The Service out-of Construction and you can Metropolitan Development (HUD) is actually setup, to some extent, and then make owning a home much easier and a lot more available. They have several some other software which could let handicapped property owners. The new Homeownership Discount coupons System (Section 8) allows those who you desire casing coupon codes to utilize these to pay the home loan otherwise help them get a property instead of just for renting.

A unique system that could let people with handicaps is the Government Homes Government (FHA) money, which provides financial insurance rates to own finance of loan providers that will be people on the FHA finance program. By providing insurance, the fresh new FHA means that loan providers can give borrowers down interest levels since their risks is actually mitigated. These types of down costs indicate that homeownership is much more accessible to some one who are lower-earnings, as well as disabled people who qualify.

Virtual assistant Home loans to possess Handicapped Pros (Virtual assistant Fund)

If perhaps you were harmed when you’re helping regarding the armed forces, then the You.S. Agencies out-of Veterans Products could easily help you with a grant or loan to buy or make property that is modified into the demands. The fresh new Virtual assistant provides Particularly Adapted Homes Provides otherwise Unique Housing Adaptation Grants to help you buy, create, otherwise remodel a house.

Federal national mortgage association

Federal national mortgage association is a federal government-paid, for-finances team that was install to simply help Americans accessibility affordable mortgages. Federal national mortgage association keeps expertise programs getting individuals that have handicaps and you may brings financing that have flexible underwriting requirements to aid so much more disabled anybody be eligible for its HomeReady Mortgage Program.

House in regards to our Soldiers

When you’re a seasoned who was simply hurt from inside the Iraq otherwise Afghanistan, you could potentially meet the criteria to find help with an adjusted family through the low-profit Land in regards to our Soldiers. It business facilitate pros have been harmed immediately after . They donates recently constructed and you may especially modified personalized belongings to possess experts to alive on their own. Which providers generally deals with pros who have had numerous limb amputations, limited or complete paralysis, or significant harrowing mind burns.

Habitat having Mankind

Habitat to have Humankind support individuals with reduced earnings fulfill the desire home ownership. Which have groups inside the nearly 29 states, Habitat to own Mankind cannot specifically manage disabled property owners, but disabled home owners yes can get qualify. Which organization is known for demanding that individuals just who get home installed perspiration equity’ and help make home, nevertheless the work doesn’t have to be real. You could deliver sweating equity’ various other an easy way to qualify.

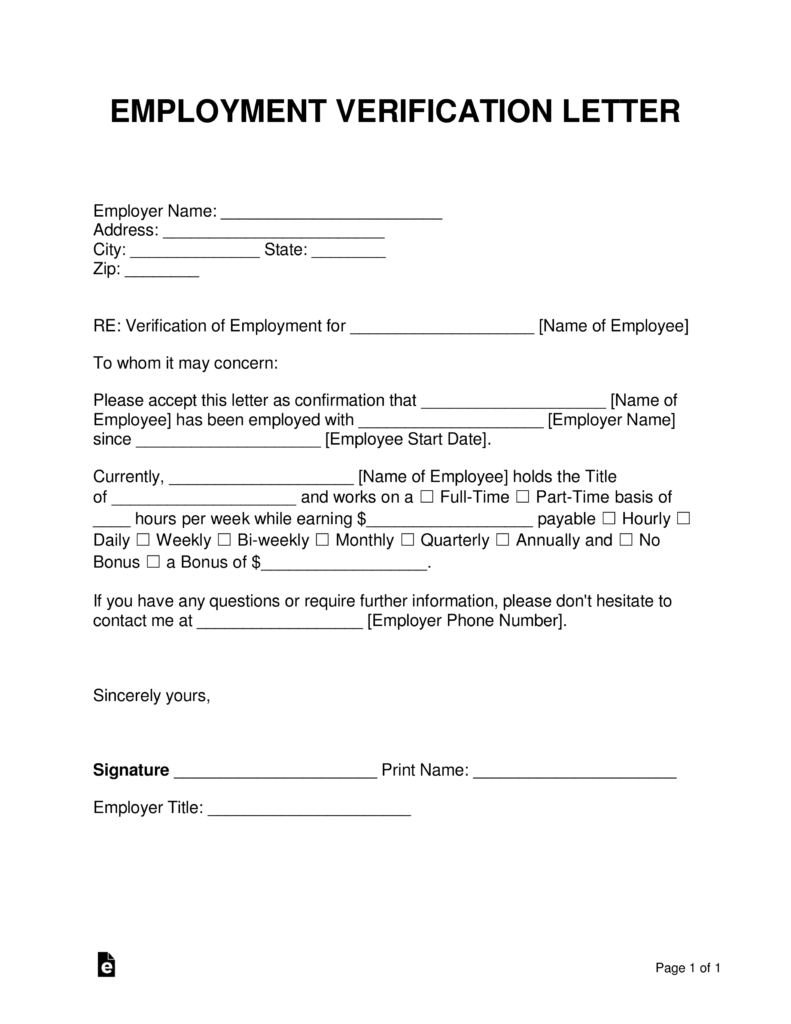

Obtaining a mortgage

If you’ve never owned a house prior to, you might be overloaded into concept of trying to get good financial. If you choose not to ever go with among the many programs a lot more than that can help one to pay money for a property due to good special program, then you might decide to strategy a lender yourself. This is what the procedure can look including:

1) Like a lender

The initial part of their financial software processes comes to opting for https://paydayloanalabama.com/needham/ an effective financial. Check around. There are websites where you can rating rates out of numerous loan providers. You can find out if you’d qualify for a loan and possess a price of your attention it is possible to shell out.

If you’d like lower costs, consider lenders whom offer FHA financing, otherwise lenders who will be known to work at those with handicaps with the limited income. For people who merely functions area-day or you aren’t effective, you can struggle to discover a loan provider who’s happy to give you home financing.

2) Rating Pre-recognized

Getting pre-approved before going away and you will shopping for your brand new house is vital. This is because you will understand what your funds was, that may be sure to cannot take a look at residential property more your finances. If you find yourself a pre-acceptance isn’t really written in stone, it gives you a better thought of how much cash you’ll be able to be considered to have.