Owning a home is a dream come true for many out-of united states, but it also comes with a serious economic duty. Paying off a mortgage may take age, and you may during those times, you might find oneself wishing getting a way to reduce your monthly payments or pay-off your house financing ultimately.

By refinancing your home mortgage, you might secure a far greater interest, shorten the payment term, or supply the new collateral in your home.

Refinancing your property mortgage is an intricate process that need careful consideration and you can browse. After all, what can get work for you to resident will most likely not necessarily end up being the best choice for another. That’s why you will need to take the time to understand the pricing to finance home financing, look home loan also offers and you can compare your options before making good decision.

Inside mortgage refinance guide, we shall take a closer look at the head the thing you need to learn about refinancing your home mortgage, so you can make an informed decision and you may reach finally your monetary wants.

Reduce new fees name

One of many benefits associated with refinancing your property financing is that it assists you shorten your own fees term. If you are currently towards a thirty-seasons mortgage, eg, you will be able to re-finance to help you an excellent 15-seasons financial, which have high payments. Thus you are obligations-free far in the course of time and probably save a considerable amount of currency for the interest along side lifetime of the loan.

Get a good interest rate

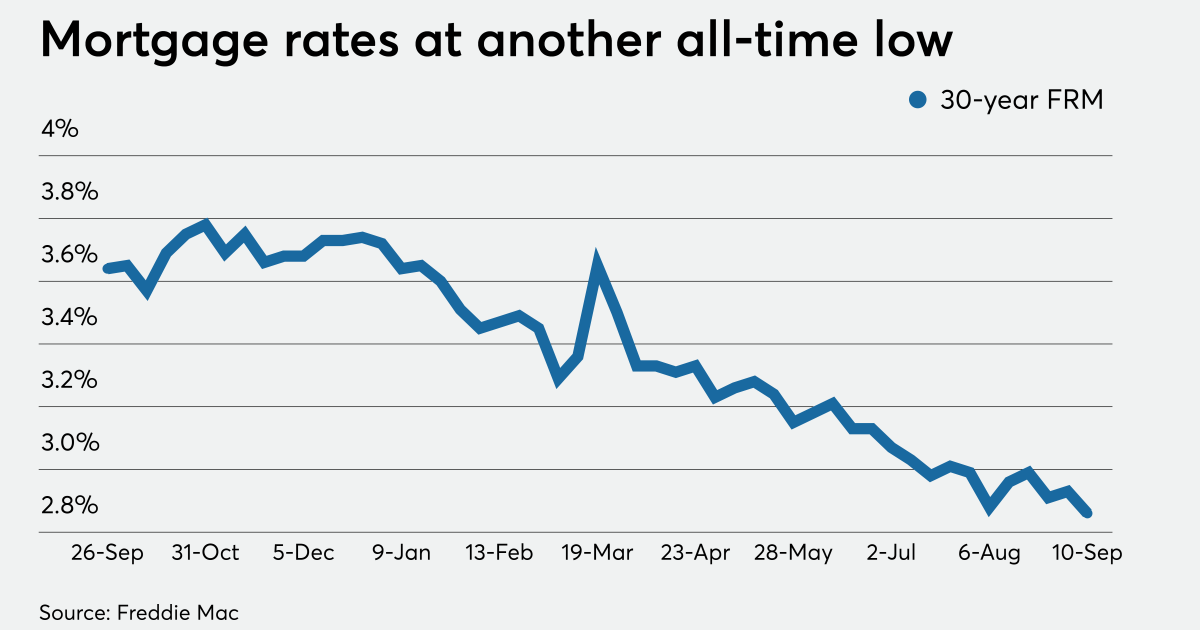

Another well-known reasons to refinance is the fact it helps your score a diminished interest rate. Interest levels normally change over time, and when prices provides changed as you basic grabbed your mortgage, you are able to re-finance to help you a diminished speed. This could somewhat reduce your month-to-month mortgage repayment and you will help you save profit the near future.

Access equity

In case the domestic has increased during the worth because you very first grabbed out your mortgage, you will be able to availableness the brand new equity of your property because of the refinancing. Collateral ‚s the difference in the residence’s latest worth and the harmony in your mortgage. Refinancing makes it possible for you to utilize you to guarantee by taking aside a larger financing otherwise by way of a profit-aside refinance.

Exactly how Refinancing Performs

The process of refinancing your home financing is similar to obtaining another financial. Once you have picked a fund financial and you may opposed rates and you will terms, you’ll want to sign up and supply documents, such as for example money verification and you can proof of home insurance. The lending company will then look at the job to discover for people who qualify for the fresh mortgage.

While recognized, the financial institution will pay of instant same day payday loans online Rhode Island your old financial, and you’ll begin making payments for the the mortgage. You additionally have to expend closing costs, that will become charge to have things such as an assessment, label look, and you may origination.

Additionally, it is needed to observe that there isn’t any perfect answer toward question of how much time it will require so you can re-finance an excellent financial. The total amount of date are different into a variety of things, including the difficulty of your app therefore the go out it will require to gather records, therefore the loan providers app comment processes.

With regards to a unique mortgage so you’re able to refinance your residence, you will need to carefully consider the potential advantages contrary to the will cost you on it. And additionally closing costs, that soon add up to thousands of dollars, there is most other costs and you can costs on the refinancing. It is essential to foundation such will cost you into your choice and view in the event your offers of refinancing usually outweigh the costs.

You need to bear in mind it might not feel the most suitable choice for everybody to refinance their residence mortgage, meaning you’ll want to directly think about your individual affairs and economic requirements prior to investing the process. Such as, if you plan into the swinging along the tune, the expense from refinancing will get provide more benefits than any potential coupons. Alternatively, when you yourself have too much security of your home, it could be far better to adopt a property guarantee mortgage or line of credit instead of refinancing.

Should you decide to re-finance, it’s imperative to prefer a lender that meets your needs and you can brings aggressive interest rates and you may terminology.

At Qudos Bank, you can expect a range of financial refinancing options to assist you achieve debt desires. The educated credit gurus can also be direct you from the financial refinance procedure which help you select your best option for the problem. You may access our house mortgage calculators, that will give you a price of the prices to re-finance your home mortgage and exactly how much appeal you could rescue compliment of refinancing.

Contact Qudos Lender today to talk to a financing pro which normally reply to your inquiries and provide you with suggestions for your own refinancing alternatives.