If you seek a mortgage for buying a new home or for refurbishing, it has to be approved by a mortgage lender for you to get your loan. One of the major factors involved in loan approval is the verification of the borrower’s financial information, but how do mortgage lenders ensure financial comments for loan approval.

Banking institutions and other loan providers can get request a great proof of confirmation put means becoming occupied inside and you may sent to the latest borrower’s bank to have processes end. A proof of put may require the borrower to include a minimum of 2 consecutive months’ lender statements. Inside mortgage approval process, if you’ve ever pondered what makes confirmation regarding bank comments to own mortgage loans needed? then your response is to minimize the possibilities of individuals with phony documents getting loans to possess unlawful activities.

Having hundreds of higher level tech around, it doesn’t get more than minutes so you’re able to create lender comments and you can almost every other data. Staying so it in mind, mortgage lenders is actually legitimately compelled to pick and you may indicate bank comments. Nowadays, there were several occasions in which mortgage brokers was basically ripped off from their currency with fake bank comments. To keep on their own eg cases of financial swindle, financial leaders need to find ways to view and you will be certain that financial statements.

Learning to Guarantee Financial Statements?

In order to accept home financing app, a home loan company has to make sure a number of info. These standards may include newest income, property, offers, and borrowers’ creditworthiness.

Into the process of making an application for a mortgage getting property pick, the lender most definitely will ask brand new debtor getting evidence of deposit on assets. The lending company next try questioned to verify that loans necessary towards the home purchase was transferred to a bank account and so are now might be reached by debtor.

The new proof deposit ‚s the only way to own home financing bank to verify if any sorts of deal has taken put before you apply on the mortgage. Evidence of deposit provides several other goal on bank. With the proof deposit, the mortgage team can be make certain if your debtor has enough financing in their membership and then make a down-payment. Whether they have decreased finance, it’s essentially experienced a red flag inside the application for the loan confirmation.

Always, a debtor pays a good 20% down-payment towards household. Whether your complete cost of the house is $two hundred,100000 then your debtor should pay $40,00 upfront. The lender should ensure when your debtor has actually adequate when you look at the their membership to help make the closing costs which might be included in an alternative financial.

The debtor needs to supply the bank for the a couple of very latest lender comments to confirm he’s got sufficient money for a good deposit. The mortgage organization up coming has reached out to brand new borrower’s financial so you can make certain in the event the information available on the bank declaration are real or perhaps not. This might be perhaps one of the most well-known means how to make sure financial comments throughout the home loan approval. The latest electronic decades makes it easier for fraudsters to manufacture phony bank statements and you will files in fact it is difficult to separate out of brand spanking new comments.

Version of Files during the Financial Getting Confirmation

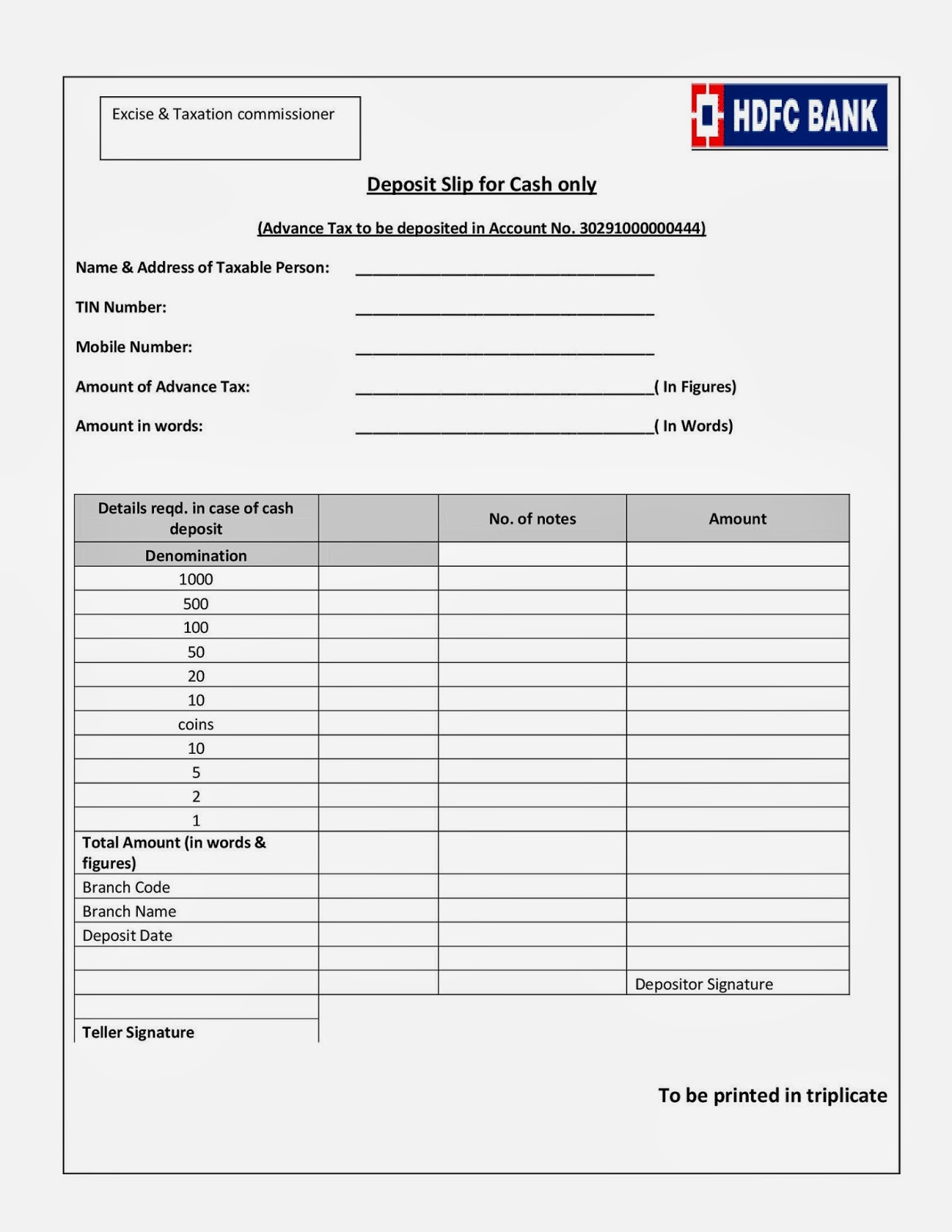

A lender should complete good POD (evidence of put) means so you’re able to a lender to get this new confirmation of your loan applicant’s financial pointers. There are many ways a lender can make certain if for example the borrower’s monetary data is genuine or not. As the file required for verification can vary regarding lender so you’re able to bank. Here are the typical variety of data for the mortgage approval:

- Account number

- Account variety of

- Discover or closed standing and beginning day

- Membership owner brands (these represent the formal owners of the fresh new membership)

- Equilibrium suggestions. (Along with most recent balance, account balance over two months/symptoms, or average bank account balance)

- Account closure day and harmony during the closure big date (if required).

As to the reasons Verification of Lender Statements Required?

Exactly why do mortgage brokers you would like bank comments? To minimize the possibility of accessibility gotten loans by borrower to own illegal affairs like radical funding or money laundering. Lenders feel the straight to ask for an effective borrower’s bank statements and you may find POD about financial, particular mindful loan providers is ask for they both. Loan providers explore POD and you may financial statements so as that the individual is eligible to have a home loan.

Particular loan providers often ignore an excellent immediately following-in-a-lives overdraft into borrower’s account within the membership history confirmation. In the event in the event that a consumer has its own overdrafts after that giving financing so you’re able to consumers is experienced a risk towards financial.

How does DIRO Confirms Bank account Comments?

As we mentioned above, it is getting easier and easier to fabricate fake bank account statements. With DIRO, you can verify bank statements with automated user consent and secure impersonation checks anywhere across the globe. DIRO can verify all account information including bank statements. Banks where to get a home improvement loan, financial institutions, and FinTechs can verify these statements using the DIRO lender confirmation provider.

DIRO’s unbelievable technology can be make certain any sort of lender document using basic steps. All the a user should would was join and be certain that lender statements on the web toward a safe browser. They facilitates enhanced user experience, reduces the risk of monetary offense, and you can immediate lender verification.

That’s not all you can use DIRO’s document verification technology for, users can access and verify any kind of bank information from any web source. One of the major ways to verify bank accounts is by processing micro-deposits, DIRO’s technology reduces the account verification time from 3-5 business days to mere seconds.

Mortgage brokers, finance companies, financial institutions, and you may FinTechs renders utilization of the DIRO’s prize-effective file verification technical so you can streamline the means of bank account and you can lender report confirmation.