Your house guarantee is the difference between industry worth of your house while the an excellent harmony on your home loan. To the a property value $three hundred,000 that have a beneficial $200,000 mortgage remaining, you might provides $100,000 from collateral.

If you have dependent adequate domestic collateral, you’re able to use that it financial support to access it for money, and and so avoid a property foreclosure. Household guarantee selection include a house security mortgage, family guarantee personal line of credit and you can household security contract.

Other kinds of fund which will help people avoid foreclosure include new foreclosure bailout loan and reverse mortgage. But in the place of the house security points mentioned above, these financing come with higher costs and higher-attract payments.

Nobody imagines after they buy a home that they might someday get rid of they. That’s just what might happen whether your home falls on property foreclosure.

Unexpected economic conditions, medical emergencies or any other facts can cause home owners to fall trailing on the month-to-month mortgage payments. When you have owned your house for a lengthy period to determine equity, you will be capable avoid foreclosure by the scraping into your house’s value. Being able to access household security brings dollars in accordance with the worth stored in your residence.

Present property foreclosure trend

When you take out a mortgage loan, you generally find the label and you may interest you to best suits your financial situation. Nevertheless when your debts change, exactly what immediately after appeared like a manageable deal may become a nightmare.

You to latest analogy impacting of several property owners could have been the new COVID-19 pandemic. Nobody have predict that for example a common infection manage throw new benefit with the chaos for many years on end. The brand new ensuing quarantine and you will unemployment caused some home owners to reduce the house to property foreclosure.

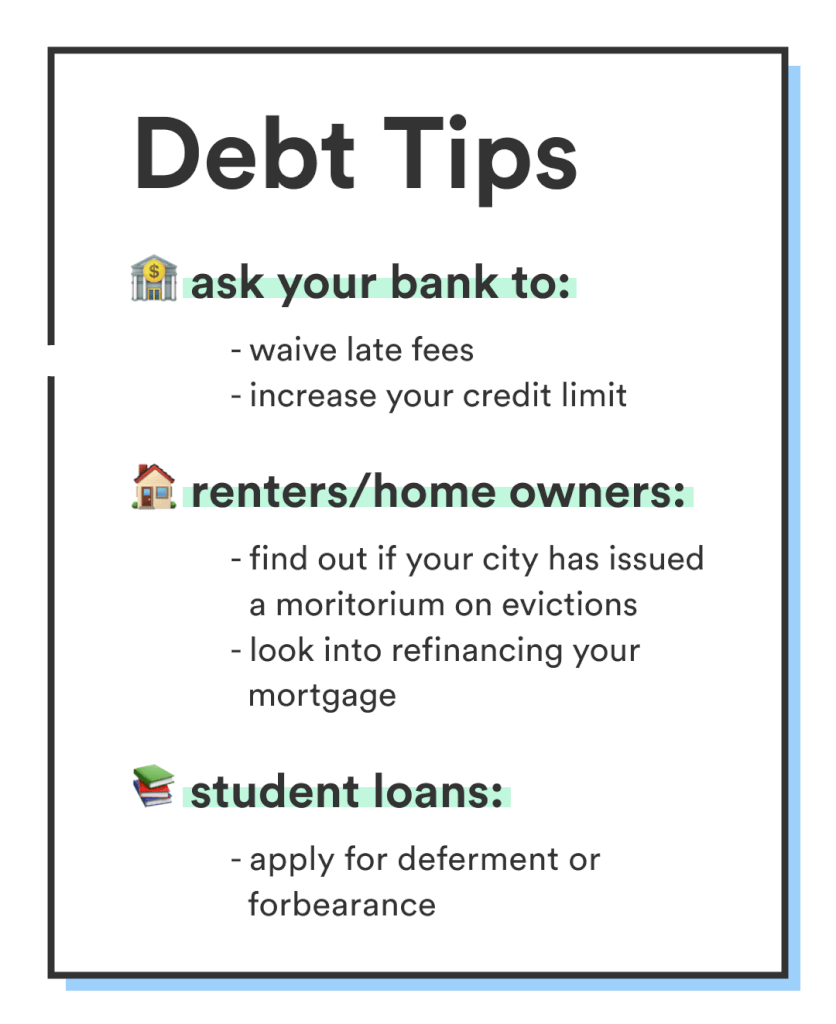

Brand new CARES Act, among government government’s solutions towards pandemic, greet specific people to get forbearance to their home loan repayments. The newest forbearance several months desired for eighteen months from paused custom loans Castle Rock costs but which period’s avoid will get foreshadow a revolution from foreclosures.

When you yourself have dropped about on your home loan repayments, don’t be concerned just yet. To prevent foreclosure could be you are able to, along with of the accessing their house’s guarantee.

Using house guarantee to get rid of property foreclosure

Many people that fallen trailing with the mortgage repayments may look to refinance, as a way to obtain a good interest rate and you may/otherwise all the way down their money.

Yet not, if you have already had a belated fee, refinancing might not be you’ll be able to. Identical to a charge card commission, their home loan company profile the fast and later mortgage payments to the three biggest credit rating bureaus. A late percentage can harm their borrowing from the bank users and you will scores, and come up with it more challenging to get refinancing.

In advance of looking at home equity, another option you may think when you yourself have overlooked home financing fee is known as reinstatement. That one allows you to spend the money for financial just what you have missed in the a swelling-contribution amount just before a certain go out. Although this amount may become attention and you may fees, it’s a chance to own home owners exactly who have not fell rather about, otherwise provides assets or offers they may be able incorporate. If you find yourself already up against foreclosure, even though, you do not get into a financial status to cover a beneficial reinstatement.

Another option is actually home financing amendment. This is exactly you can easily when you show the lender that the economic issues was temporary (age.grams., youre let go however, anticipate to feel reemployed soon). A mortgage modification also can include a deferral contract, and that requires one to pay a lump sum initial, otherwise a good balloon fee towards the bottom.

Tips accessibility domestic collateral

The opposite home loan option is available to home owners at the very least 62 years of age. As opposed to a classic home loan otherwise unsecured loan, your credit score is not one thing. Instead, the lending company considers your house guarantee to determine the total matter so you can provide you.