It is basically problematic for Deferred Step getting Childhood Arrivals (DACA) receiver to locate loans from banks – but it’s nonetheless you’ll be able to. Many banks and loan providers will envision your a top-chance individual because of your updates. Many financial institutions thought DACA are short-term and not secured since DACA is easily impacted by U.S. immigration legislation. Although not, DACA readers is also use from other loan providers. You can aquire unsecured loans, figuratively speaking, and lenders out-of banking institutions or any other loan providers. This information demonstrates to you ways to get unsecured loans, student loans, and you can lenders because a good DACA individual.

What sort of Financing Is DACA Receiver Score?

You start with the latest National government, Deferred Step to own Youthfulness Arrivals ( DACA) readers you can expect to stay in the united states and you may availableness a work permit, driver’s license, and Societal Safeguards number. Not surprisingly, obtaining loans remains quite difficult for Dreamers, who will be felt high-exposure consumers.

However, Dreamers have certain mortgage choice. People who have DACA status meet the requirements private money, college loans, and you can lenders. Your odds of efficiently getting financing confidence their chance position otherwise exactly how risky from a borrower you are.

Normally DACA Recipients Get Personal loans?

Usually, DACA users meet the criteria private finance. Signature loans are financing provided when it comes to individual reasoning. Such as for instance, you are able to money the college tuition can cost you otherwise family solutions. Although not, of many lenders thought DACA funds a large chance. Given that legislation and you can standing regarding DACA you are going to alter at any time, there was a danger one to You.S. Citizenship and Immigration Services (USCIS) could deport your afterwards. The financial institution would be unable to recover their currency if that took place.

Concurrently, of bad credit installment loans Pennsylvania numerous Dreamers do not have the expected files or nice credit history. Of a lot as well as use up all your a beneficial co-signer or anyone prepared to be sure repayment once they do not pay their finance. Finance companies tend to be unwilling to loan to help you DACA receiver. Nevertheless, option personal loan providers is generally prone to approve the loan demand.

Can also be DACA Users Get Bank loans to own College?

DACA system beneficiaries don’t be eligible for government school funding or federal figuratively speaking. But you can discuss solution school funding choices. Undocumented pupils qualify for into the-county tuition pricing in a few states, such as Nyc, Florida, and Illinois. Your school get request you to fill in the brand new Free App getting Government Student Services (FAFSA) to find out if the country’s Department off Studies or even the school by itself gives you educational funding.

Depending on a state home updates, specific says such as for example California, Connecticut, and you will Minnesota provides school funding programs particularly for Dreamers. You will want to contact your school’s educational funding workplace to inquire of their eligibility. You can also start shopping for grants to possess undocumented immigrants from inside the high-school.

Additionally, certain schools and loan providers believe DACA students is around the globe people. If this is the case, you may be able to get financial assistance having internationally children, such as for instance personal scholarships or individual student loans. not, financial institutions get envision DACA figuratively speaking given that alternative money, that could cause high interest rates. Very carefully take into account the cost terms of any financing you take away, for instance the amount borrowed, interest levels, and whether you can find fixed prices, payment costs, origination charges, and autopay possibilities.

Can be DACA Receiver Get home Finance?

DACA readers are eligible getting mortgage brokers. Tend to, conventional financial institutions cannot accept your application, however, you can find alternative possibilities. One to option is a loan regarding Federal Property Management (FHA) tailored explicitly for Dreamers. You’ll find four standards in order to qualify as a low-permanent citizen:

You want a jobs Agreement Document (EAD) out of USCIS to show you have permission to operate regarding the United states.

You might like to shoot for a loan away from an exclusive financial. Such finance tend to have a lot fewer files requirements. not, they will certainly probably anticipate a minimum credit score of 650.

What do You will want to Yield to Score a mortgage since a good DACA Recipient?

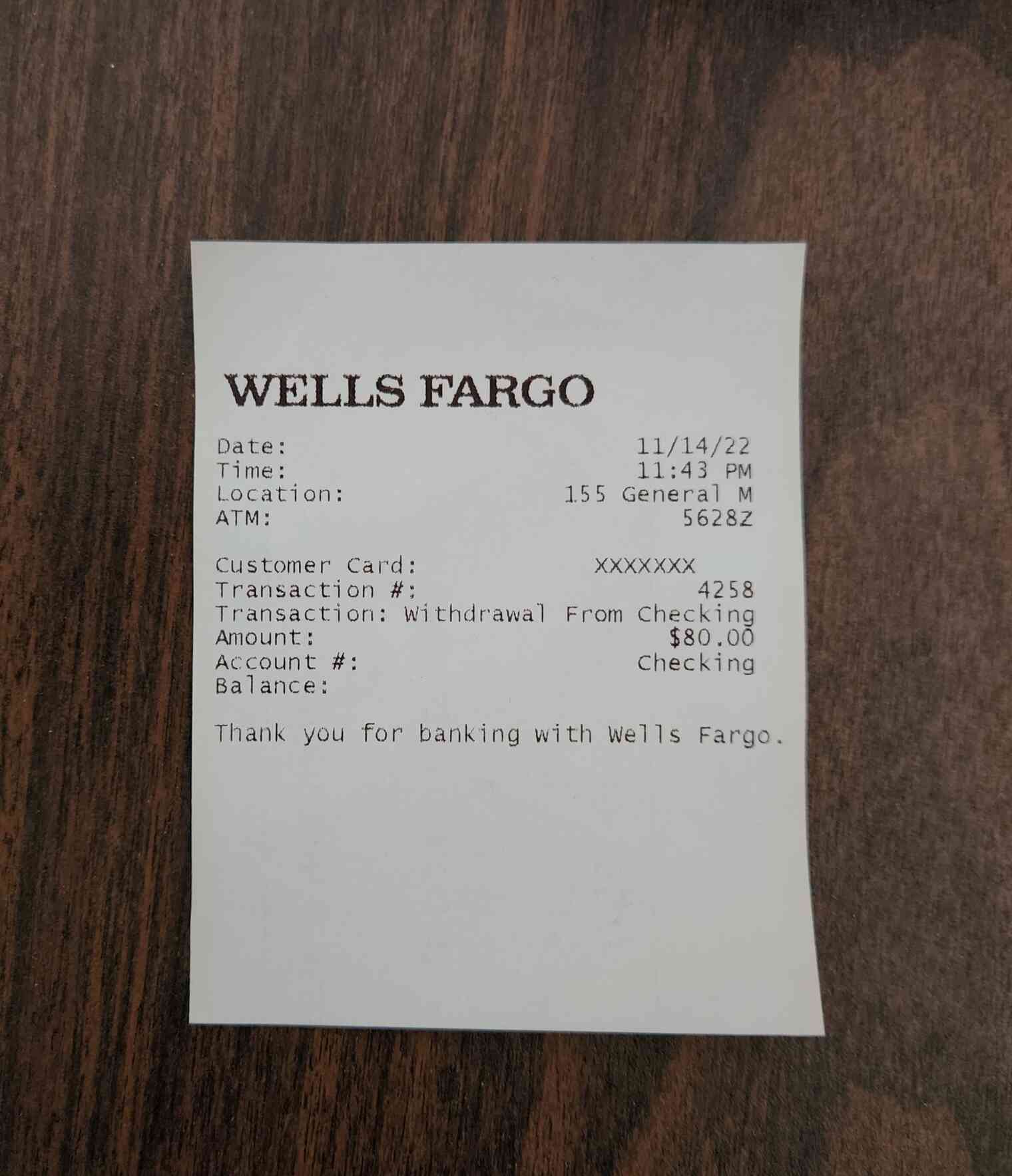

Then there are to show you have a steady earnings and show an account equilibrium to prove you really can afford to get a house.