Traditional 97 Loan System

A comparatively the fresh choice for reduced money down mortgage brokers are the regular 97 program provided by Fannie https://paydayloancolorado.net/sugarloaf/ mae and you may Freddie Mac. This means that it is possible to purchase a home with just good 3% down-payment. This is exactly below FHA already needs.

- Fixed rates financing

- Maximum loan amount is $424,100

- The home have to be the majority of your household

- Have to be an individual-family home otherwise condominium

- You shouldn’t has possessed a home in the last about three years

This option, even though it is a normal loan, merely demands a 620-credit rating in order to meet the requirements. This makes it really in the take of many buyers. Additionally, it makes you shell out the down payment into the a good provide away from family unit members or family unit members.

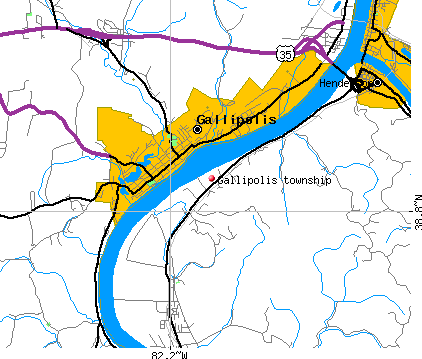

It’s really attainable today to get a mortgage having putting no money off, otherwise little currency off. The best options are to have armed forces vets through the Va financing program or Navy Government program, nevertheless the USDA system is even a lot for many who has actually a lower life expectancy earnings and so are purchasing a property in a great even more rural city.

Probably one of the most tough elements of buying a house having everyone is the downpayment. Residential property nowadays are receiving more expensive from year to year, and is also hard to pony upwards a hefty 20% downpayment.

However it is not needed in a lot of items to get you to definitely much currency down. While you are discover never as of several lower and no money down mortgages offered given that a decade in the past, you can still find a number of higher choices around.

The objective of this post is evaluate this new step one% off with no currency off apps that are offered since 2024.

The brand new 1% Off Financial Alternative

In the 2024, super banking institutions Financial regarding The usa, JP Morgan Chase and Wells Fargo made reports of the declaring arrangements to provide 3% down mortgage loans. While this is a good deal, there clearly was a special system in your area which is worthy of the believe.

That is the step 1% off financial given by Quicken Money. There are a few constraints and restrictions, but this is certainly a feasible selection for of a lot consumers who require to place smaller right down to pick their property.

The fresh step one% off Quicken financial exists within Freddie Mac’s House You’ll Virtue program. That is a government-sponsored program which had been revealed inside 2014 one requisite good 3% downpayment.

How does Quicken Loans get this to a 1% down program? Quicken Financing gives 2% to your household client and requirements a-1% deposit about debtor.

The latest 1% off financial program doesn’t benefit most of the domestic buyer. Earliest, it does simply be useful for orders zero refinancing is obtainable. 2nd, the application form is only to own people’s house house in addition they need to feel just one household members or condominium that they’ll reside in.

Third, for each and every debtor need to have a credit history from 680 or even more. They also must earn less than this new median money due to their county; this is the say goodbye for most consumers. History, they want to provides a loans to income proportion away from forty-five% otherwise shorter.

Why would individuals want to consider this financial other than for the fresh new 1% deposit? Professionals say that the newest regards to the loan are most useful compared to those offered by brand new FHA; you to definitely authorities-backed program now offers lenders to own lowest borrowing borrowers having an effective step 3.5% deposit.

Professionals declare that the newest FHA system provides an optimum LTV regarding 96.5%, but most borrowers rolled the necessary at the start financial premium out of step one.75% to the loan. Which simply leaves these with good % LTV.