Having fun with a house guarantee financing to own debt consolidating can be beneficial, specifically for people with higher attention. Although not, moreover it comes with threats, generally putting your home since the security, starting you around the risk of foreclosure.

Because of the Zachary Romeo, CBCA Analyzed by the Timothy Manni Modified by Jonathan Ramos By the Zachary Romeo, CBCA Reviewed because of the Timothy Manni Edited by Indiana online payday loan Jonathan Ramos With this Page:

- A choice for Debt consolidation reduction

- Debts so you’re able to Consolidate

- Benefits and drawbacks

- Factors to consider

- 6 Measures to utilize property Security Mortgage

- Investigating Selection

- FAQ

The difference between your own home’s well worth and your mortgage equilibrium is become borrowed as a consequence of a property equity loan. Increasingly, men and women are together for debt consolidating. This procedure could possibly offer straight down rates of interest but also means their home is utilized due to the fact security, hence carries exposure. We shall explore how a house guarantee financing you are going to squeeze into your debt management strategy. You will learn regarding their pros, potential dangers as well as how it can impact your financial position, working out for you create advised solutions on the with your domestic guarantee to have combining expense.

Key Takeaways

Playing with a house guarantee financing to own debt consolidation reduction could offer down rates of interest, however it uses your property just like the security.

Assessing your financial balances, quantity of domestic equity and you will mortgage terms is crucial just before merging financial obligation with property guarantee loan.

Options so you’re able to household guarantee money, particularly signature loans otherwise equilibrium import cards, bring integration choices without using domestic guarantee.

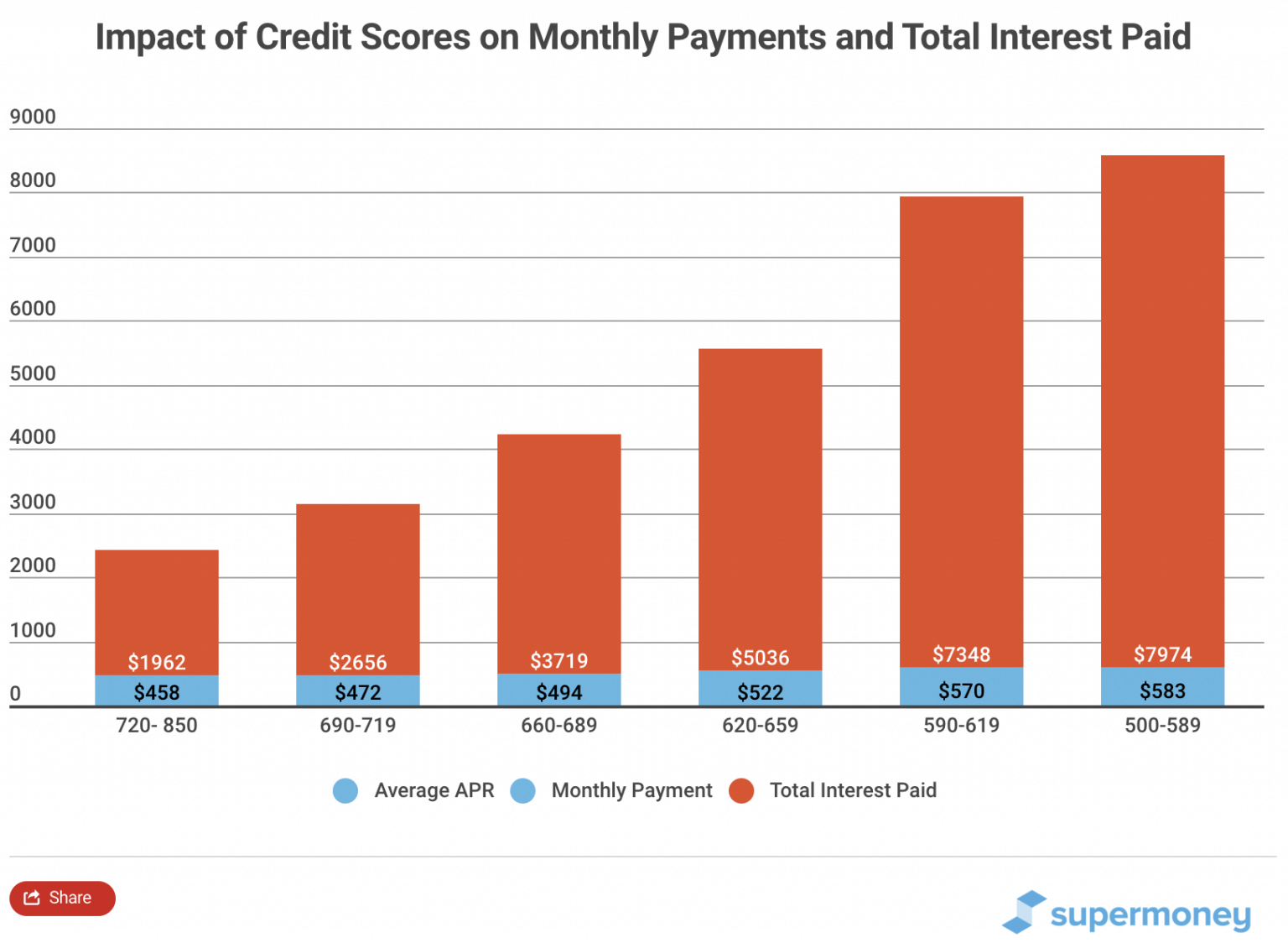

Centered on Experian, the total average debt equilibrium on the You.S. by Q3 from 2023 try $104,215 – a 2.3% raise on the preceding 12 months. Considering that shape, it’s obvious as to the reasons many seek to combine obligations. Playing with a property security loan having debt consolidating should be a great solid means as it enables you to combine more costs, such as for example unsecured loans and you can charge card balance, into you to mortgage having probably all the way down interest rates.

Like, imagine you are balancing multiple month-to-month mastercard payments, for each featuring its own large interest rate. From the consolidating these types of to the a property equity loan, you perform just one fee, will at the a lowered rate. They simplifies your financial management and will save you money in focus over time. Your credit score you’ll drop very first as a result of the new mortgage app, but through the years, uniform with the-time money you may improve your score.

Since your domestic secures the borrowed funds, failing woefully to build payments you will definitely place your family at risk of foreclosure. While making a properly-advised choice is key in relation to property equity loan to possess debt consolidation reduction.

More Expense to help you Consolidate Having a home Guarantee Mortgage

An average American’s debt collection try varied, often and mortgages, family guarantee personal lines of credit (HELOCs), playing cards, automobile financing and you will college loans. Its important to decide which debts to combine smartly. High-focus expense such charge card balance are prime candidates, as you possibly can significantly slow down the attract you pay. But not, you do not work for as often off consolidating lower-appeal finance, including certain student loans. Each kind out of personal debt enjoys different ramifications, and you will skills these distinctions is crucial while using the a house equity mortgage to combine costs.

Bills so you can Combine

Knowing and therefore debts in order to consolidate using a home security financing can also be become a-game-changer on your monetary strategy. By emphasizing certain kinds of expenses, you could potentially streamline your finances and you will possibly save well on appeal repayments. Let us talk about the sorts of debts that are generally suitable for consolidation as a consequence of a property equity mortgage.

Bank card Balance

Such have a tendency to hold higher-rates of interest, which makes them best individuals to own combination. Of the going these stability with the a house collateral financing, you could potentially rather reduce the level of interest you have to pay over big date.