The credit business is alternative once you line-up borrowing from the bank devices with investment components. On one hand, you will want to offer diverse lending options in the designed rates and fee terms. On the other, you will want to care for attractive investment sources, together with merchandising accounts, label dumps, solitary and you may multiple investor profiles, and you will asset-connected industrial paper. You prefer financing software that can help speed up that it feel to own subscribers.

Portfolio+ loan, rent and you will home loan government software will bring a single source of finance getting users, towards the added capacity to combine products which have changeable costs, words and currencies significantly less than a faithful borrowing from the bank studio. In addition, it allows loan providers in order to broaden their product holdings easily and you can effortlessly by adding and you will / otherwise revitalizing loan affairs.

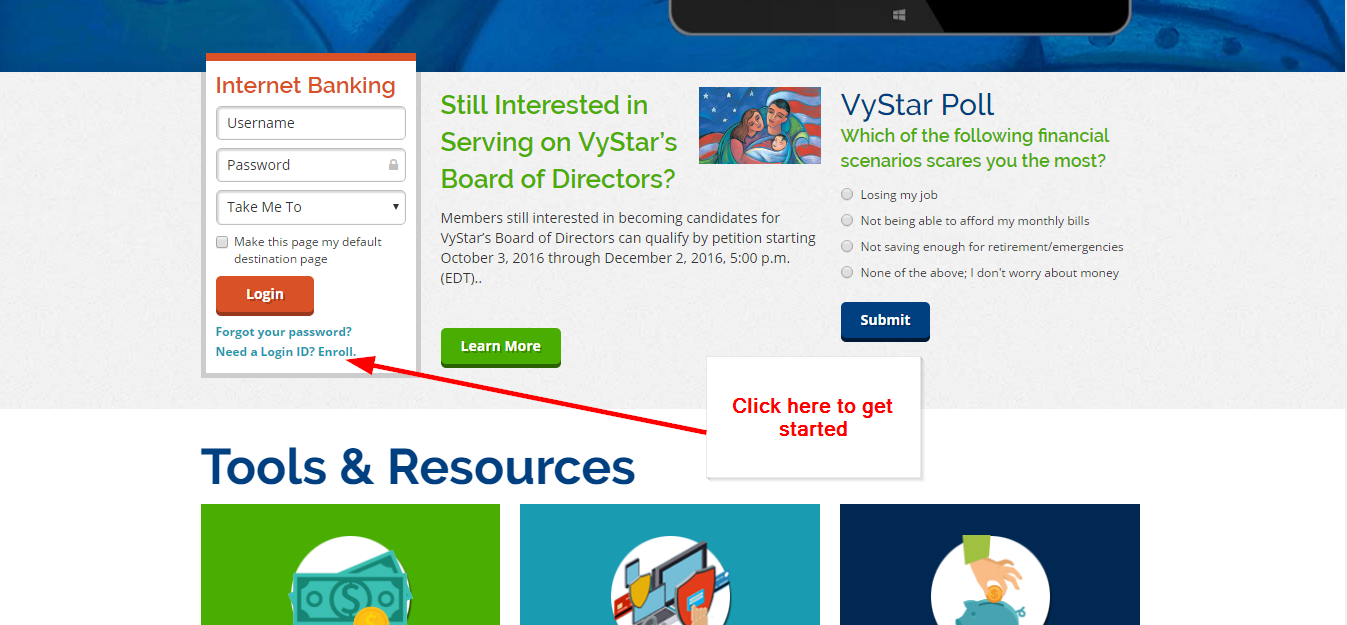

Our credit software allows lenders to handle a large collection away from circumstances using a beneficial harmonious program for origination, acceptance, underwriting, maintenance, and capital. Permits mortgage and you may lease applications to get accepted thru an effective websites portal, XML feed, agent, or the top workplace. Our service supporting shielded credit lines eg domestic collateral, contrary mortgage, and you will choice lending as well as bodies financing efforts to own farming development, sanitation and you can water-supply, housing, and you can infrastructure development.

Portfolio+ line a financial mediator

We let an economic mediator worried about retail and you may domestic dumps including commercial mortgages to optimize the business owing to techniques automation and you will combination for the CANNEX Financial Community (CFN).

Why Profile+ mortgage, lease, and financing profile management app?

Portfolio+ mortgage, rent and you can financial management provider increases the latest purchasing stamina off domestic consumers if you’re complying that have legislation to decrease your debt land regarding Canada. This has independence to use borrowing from the bank bureau reports, perform a bespoke scoring system, otherwise adopt a hybrid model to assess credit history.

Our very own solution integrate hand calculators to select the terrible personal debt solution ratio and you may total personal debt services ratio regarding individuals. It will help federally controlled lenders be considered of the home loan fret sample mandated from the Office of one’s Superintendent out-of Financial Organizations (OSFI) in Canada. Further, the centered-into the checklists speeds operating and acceptance regarding home loan programs.

Portfolio+ allows financial businesses so you’re able to broaden their funding present of the personally hooking up buyers to help you financing instruments, funds to possess get better, as well as on-supposed commission administration. Percentage remittances for a keen investor’s holdings will likely be according to research by the conditions and terms of your own financing appliance (pari-passu) or investor (non-pari-passu). The capability to identify anywhere between resource discussing and you will individual revealing lovers means remittances correctly fulfill the regards to financial / trader preparations.

The loan syndication function lets remittances to get placed and you will stored into the an investor’s cash account, that’s employed for coming opportunities or paid out as a consequence of automated booked transactions. The app helps reporting (T5 slip to own attention income), deduction off tailored maintenance charges at the origin, and you can recharging of interest to your debit stability.

Portfolio+ mortgage, lease and you may home loan government services allows companion syndication and you may addition away from exterior financing supplies. New direct mortgage admission and you may financing group entry functionality of our solution simplifies onboarding and you may government out of an obtained portfolio and you will / otherwise a different business entity. All of our solution enables loans and apartments to be applied and you may accounted for regarding the underwritten money. Likewise, it advances upkeep visit this website out-of pari-passu money.

All of our provider facilitates securitization regarding contractual financial obligation, particularly car mortgage, farming loan, and you will assets home loan. It will make asset swimming pools based on varied conditions, and additionally payment regularity (month-to-month, bi-month-to-month, semi-monthly), compounding frequency (month-to-month, every quarter, bi-yearly, and you can yearly), in addition to financing tool (loan, home loan, page out of borrowing from the bank, and you will equity personal line of credit).

The provider mitigates borrowing risk from the providing recording, feedback and you can amendment of every house pond. Additionally, asset-linked securities shall be shipped in order to external mortgage investment, securitization, and whole loan profile administration software options like TAO Solutions’ mortgageHub.