If you’d like to pay money for emergency household fixes or medical expenses, a house equity financing will help. Fl family equity money allows you to safe that loan within an aggressive rate with the equity of your house.

At the Griffin Funding, we have been dedicated to letting you get a hold of finance that fit your circumstances – along with house security financing inside the Fl. E mail us or incorporate online to find out if you qualify getting a florida household collateral financing.

A florida house guarantee mortgage (HELOAN) enables you to safe that loan utilising the collateral in your house just like the collateral. Since you live in your property for extended and start so you can generate much more collateral, you should use one to collateral to make it better to safer that loan.

Household security mortgage cost from inside the Fl act like home loan rates, meaning a home guarantee credit line or loan have a tendency to generally offer you a lowered rates in comparison to something such as a charge card otherwise consumer loan.

Generally speaking, you might acquire a total of 95% of one’s guarantee you have in your home. Once you have covered the loan, possible make monthly obligations as you manage that have all other loan. If you choose to sell your residence, payday loan? you will have to pay off your residence collateral financing entirely. Or even pay back your loan, those funds will come from your own home purchases.

We truly need which you give W2s and you will taxation statements after you submit an application for a home guarantee loan for the Fl, but we supply a bank declaration HELOAN having care about-operating borrowers.

Form of Home Security Finance

Selecting the most appropriate style of home guarantee financing is the first step if you would like tap into your property collateral . Different varieties of funds give some other pros and cons, so you need certainly to like financing that meets debt means.

Fixed-rate house guarantee finance for the Fl allow you to sign up for just one lump sum making use of the guarantee of your home and you may pay-off financing over a predetermined several months. Fixed-speed finance maintain the exact same rate of interest and payment per month while in the the length of the borrowed funds – which is usually between four and 40 years.

Property equity credit line is far more instance a cards card. You’re provided a fixed paying limitation for how far security you have of your house, and you may monthly installments vary for how far spent. Immediately after four or 10 years, you are no further permitted to mark from your own HELOC, and also you should begin paying the credit line.

One another loans are used for numerous purposes, from home developments and you will medical problems to college tuition and paying out of credit cards. Fixed-rate financing is a simple and easy safer option for particular some one, however, a HELOC may be the proper solutions if you are not sure simply how much you will want to purchase.

Benefits and drawbacks off Fl House Security Funds

Understanding how a beneficial HELOAN works and you may precisely what the benefits and drawbacks is can help you decide if a home collateral financing is good for you. Within this area, we are going to examine a number of the positives and negatives off house equity money in order to make an educated choice.

- You have access to income that you otherwise wouldn’t have admission to.

- Griffin Funding also offers aggressive pricing to your home security money for the Fl.

- Less rate of interest function the payment is actually less, in order to pay-off your loan punctually.

- Household guarantee loans don’t require you to sacrifice their reduced-speed first-mortgage.

- You are able to household equity fund for different motives, such as for instance money domestic home improvements, consolidating personal debt, and you may investing in most other large expenditures.

- You could add on the overall obligations that have house equity loans.

- Failure to settle a house collateral mortgage can result in shedding your property.

- A great HELOC can get you in trouble for many who spend more than just your expected.

As you can tell, you can make a quarrel to possess both sides. Fl family security loans is a beneficial equipment when put sensibly, nevertheless they can increase the debt weight and place you from the chance economically if you are not cautious.

Florida Household Equity Financing Degree Standards

If you’re considering applying for a fl household guarantee mortgage, there are certain standards you need to see. There are even constraints to help you simply how much you can use created with the security of your home.

Typically, you want 20% equity of your house to apply for a home security mortgage. Particular loan providers will let you get a loan having because nothing because fifteen percent security. You will need to find yourself with no less than 5-15% in the collateral leftover of your property after the bank finance your own family equity loan.

Before granting the loan, loan providers look at your credit score and you can personal debt-to-earnings ratio to determine your creditworthiness. A reduced obligations-to-income proportion makes it much simpler locate approved for a loan.

Lastly, lenders will at your mortgage repayment record and your earnings. You want to be sure to can pay off your home security loan just before we approve the application, therefore we view to ensure that you has consistent and you will enough money.

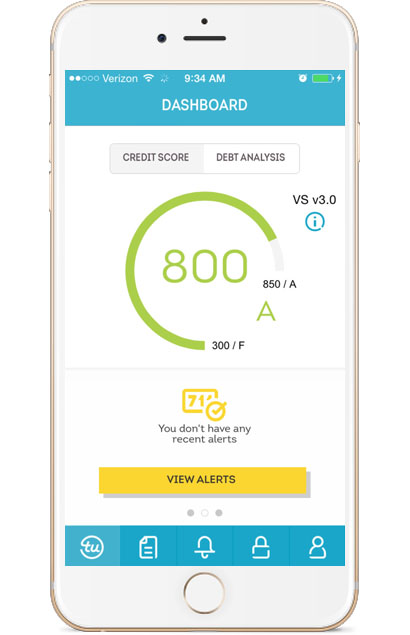

You need to use the Griffin Silver application to trace your own earnings, check your credit score, and continue maintaining tabs on the current worth of your property. Griffin Silver also includes budgeting equipment that can help you get right back focused and make certain your debt-to-money ratio is good adequate to be eligible for a house equity loan.

Make an application for property Guarantee Mortgage in Fl

When put responsibly, home security financing can help you hold the financial support need to fund school, renovate your house, otherwise purchase a health crisis. You will need to select the right sorts of Florida domestic collateral mortgage and just obtain what you want – particularly if you favor a beneficial HELOC.

If you are looking to possess property collateral financing otherwise Fl home collateral mortgage refinancing, our company is here to assist. Griffin Financing also offers aggressive rates to your household security finance into the no. 1 homes, second residential property, and you can funding properties, which means you can access the money circulate you want in place of high interest rates. Contact us or over a HELOAN app on line to see if you be considered.