Veterans and you will energetic service members can continue steadily to incorporate Va mortgage experts from the understanding the occupancy conditions regarding Virtual assistant money inside the 2024.

In this publication, you will observe how exactly to take care of eligibility and maximize your professionals by knowing the requirements and you may timelines of the this type of standards.

Be it the essential occupancy laws or even more advanced affairs like deployments otherwise offered absences, we’ll safety all you need to learn.

Dining table away from Material

- Do you know the Virtual assistant Loan House Occupancy Criteria?

- How come the brand new Virtual assistant Determine Occupancy?

- Will there be a non-Tenant Co-Debtor towards a beneficial Va Financing?

- What Qualifies because a first Home?

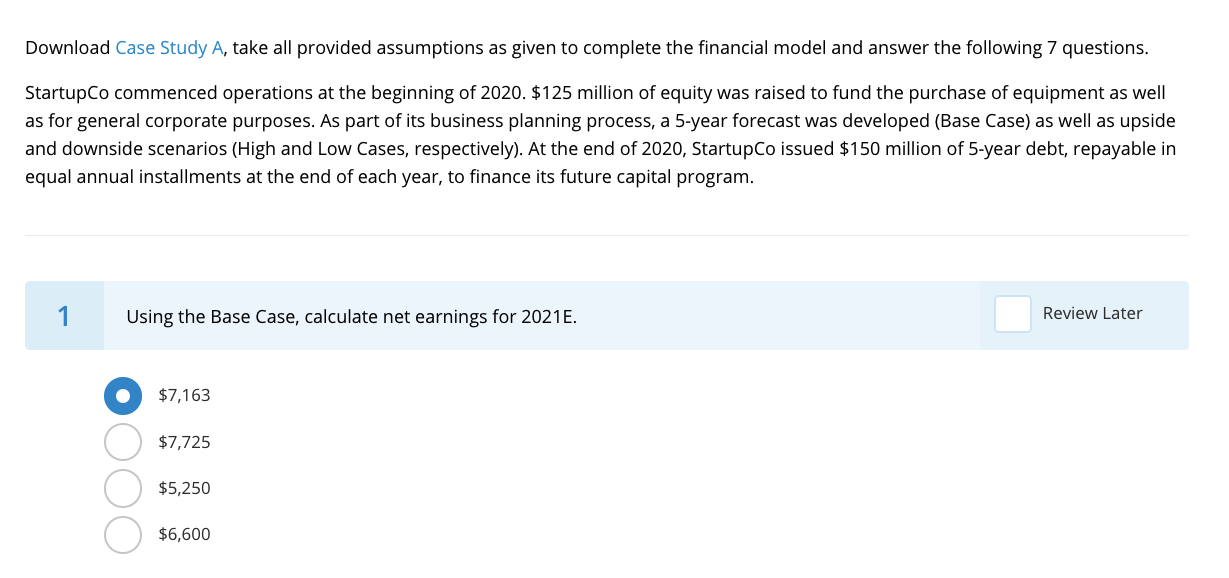

- FAQ: Virtual assistant Loan Occupancy Requirements from inside the 2024

- Conclusion

Exactly what are the Va Mortgage House Occupancy Standards?

Using an excellent Virtual assistant loan to get property mandates that property need certainly to function as consumer’s no. 1 residence, excluding the possibility of using it to possess supplementary or financial support aim.

The newest assumption is actually for the consumer for taking household from the freshly purchased household promptly, usually mode this era on no more than 60 days pursuing the the latest property’s closure.

In conditions in which impending repairs otherwise home improvements reduce brand new client’s element in order to reside the house, it departure regarding basic occupancy timeline is actually branded an effective „decrease.”

Consequently, particularly delays could trigger the borrowed funds bank asking for more papers to deal with new postponement into the rewarding the fresh new occupancy requirements.

Standards To possess Group

To own categories of veterans otherwise effective solution users, the fresh new Va financing occupancy requirements provide freedom. A wife otherwise based youngster can fulfill the occupancy specifications when the the fresh veteran never entertain the house due to services financial obligation otherwise most other legitimate grounds.

So it supply means household can still benefit from Va financing even if the provider user are deployed or stationed out-of domestic.

New veteran should give qualification of one’s intent so you’re able to entertain our home as fast as possible, ensuring conformity having Va advice.

Criteria To have Refinanced Va Loans

To have an effective Va cash-aside re-finance, consumers need go through another assessment and you can credit testing, indicating your refinanced possessions usually act as its number 1 quarters.

The fresh new Va Rate of interest Reduction Home mortgage refinance loan (IRL), are not known as Virtual assistant Improve Refinance, simplifies the process. Here, the debtor is needed to check if the property supported because their top house in the period of your own first Virtual assistant loan.

Conditions Having Deployed Productive-Obligation Service Professionals

Recognizing which, the fresh new Virtual assistant takes into account a service affiliate deployed off their long lasting obligation route given that occupying the house, given it want to get back. It provision means the individuals offering our very own country can invariably accessibility Va mortgage gurus instead punishment for their provider.

Documentation and you may Redding Center bank loans communication into lender are foundational to so you’re able to satisfying this type of criteria, ensuring services members normally focus on the obligations without having to worry on financial conformity.

Special Occupancy Circumstances

One such condition ‚s the „Rent Straight back Agreement,” hence do not meet or exceed 60 days. This agreement allows the fresh new experienced to temporarily lease the home so you’re able to the seller, delivering even more autonomy for the swinging situations.

However, people rent-back period more than two months need past acceptance on Va, usually only offered for the unusual circumstances. Pros against book occupancy demands is always to talk to their lender and you can the fresh Va to explore you’ll be able to leases.

How does the fresh new Virtual assistant Dictate Occupancy?

When selecting a house that have a good Va mortgage, the fundamental requirement is the fact that domestic need to be most of your home.

This is why attributes meant given that 2nd property or for money objectives aren’t eligible for resource owing to a great Virtual assistant financial.

The new Va mandates that the fresh new residents entertain their houses inside just what is considered a fair timeframe, that is generally likely to end up being in this 60 days pursuing the residence’s closure.