Second Financial Rates and Charge

Contemplating bringing a second financial? It’s a convenient solution to use your home’s value to possess big tactics or to pay expenses. But, identical to with your first-mortgage, there are rates of interest and you may costs to take into consideration. These may differ a lot, very knowing the basics could save you currency and you can be concerned.

Interest rates getting second mortgages would-be more than very first home loan, as they are named a little while riskier getting loan providers. But never worry, into the best pointers and choice, you can find a great deal which works for you.

Willing to diving deeper and work out informed selection? Race Financial support is here to help you through the basics of 2nd mortgage loans.

What does a second Home loan Imply?

A second mortgage, also known as a property equity mortgage, feels like that loan you get utilizing your household while the security.

- Referring second in line having payment. It indicates if you can’t generate costs, the lending company will require your residence to repay their typical mortgagefirst, and, next people kept currency is certainly going into the 2nd mortgage.

- You get the bucks for how far collateral you really have at home. Collateral is simply the difference between exacltly what the house is really worth and exactly how far you still owe on your normal home loan.

Individuals sign up for second mortgage loans for many reasons, instance upgrading their house, paying financial obligation, or coating larger costs.

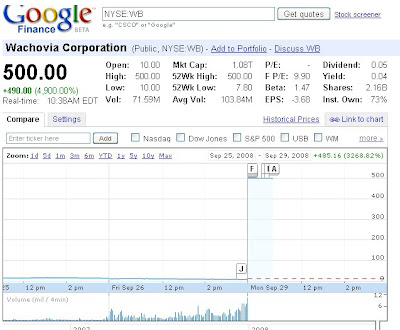

Think about, rates into 2nd mortgages can alter with regards to the market, exactly what the lender demands, as well as your very own financial predicament.

Benefits associated with a second Home loan

- Tax Benefits The eye this will pay to your a home collateral loan you can expect to probably getting taxation-deductible. It is, yet not, important to consult with your tax advisor to verify the new tax deductibility of interest.

- Unification from Costs When you’re currently balancing several monthly installments, combining this type of on a single, in balance home security mortgage percentage you certainly will describe debt lifestyle.

- Aggressive Interest levels Domestic security funds are notable for its appealing interest levels. When accustomed consolidate high-interest playing cards, new deals will likely be unbelievable.

- Expidited Loans Independence Whether your ultimate goal is to be totally obligations-100 % free, reorganizing your expense having a house security financing could be the ideal strategybining this that have abuse and you will persistence, you could find the right path in order to loans elimination simpler and you can quicker than simply your think you can easily.

Exploring the Styles of Next Mortgages

With regards to utilizing brand new security of your house, just remember that , the word 2nd financial means a number of money. Let me reveal a closer look within different varieties of 2nd mortgage loans offered, for each and every with exclusive features and positives.

House Equity Finance (HEL)

A house Guarantee Mortgage offers a fixed amount of money that try covered by equity of your property. It is generally disbursed from inside the a lump sum payment, while pay back the mortgage from the a fixed rate of interest over a predetermined several months.

It balance will be ideal for budgeting motives, but it addittionally form possible begin repaying interest into the complete amount borrowed quickly.

House Equity Credit line (HELOC)

A property Collateral Personal line of credit functions similar to a cards card. It includes a maximum borrowing limit, and acquire as required during the draw months. During this period, you might only have to pay the attention to your amount pulled. Following the mark several months finishes, you go into the payment several months, for which you pay-off the main along with appeal. HELOCs typically have changeable interest levels, so that your repayments can differ www.elitecashadvance.com/installment-loans-ia/portland/ as pricing alter.