- Just after discussing the purchase price, you would need to pay the choice commission to help you secure the Choice to Pick (OTP) regarding supplier. That it grants the exclusive right to buy the property contained in this a selected period.

- Obtain an in-Principle Recognition (IPA) away from a financial thereby applying for a mortgage prior to exercise brand new OTP to be sure you have the required fund.

- Take action the new OTP inside the consented schedule, sign product sales and get Arrangement, afford the equilibrium places, and you can complete every legal conformity so you can finalise the house or property transfer.

Just after much energy, you ultimately discover your ideal home to your resale market. You can not waiting in order to upgrade the home and you may move in, however, numerous actions are essential anywhere between protecting the possibility purchasing (OTP) and you can become the owner. Continue reading to determine exactly what needs to happens before you could obtain the tips on your own hands.

A choice to Buy (OTP) is a legal package in a residential property that has a buyer the latest private directly to buy a home within a specified period (usually 2 weeks for personal services and you will 3 days to have HDB) , in exchange for an option payment. If for example the visitors does not exercise which best in the option several months, owner gets the directly to forfeit the choice percentage s and you may re-listing the home for sale.

step 1. Procuring the OTP

Following the rate negotiation, the vendor (or the designated representative) continues in order to question the choice to find (OTP). A keen OTP try a contract you to definitely, following commission of one’s solution commission, gives a solution to the prospective client purchasing the house or property from the a concurred price within this a decided months (generally speaking two weeks, even though this duration might be worked out between your merchant and the consumer).

When you are i don’t have a recommended help guide to the actual articles or phrasing regarding terms and conditions inside an OTP, most possessions agencies generally speaking play with layouts provided by its particular enterprises. Perform cautiously remark the brand new terminology spelt away given that sale from the property was bound by the fresh contractual conditions listed in they.

To procure the OTP, you would have to pay the solution cash advance america in Citronelle Alabama fee, usually step 1 so you can 5 % out of price to own personal belongings (negotiable) or otherwise not more than S$1,000 for HDB flats.

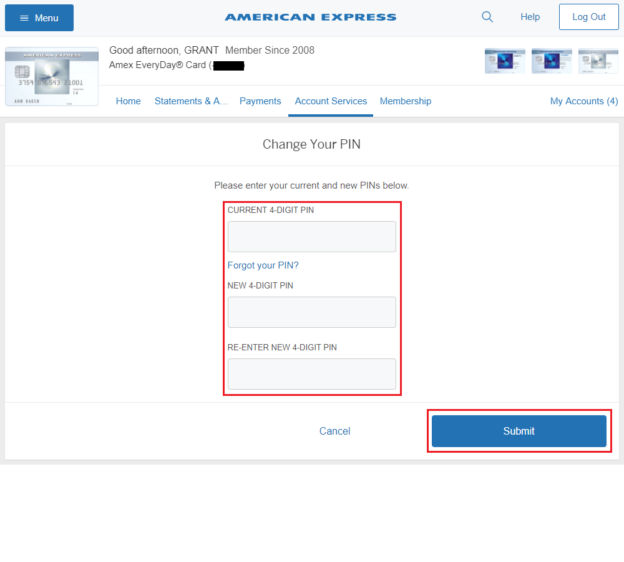

Just before reaching the OTP and you will loan application degree, you need to currently have a sense of exactly how much you enjoys available along with your CPF -OA balances. Its good practice to find an out in-Principle Recognition (IPA) out of a bank.

While not lawfully joining, protecting the IPA will give you an estimate of your level of mortgage you are entitled to when searching for property, decreasing the chance of dropping your put in the event that you don’t secure a mortgage.

Once you place your solution percentage, make an effort to make an application for a home loan on the bank just before exercising the brand new OTP.

step three. Working out the new OTP

Just like the home loan could have been approved by the bank, consumers may then move on to do it the latest OTP inside specified schedule, right after which go into an income and get Contract (S&P) toward merchant. Property transactions are usually techniques, nevertheless assistance of a legal professional be effective for the conveyancing and you can homework will become necessary.

As part of S&P, customers are required to move on to spend the money for harmony deposit (4% off price having private properties and less than just S$5000 having HDB ). The newest sale might possibly be entitled away from if for example the OTP isnt properly resolved in the specified period, while the option percentage would-be forfeited.

Don’t forget to invest the brand new Buyer’s Stamp Obligation (BSD) (estimated step three% from price) for the authorities inside 2 weeks of working out this new OTP, as well as Extra Consumer’s Stamp Obligations (ABSD) for many who own more than one assets.

Their lawyer will then resort a caveat into property. This is exactly a proper find of interest towards the possessions, blocking they away from on the market several times.

4. Pre-end

Upon workouts the latest OTP, both you and the seller would have decided a night out together out-of completion on the product sales, usually in about 10 to twelve weeks’ big date. During this time period, their designated lawyer will run the necessary checks to make certain that possessions will be offered having a flush label, with no most other caveats lodged up against they otherwise people encumbrances. During this time, a formal valuation of the property will additionally be achieved by the bank’s otherwise HDB’s designated appraiser.

By you, prepare to submit people requisite data files to the bank and/or regulators, to make the newest down-payment as required.

We f you are having fun with a keen HDB loan, the down payment was 20% of the price, that is repaid having fun with dollars, CPF Normal Account (OA) offers, otherwise one another. If you use a mortgage, the fresh downpayment are twenty five% of one’s price, that have at the very least 5% required in dollars as well as the kept 20% using sometimes bucks and you will/ or CPF OA offers.

The time gap allows owner to maneuver out from the possessions, once they haven’t already, in order to make sure old furniture was disposed of, or assented solutions done. This needless to say hinges on the fresh decided conversion terms and conditions while you are getting the assets during the as-in position or vacant hands.

Finally, at the time out of conclusion, build a trip to your own lawyers’ work environment where you might be theoretically entered as happy the new proprietor of the house. Right now, the attorney could have currently observed on move the rest 95% into seller, enabling you to assemble the secrets to your ideal house.

Manage observe that any repairs charge, property taxation or other costs of the possessions will take feeling using this day from achievement.

With our last stages in put, you could potentially initiate any need restoration and begin converting the brand new recently bought product into your dream house.

Begin Believe Today

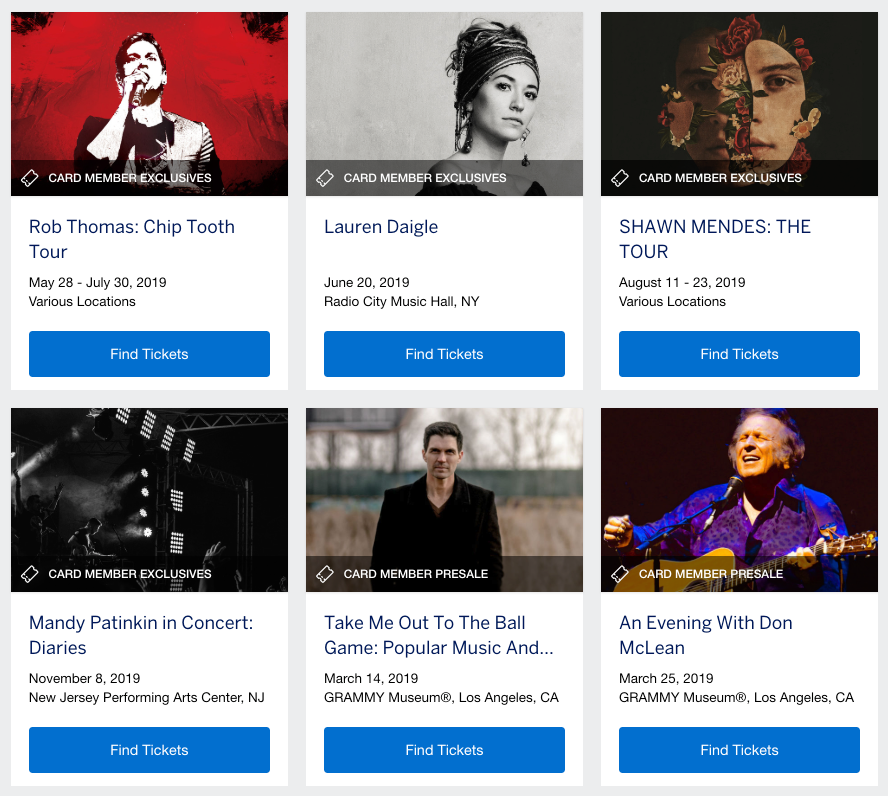

Below are a few DBS MyHome to work through the fresh new sums and get a property that suits your financial budget and you will preferences. The best part they incisions the actual guesswork.

Instead, ready yourself which have an out in-Concept Recognition (IPA), so you keeps certainty how much you could potentially borrow having your residence, letting you see your financial budget precisely.