- A non-repayable provide away from a primary cherished one

While the down-payment can be one of the greatest obstacles when selecting a house, specifically for first-big date homebuyers, saving to possess more substantial advance payment features tall positives:

- You’ll need to use quicker out of your lender, that could make it easier to qualify for home financing.

- The month-to-month mortgage repayments might be all the way down.

- You can easily spend quicker in desire over the longevity of your mortgage.

- When your advance payment are more than 20% of your own cost, you simply will not need mortgage loan insurance policies.

3) Keep the Day job

While contemplating quitting your work, creating a special company or supposed freelance, you might want to believe prepared up to shortly after your own financial has actually come acknowledged.

Loan providers like to see a regular source of income as well just like the stable work to display you could potentially continue earning across the course of the loan. When you yourself have a track record of bouncing around out of jobs so you can employment otherwise durations instead a constant earnings, your bank will question the precision in the learning how to expend the loan.

Normally, you’ll want to offer factual statements about their past a couple of years of a career. Substantiating your revenue is pretty simple if you are an effective salaried worker as you are able to use your shell out stubs, lead places or T4s to confirm their income. For individuals who works hourly, or discover profits otherwise bonuses inside your money, you will need to provide at the very least the very last two years out-of See away from Examination. While you work on your own company, you will likely have to bring financial statements as well.

4) Don’t Take on A great deal more Obligations

Your own Disgusting Obligations Provider ratio (GDS) ‚s the percentage of your own monthly money you to definitely visits houses can cost you. Target: 39% or faster.

Your own Total Obligations Provider ratio (TDS) is the part of your monthly income one to visits property will cost you or other debts. Target: 44% otherwise faster.

If you are contemplating to shop for a home, it makes sense to not make large orders who would include toward personal debt weight. Of course, if you have home financing preapproval, you definitely don’t want to deal with any extra obligations, given that preapproval are conditional on the level of loans you had at the time of the program.

5) Reduce Current Obligations

While it is vital that you perhaps not take on more financial obligation, it’s incredibly important to pay down the financial obligation you have. The degree of debt you happen to be holding impacts your ability discover home financing in 2 key means:

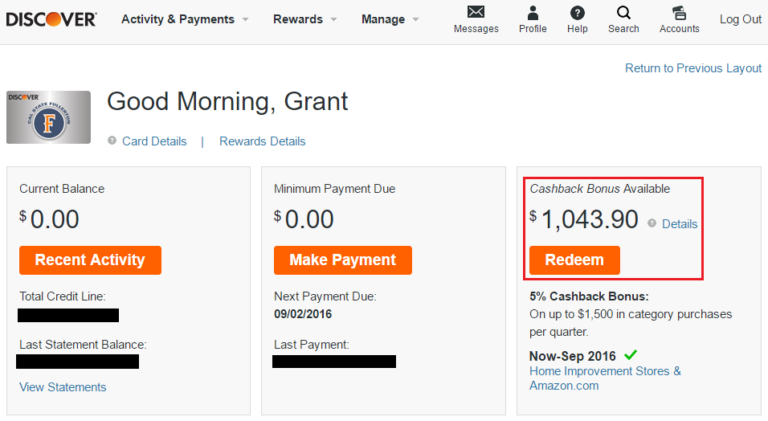

The borrowing from the bank application: This is certainly a proportion out of how much financial obligation you may be playing with divided because of the overall borrowing from the bank nowadays. It’s best if you keep your borrowing usage lower than 31%. Including, for those who have credit cards with good $10,000 limitation and you are clearly carrying an effective $step three,000 harmony, you’re playing with 30% of your offered credit. But if you have a line of credit which have an effective $ten,000 maximum and you are clearly carrying an effective $8,000 balance, their borrowing use for the account try 80%, and on mediocre across one another membership are 55%. By paying off your own the balances, you might be exhibiting you could potentially control your financial obligation if you find yourself in one go out enhancing your credit history.

Your debt-to-earnings proportion: Just like the noted a lot more than, lenders check your capacity to service your personal debt depending on the latest money. Because you pay down your debt, your own TDS commonly miss, which makes getting a more powerful app.

When you are loan providers like to see a diverse credit rating, definition you are controlling several types of financial obligation, certain types of financial obligation are believed riskier because of the lenders and really should income installment loans in Iowa with bad credit be distributed down very first. Such as: