- Contact that loan Officer

- The Processes

- Free Financial Calculator

- Resource Words

Delivering a home loan can seem challenging regarding exterior searching within the. That is why Payment House Lending strives commit apart from and also make your own financial techniques simple, smooth, and you may stress-totally free.

That have action-by-step pointers out-of Settlement’s knowledgeable mortgage advisors, you are able to constantly see what’s happening with your financing. And additionally, you might almost begin and you will song your own deal on our very own free LoanFly application. Away from posting files and you will seeing next tips in order to checking their borrowing rating and you can overseeing the loan updates, you should have a totally transparent look at their home loan processes towards one internet sites-linked product.

Contact a financing officials right now to start. You happen to be and additionally this is browse Settlement’s Frequently asked questions page discover responses to help you popular home financing issues. We have been right here in order to make the loan techniques an amazing one and also to make sure that your financing closes punctually.

- Contact that loan Manager

- All of our Techniques

- 100 % free Mortgage Calculator

- Capital Terms and conditions

Prequalify

Earliest, submit their prequalification setting that have Settlement Domestic Lending. This is one way i begin new confirmation process and ask for additional what to conduct your home financing approval.

Get your Papers In a position

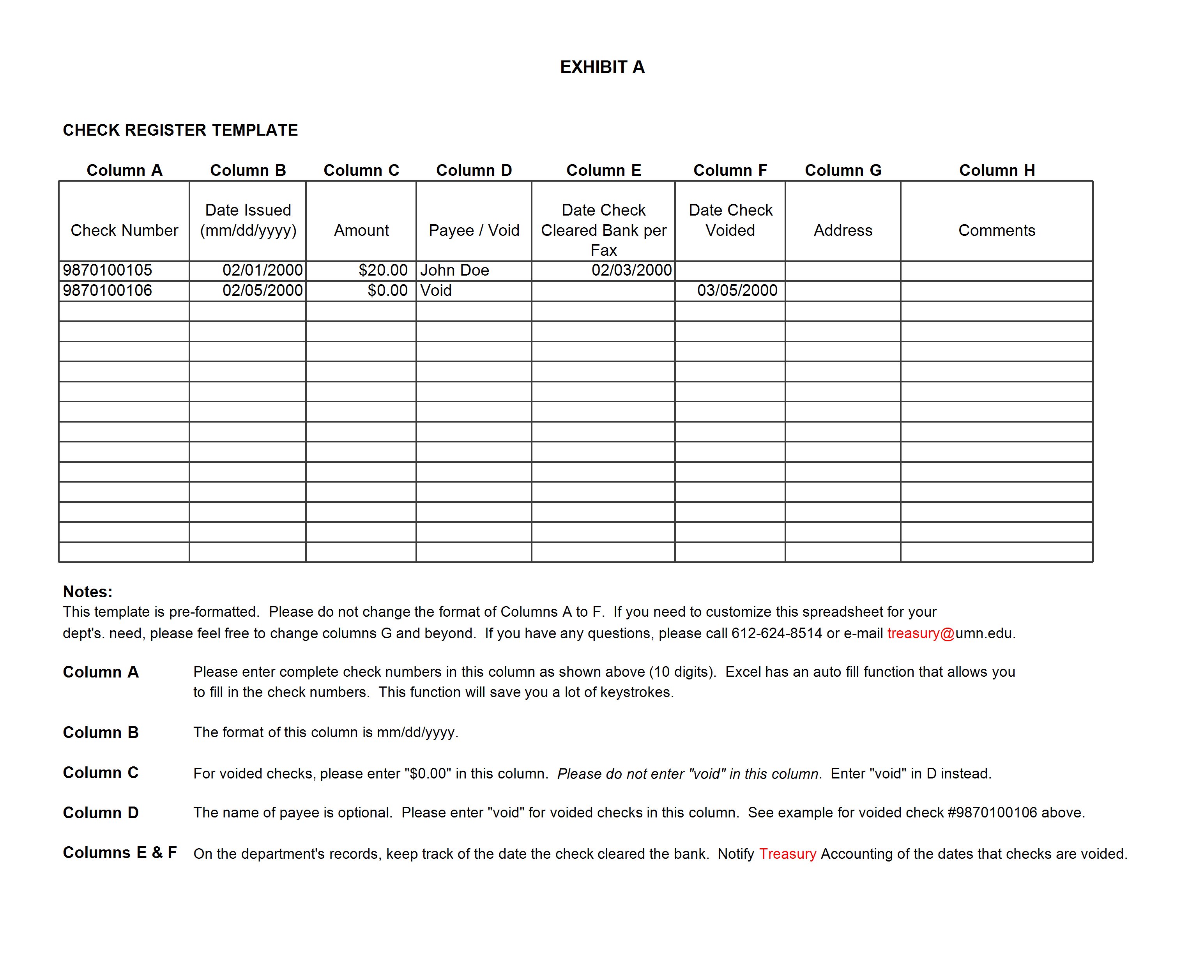

The loan officer often current email address your a listing of products requisite for your application, which you yourself can upload thru safe elizabeth-facsimile otherwise publish so you’re able to LoanFly Debtor Site from your own desktop otherwise favourite tool.

Done Their Specialized Software

Work at the loan administrator to accomplish all expected papers. To rates anything upwards, you might consent to sign and you will discover documents electronically. It is possible instant same day payday loans online Arkansas to schedule a consultation with our team to go more questions in order to opinion and you may signal documents directly.

Handling

Our processor purchases the brand new assessment, label union, or other verifications. You may be requested to transmit more info considering exactly what the fresh chip knows will be required to suit your certain mortgage system maintain the method on course.

Underwriting and you will Clearing Standards

Our very own underwriter reviews their documents to decide if every loan program direction was basically found. Sometimes, a loan are Accepted that have Criteria, which means that your underwriter might need much more information before it officially agree the loan. Including your outlining a work gap otherwise bringing evidence that the serious money fee has cleaned.

Prepare to close

This can be exciting your loan simply several actions of closing! All of our nearer brings their closing data towards the term organization’s closer, just who next contributes those people amounts on their title charges and the of those as part of the a residential property contract.

Latest Figures

Your loan officer covers last numbers to you in advance of your own closing meeting. When you are needed to give one money so you’re able to closure, cause them to in the form of a great cashier’s have a look at produced over to the latest term company. It is possible to love to cable money into label company.

The big Time!

Just take a final walk-as a result of of one’s gorgeous custom-made domestic! A short while later, you’ll be able to sit-in this new closure meeting in order to sign files. Then, pat oneself on the back and you will commemorate you might be a citizen!

Of the decorating one and you will/or all documents, a candidate is actually not a chance forced to accept the fresh new terminology and you may standards of one’s financial considering, nor do new borrower need certainly to provide these data files to get that loan Guess.

Seek out one of our most-put financial calculators, our Fee Calculator, to compare different price points and determine and that fee choice suits your money.

This type of calculators are good undertaking things to guess the homebuying will cost you. To get more accurate wide variety predicated on individual demands, offer Payment Home Lending a call. We have been willing to manage a home loan plan to assist you achieve your quick-label needs and you will enough time-title fantasies!

Funding Terminology

The complete annual price of a mortgage conveyed while the a portion. It gives attract or any other fund charge such activities, origination fees and home loan insurance rates.

The brand new proportion so you can be considered you having a beneficial mortgagepares your own overall monthly construction expense and other debt (extent you only pay out) together with your overall month-to-month revenues (the quantity you earn).

The essential difference between product sales cost of your house as well as the home loan number. Visitors will pay having bucks and won’t financing with a mortgage. Serious Currency: a deposit provided to owner to exhibit one a potential consumer is serious about purchasing the family.

The procedure of pre-determining how much cash a prospective visitors would be entitled to borrow. Prequalifying for a loan doesn’t be certain that acceptance.

The loan count, not including notice; extent lent or left delinquent. Together with, the newest an element of the payment per month one to decreases the a great equilibrium off a home loan.

Written evidence you to proves you are the holder of your home. Underwriting: the analysis of the overall borrowing from the bank and property value while the dedication out of a home loan rates and you can identity.

The total yearly cost of home financing expressed because the a share. It offers focus or other fund charges including affairs, origination costs and financial insurance rates.

The newest ratio so you’re able to be considered your getting good mortgagepares the total monthly houses expenses or any other loans (the quantity you pay away) together with your complete monthly revenues (the amount you get).

The essential difference between the sales cost of our home plus the home loan count. Customer pays which have dollars and will not funds with a home loan. Serious Currency: a deposit given to owner showing one to a potential consumer try serious about purchasing the house.

The process of pre-deciding how much cash a prospective client is eligible to acquire. Prequalifying for a financial loan cannot ensure acceptance.

Your loan count, not including interest; the amount lent otherwise leftover delinquent. In addition to, the fresh a portion of the payment you to reduces the an excellent harmony regarding a home loan.

Created proof one to shows you’re manager of your property. Underwriting: the analysis of one’s full borrowing from the bank and you will worth of and the commitment regarding a home loan rate and label.