He and additionally did not recognize how tough it could be to save in the regards to this new bargain, while the the guy didn’t read simply how much functions our home manage you desire. There isn’t any criteria one a property inspector go through the household prior to an agreement-for-deed agreement is finalized. Whenever Harbour informed your he needed to score insurance, according to him, the insurance business been giving your issues with loans in Lazear our house one the guy failed to know stayed-you to definitely document he presented me, such as for instance, told your that his rake board, that’s a bit of timber close his eaves, try appearing damage.

And you can second, Satter said, all these companies are aggressively concentrating on areas in which owners strive which have borrowing from the bank due to earlier in the day predatory lending practices, such as those that powered the brand new subprime-mortgage drama

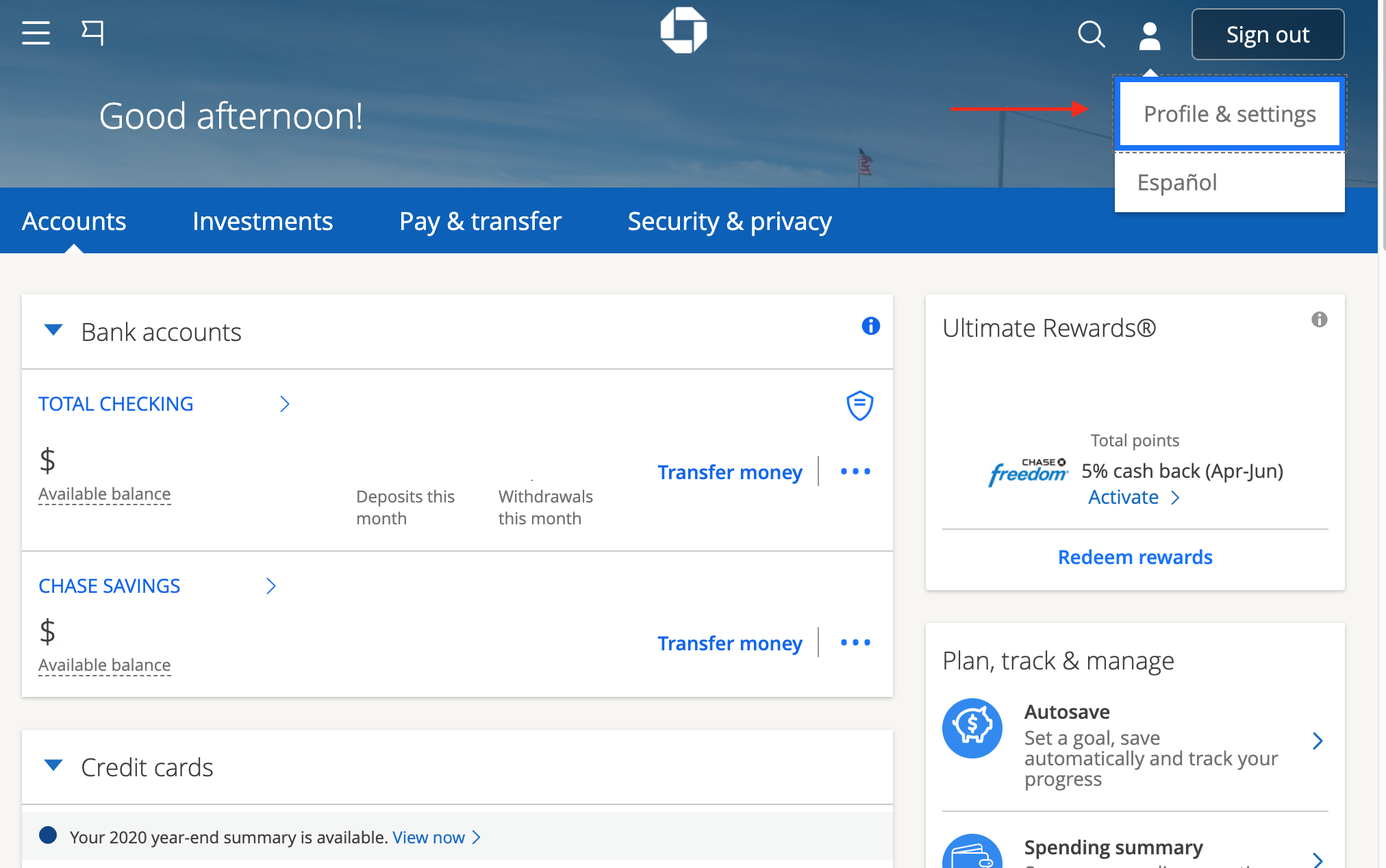

So it chart, within the Legal Support problem, shows brand new racial composition of the places in which Harbour functions is located in one to Atlanta state. (Atlanta Courtroom Aid People)

There is nothing inherently completely wrong with bargain-for-action plans, states Satter, whoever dad, Mark Satter, aided plan out Chi town customers resistant to the practice on 1950s. Will still be possible for suppliers who are not financial institutions to invest in features inside a fair ways, she said. A san francisco begin-upwards entitled Divvy, as an instance, is actually review a rental-to-very own design within the Ohio and you can Georgia that gives carry out-feel people specific collateral in the home, in the event it standard towards money. However, there’s two grounds such package-for-action plans see such as for instance unjust, Satter told you. Earliest, the brand new belongings a large number of these companies buy come into awful condition-many got bare for many years in advance of are purchased, in lieu of the brand new home ended up selling having bargain to have deed on 1950s, which was left behind from the light property owners fleeing to help you the fresh suburbs. Fixer-uppers enable it to be even more difficult for create-end up being customers to fulfill all regards to their agreements, as the home you desire plenty work.

The brand new lending uck, enabling banking institutions provide subprime loans or other financial products so you can individuals who otherwise might not have entry to lenders

In certain means, the concentration of deal-for-action characteristics within the African american areas is a medical outgrowth out of how it happened during the housing boom-and-bust. Commonly, these products recharged exorbitantly higher rates of interest and you will targeted African People in america. One to research learned that between 2004 and 2007, African People in the us was 105 per cent likely to be than white consumers so you’re able to enjoys high-rates mortgages to own home orders, though dealing with to possess credit history and other chance affairs. Whenever most of these somebody lost their houses, financial institutions got all of them more than. Those people that don’t offer in the public auction-usually those who work in mostly Dark colored areas where individuals with financing failed to have to go-wound-up on the collection off Federal national mortgage association, which had insured the loan financing. (These are therefore-named REO, otherwise real-house had home, once the financial possessed them immediately following neglecting to sell them within a foreclosures auction.) Fannie mae up coming offered these land right up in the reasonable prices to help you dealers exactly who planned to have them, like Harbour.

But Court Assistance alleges that Harbour’s visibility when you look at the Atlanta’s Ebony neighborhoods is over coincidence. From the choosing to just buy homes regarding Fannie mae, the lawsuit says, Harbour ended up with homes during the section one knowledgeable the most significant quantity of property foreclosure, do you know the same groups focused by subprime-mortgage lenders-groups from colour. Probably the Federal national mortgage association residential property Harbour bought was in fact inside distinctly African Western areas, the brand new lawsuit alleges. An average racial constitution of your census tracts inside Fulton and you will DeKalb counties, in which Harbour bought, try over 86 % Ebony. Other customers in the same counties one to ordered Fannie mae REO qualities bought in census tracts which were 71 % Ebony, new lawsuit states. Harbour and additionally targeted the products it makes during the African People in america, this new suit argues. They didn’t field its package-for-deed plans into the press, toward radio, or on television during the Atlanta, the brand new match claims. Rather, Harbour create signs inside the African american areas and you may gave referral bonuses, a practice hence, the suit alleges, intended it was mainly African Us citizens who observed Harbour’s render.