Arizona – That have developers shopping for it much more difficult to obtain to get content and you can spend subcontractors, the fresh new wager is the fact alot more homebuyers might be asked so you can neck the burden by firmly taking aside framework funds in their own personal brands.

Not too discover some thing wrong thereupon. In reality, while you are there are lots of so much more dangers involved — we shall reach those — customers can acquire framework-to-long lasting, otherwise C2P, loans much cheaper than just builders, meaning that our home can probably feel built for less money.

Sometimes known since the single-personal, one time romantic if you don’t all-in-one funds, C2P mortgage loans start out once the framework finance then convert automatically to permanent resource in the event the residence is accomplished.

But although your financial explores new builder’s records and you will financial accounts, this is your shoulder at risk if one thing goes haywire

Brand new C2P money aren’t this new. They might be around for years and therefore are the best function off resource in the custom-built home field. But with loan providers improving the pub higher to possess builders, a growing number of manufacturing designers are needed to show to help you this product.

Accurate numbers are difficult to come by, however, estimates was you to C2P financing accounts for $49.4 mil during the framework financing, or around 20% of your own $222.1 billion altogether construction financial support got its start a year ago.

Richard Nirk, this new voluntary executive manager of the fledgling Federal Assn. away from Home-based Build Loan providers in the Greenwood Village, Colo., forecasts you to $forty five billion to $fifty mil of the newest credit lines supplied to builders commonly become C2P financing into the second 3 years.

Regarding to occur, some semblance away from buy needs to be taken to industry. Already, different build-to-perm applications all are along side ballpark, driving developers as well as their people batty with different guidelines and requires.

But with single-close finance, there is no altering your face, unconditionally, once structure initiate

Particularly, one financial must remark the newest builder’s banking references whenever you are a special might not. Or a lender may want to document a good builder’s permits, check-over his lien releases otherwise his draw otherwise payment plan or even have a look from the their terrible conversion process, however, someone else may not.

Many out of C2P lending, possibly sixty%, nonetheless comes to designers exactly who vertical you to-of-a-form domiciles. But Nirk, just who dependent Chase Manhattan Home loan Corp.is the reason design-financing department towards the a beneficial powerhouse in advance of to be a representative, told you production builders are in the end beginning to catch to the pros one C2P finance provide.

Huge developers can always obtain cheaper money, but nothing dudes at all like me cannot, said Jim Janco, which already been Montgomery House inside Denver early last year once expenses the prior 20 years while the a government within other strengthening agencies. He’d far more issue than just the guy asked, provided their structure feel, inside the lining up investment.

Janco, chairman of one’s Denver Household Creator Assn.is the reason sales and you can marketing council, likes construction-to-perm loans as the he is able to rate their domiciles a whole lot more relatively.

Because most consumers can buy a construction financing at about step 3 payment situations below normally the average builder, the offers to your an effective $2 hundred,000 family more than a typical 180-time building succession is approximately $3,000. Therefore, he can bump you to amount off his price tag.

There is also $dos,000 to help you $3,000 for the savings just like the there isn’t any extended two closings, one in the event that builder takes out the development loan plus the almost every other if customer removes the finish financial.

Most importantly of all, Janco wants that that have C2P loans he is able to explore someone else’s currency to create his home. I get the very best of both worlds. I’m able to generate plus it will not prices me a dime. It frees up my personal line of credit to put up specification home if i want and keep maintaining my [workers] hectic.

It isn’t plenty one financial support is far more expensive lately, told you James Owen, executive director of one’s Medina (Ohio) State Family Designers Assn. Rather, developers are increasingly being squeezed because of the loan providers who will be requiring far more records and or even forcing builder-borrowers to help you plunge using far more hoops.

That have normal capital, for individuals who reduce your task, endure a medical problem or maybe just features a positive change regarding center, you could straight back out of the income as well as you can beat is the deposit you gave new builder.

Likewise, you need to be mindful in selecting your own company. Only a few loan providers has monitors and you will stability set up to protect their passion otherwise your personal.

Finally, certain loan providers commonly creating enough to ensure that the specialist will pay his debts. Hence, it is up to you to be certain you to definitely closed releases was built-up out-of subcontractors and you may companies whenever brand new builder requests for currency. If not, you might be hit with a technicians lien.

Actually, you would be wise to ensure that the monitors the latest creator writes have been deposited and just have cleared before going to the second percentage. Its simply pursuing the money will get a beneficial funds in this manner the directly to file a great lien was extinguished.

This new Federal Assn. out of Residential Design Lenders is molded sixteen months in the past to Portland federal credit union personal loans take order into the extremely disconnected construction-to-long lasting, or C2P, financial market.

Beginning people were such as for instance home loan heavyweights because Washington Shared, Nationwide Monetary, Waterfield Financial, Pursue Manhattan and Federal national mortgage association. Today, the team comes with CitiMortgage and you can IndyMac Bank.

The team was designed to boost focus on the product, boost their access, boost support service, drop off chance and you may increase success. It is very developing criteria to your advantageous asset of designers, lenders and you will people.

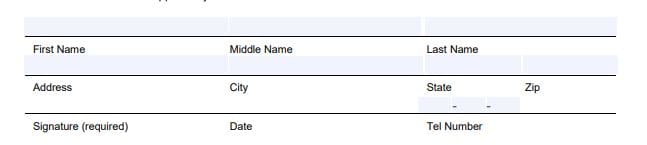

As the a first step, the latest 50-affiliate category are creating a standard contractor questionnaire you to definitely C2P loan providers are able to use to assist evaluate developers otherwise you to definitely builders have able getting consumers who will be going to apply for financial support.

In addition to towards association’s plan ‚s the creation of standardized papers having household plans and you will methods, for home inspectors and also for contracts, together with draw structure, disbursement alternatives and you can auto mechanics lien records.