The 3rd Routine together with discover the latest Watsons’ reliance upon a line out of circumstances condition towards suggestion you to an effective conditional union never fulfill home financing contingency term since mistaken, to state a minimum. The Watsons contended one, since next financial and assessment was in fact outside the control of your own Geraces, the fresh partnership was as well unsure. The third Circuit discovered this new quoted circumstances just like the inapposite since the, in those instances, the mortgage backup clauses was in fact depending on the profitable business out-of the newest buyers’ earlier belongings.

The third Routine noted that [t]right here, instead of here, the new requirements not only got a hefty likelihood of nonfulfillment using no-fault of the buyers, but in reality failed before deadline on mortgage contingency term. ‚ There’s absolutely no research about list that there try one genuine risk your next mortgage wouldn’t be offered. The fresh appraisal possess blocked the loan relationship only when it is to have an esteem underneath the arranged sales price.

In most, the third Routine emphasized that Geraces encountered the undisputed ability to comply with the remainder criteria, were under an excellent-trust obligation to accomplish this, and did conform to all of them.

Next financial was also awarded of the Wells Fargo; the financing Recognition Page identifies it an element of that it transaction

The next Routine and checked baffled as to why the brand new Watsons had any to terminate brand new agreement off marketing for each and every brand new home loan contingency clause. The next Routine very first stated that the new Geraces, within the price in itself had best and you will unfettered discernment to decide whether the home loan backup it received is actually enough. The 3rd Routine noticed that the newest deal particularly provided [a]new york mortgage partnership closed because of the Customer will satisfy that it mortgage backup.

For the good forcefully worded rebuke to your Watsons, the third Circuit influenced one to [t]he Buyers located the credit Acceptance Page sufficient and you can finalized it

The brand new Customers had the choice to waive the borrowed funds union completely, highly indicating which they you will definitely waive they so you can any sort of the quantity the fresh new financial connection are decreased. After that, the borrowed funds contingency condition makes the home loan commitment a disorder precedent for the Buyer’s obligation to complete it offer,’ showing that mortgage contingency condition operates with the Buyers’ work for.

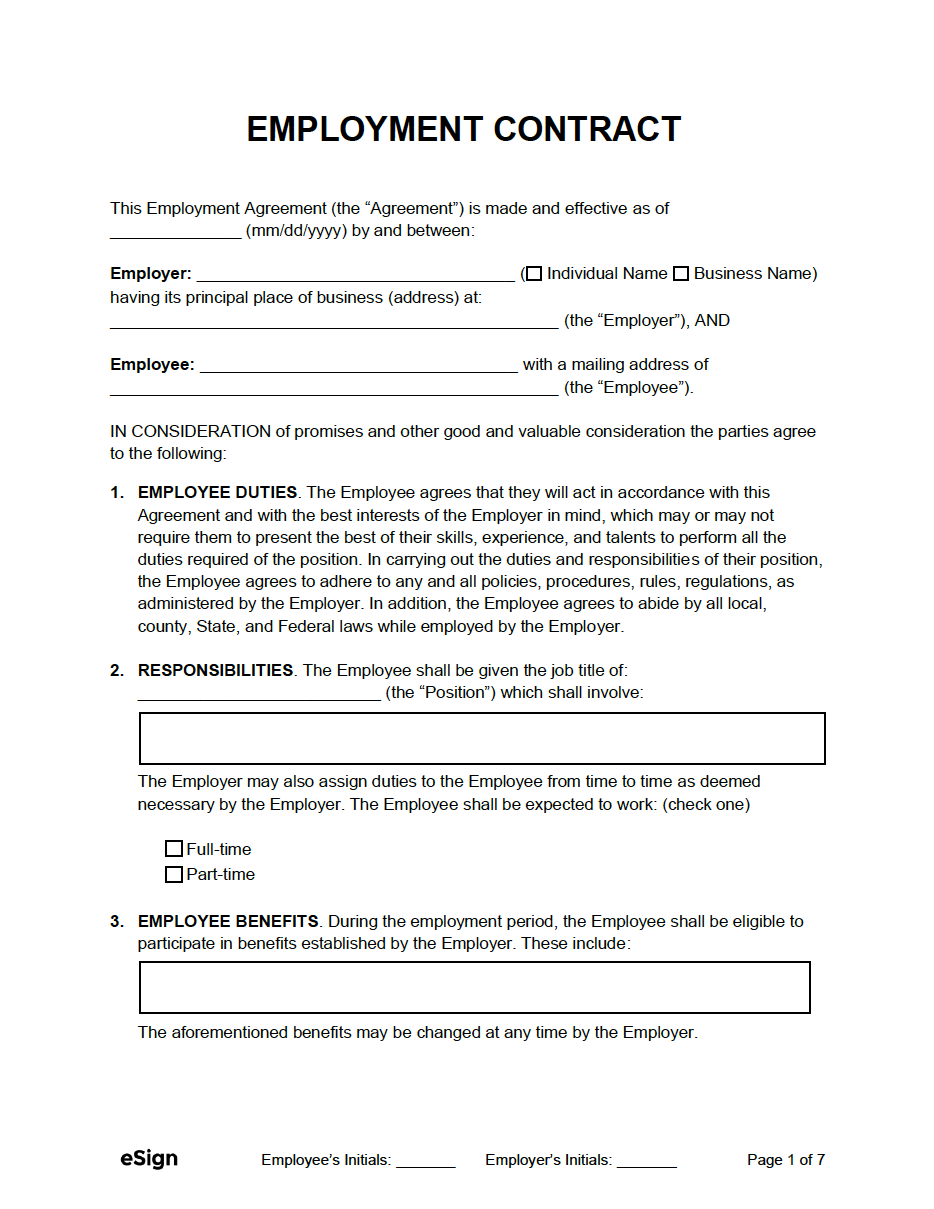

The standard variations authorized by the Pennsylvania Organization regarding Real estate agent (PAR) can be used for extremely domestic home purchases when you look at the Pennsylvania. Part six of simple arrangement has the financial backup condition. If the functions elect to are the home loan contingency condition since the an element of the arrangement, the buyer need to number, among other things:

- The mortgage amount of South Carolina personal loans the mortgage(s);

- Minimal identity of one’s mortgage loans(s);

- The type of the loan(s);

- The mortgage bank(s); and you may

- Maximum appropriate interest of financial(s).

Under the regards to the fresh agreement, the buyer must complete a mortgage software contained in this a keen decided time period regarding time of one’s arrangement is fully done because of the parties.

In the event the client doesn’t sign up for home financing inside decideded upon time, he is in standard of the contract.

- Just after getting the mortgage connection, the seller may only terminate the agreement in the event the:

- the commitment isnt appropriate through to the day off payment;

- the newest union is conditioned up on the fresh new sales and settlement of any other possessions;

- this new union will not keep the mortgage financing terminology conformed by the customer on agreement by itself; otherwise

- brand new union consists of almost every other standards not specified on the arrangement almost every other than others issues that is commonly met during the otherwise close settlement, including acquiring insurance coverage and you will confirming employment status.