to be forgiven considering maintaining staff and you can salary profile. The part of the financing that’s not forgiven, the latest terminology is a maximum label from a decade and you can an excellent limit rate of interest of five per cent. You can get doing $75,000 for a few several years of complete-day performs otherwise $37,five hundred to have region-time functions. NHSC Outlying Society Mortgage Payment System: Plus concerned about organization regarding material explore and you will opioid.

Authoritative Nursing assistant Across the street System.

Active ily Property Direct home loans are step three.25% having reduced-earnings and extremely lowest-earnings individuals. Fixed interest rate predicated on economy rates in the loan recognition otherwise financing closing, almost any is lower. Interest when altered because of the percentage advice, is really as lowest because the 1%.

FHA Mortgage brokers to own Medical care Pros – Property having Heroes.

Downpayment Advice Apps To have Healthcare Experts To buy property when you find yourself plus becoming a health worker is going to be difficult, especially for those who want to buy a property for the Ca. The added worry regarding managing your bank account to cover the down commission makes a mortgage look incredibly daunting. NAB’s professional fitness money organization taking novel business lending products getting over 3 decades. Behavior and industrial assets finance, cash flow, devices, fitout and you may car funds. Design the proper monetary possibilities for those seeking initiate, develop otherwise purchase a habit. Consider Medfin’s company financial loans. Make an application for a good SSM Medical care Partner We/ Per cent – Bordley Tower WO work in the Saint-louis, MO. Use on line immediately. MO-SSM Health Saint louis College Hospital. Staff member Style of: Typical. Job Shows. Home loan Expert I. Est. $ – $; Full-big date, Part-time; Saint louis, MO 63101.

PPP Financing Study – Relatives Notice Home Health LLC, Newark, OH.

Nearest and dearest Desire Domestic Health LLC is actually a small liability team (LLC) located at 843 Letter twenty-first St Ste 109 during the Newark, Ohio one to acquired a beneficial Coronavirus-related PPP financing regarding the SBA regarding $204, inside the . The organization possess advertised by itself as a masculine owned organization, and employed at the very least 36 some one for the appropriate mortgage financing several months. Choice #2: Top-notch mortgage brokers to have medical care gurus If not be eligible for a physician financial system, you are qualified to receive an expert financial program. Such programs are not normally as generous given that a doctor mortgage, but they can always benefit healthcare workers finding the lowest deposit service having flexible underwriting. The audience is dedicated to providing medical care specialists feel residents. We have been here to acquire our home funding you need. With your apps, you’ll be able to be eligible for gives, rebates, faster credit charges, loans within closure, as well as other merchant coupons. Avoid throwing away the tough-received money because of the renting your home.

Virtual assistant Home loans Family – Experts Circumstances.

Some tips about what FHA direction state: Is qualified to receive a mortgage loan, anyone have to have about a couple of years away from reported earlier successful a career in the collection of work with that he/she.

Lenders getting Health care Experts.

Another type of perk out-of health care staff member mortgage brokers is that the interest rate can often be tax-deductible. Instance, the interest rate toward Virtual assistant fund is eligible to possess an effective 100% mortgage taxation deduction towards the notice money. The newest Failures from Medical care Staff member Home loans. Once the a medical staff member, you happen to be eligible for home financing, but you will have to go.

Guidance on granting out of interests loans – To have group.

Whether you are to shop for otherwise refinancing a home, you can expect competitive cost and you can terms and conditions, plus have a glance at the website timely, friendly and private service. We could pre-approve your house money so that your domestic searching feel could be reduced plus enjoyable! To find, refinancing, otherwise boosting – we have the financial to you: Repaired and you can adjustable prices. 15, 20, 30-seasons terms.

Quick Self-help guide to Home loans To own Healthcare Gurus.

$2 million to help with health care and you can mental hygiene personnel retention incentives, having around $step 3,000 bonuses planning full-time specialists which stay static in the ranking for example year, and specialist-rated incentives of these working a lot fewer era $five hundred billion to possess Cost-of-living Changes (COLAs) to greatly help improve wages to possess individual features specialists.. One-way Nurses can aid in reducing the costs of the mortgages try that with nursing financial recommendations software. Lower than, we’ve got noted 6 options you can explore. Nurse Next door Features Mortgage assistance around $six,000 is available having being qualified medical professionals, even though, based on accessibility, gives as low as $step one,000 may be offered.

3 Lenders to have Medical care Pros – Grants for Medical.

Phone call 866-297-4311 for complete program facts. dos BHG Money business loans generally speaking may include $20,000 in order to $250,000; not, well-accredited individuals can be qualified to receive business loans to $500,000. step three This is simply not an ensured give of borrowing from the bank and is at the mercy of credit acceptance. cuatro There is no effect on your borrowing from the bank to possess implementing. Lenders to have Health care Experts Providing Our Doctors & Nurses Arrived at Control Start Providing Amazing Discounts to our Wellness.

Education loan Forgiveness for Medical care Professionals – Forbes.

New CalHFA FHA System was an FHA-insured loan featuring an excellent CalHFA 29 season repaired interest basic home loan. CalPLUS FHA Loan System The fresh CalPLUS FHA program try an FHA-insured first mortgage with a somewhat higher 29 seasons fixed appeal speed than just our simple FHA program and that’s combined with CalHFA No Attention Program (ZIP) getting closing costs. The mortgage title would be of step three so you’re able to three decades. Certified individuals normally financing to $899,000. Month-to-month home loan repayments commonly necessary. 100% financing to own a unique family. Pupil debts goes through the test procedure. Upcoming money is certainly going from the test techniques also. Certain programs to help with medical professionals.