Therefore, we want to use the bank concerning you to definitely

Underneath the digitized financing provider, there is certainly the very least $100,000 credit line and you will interest levels are noted toward Fed’s overnight mortgage rates, currently at the 5.3%, and additionally a-spread associated with how big is the borrowed funds. Schwab intends to maximum borrowing so you can 70% away from underlying security to help you hedge market-relevant exposure, with regards to the form of safeguards incorporated. Many collection possessions can also be straight back the fresh new loans, long-identity illiquid funds are usually avoided, due to the fact are certain assets treated from the businesses, Kerr said.

Effortless programs is approved within just days, however, harder issues can also be need doing five days. Advisers can view the fresh new improvements of various proposals and loans within all the stage out of design to closure on a single system.

It simply creates a far more prevent-to-avoid have a look at for both the advisor and their buyer since they’ve been dealing with it, said Kerr. They usually have a-one-stop-shop today to see all of this and also profile towards the balance of one’s account, how much mark-off they have used and you may what the visitors is getting in line with the rate.

If you find yourself securities-depending funds is actually accessible as a consequence of various traditional and you may tech-motivated companies, merely Goldman Sachs is apparently advertisements an answer which can become finished toward an equivalent timeline.

SAS and you may Schwab Bank will highlight a number of extra position in order to banking characteristics to possess consultative readers with this week’s Perception appointment inside Philadelphia, considering Kerr

There’s an explanation why credit offices exists, said Alois Pirker, originator away from wealthtech consultative corporation Pirker Partners. They’ve been delivering things like risk into consideration. If you wish to stretch any organization techniques out thanks to an effective digital interface functioning on much faster increase, it ought to be managed carefully along with in order to enjoys great root analysis. That’s a non-flexible.

I know Schwab have envision throughout that, https://paydayloanalabama.com/tuskegee/ how to get in addition possible exposure due to course on one hand that you don’t comprehend the property date of your own business, and that means you keep them enrolled, that’s good for Schwab and you will best for the customer when the the market’s developed the right way, the guy said. However,, without a doubt in case the market happens sour, they could not only lose cash into the credit, plus might beat an individual that gets disgruntled. Therefore, it’s a dual-edged blade, but I will realise why it is the ultimate time and energy to manage they if the well-done.

We’ve got invested numerous space on the floor towards the bank to show the latest improvements they’ve got generated, therefore discover will be an increased impact indeed there, and you may we’ve certainly done an abundance of strive to up-top all of our offerings having advisers relative to tech, she told you. What we’ve concerned about the quintessential is prior to higher volume things that advisers is engaging in.

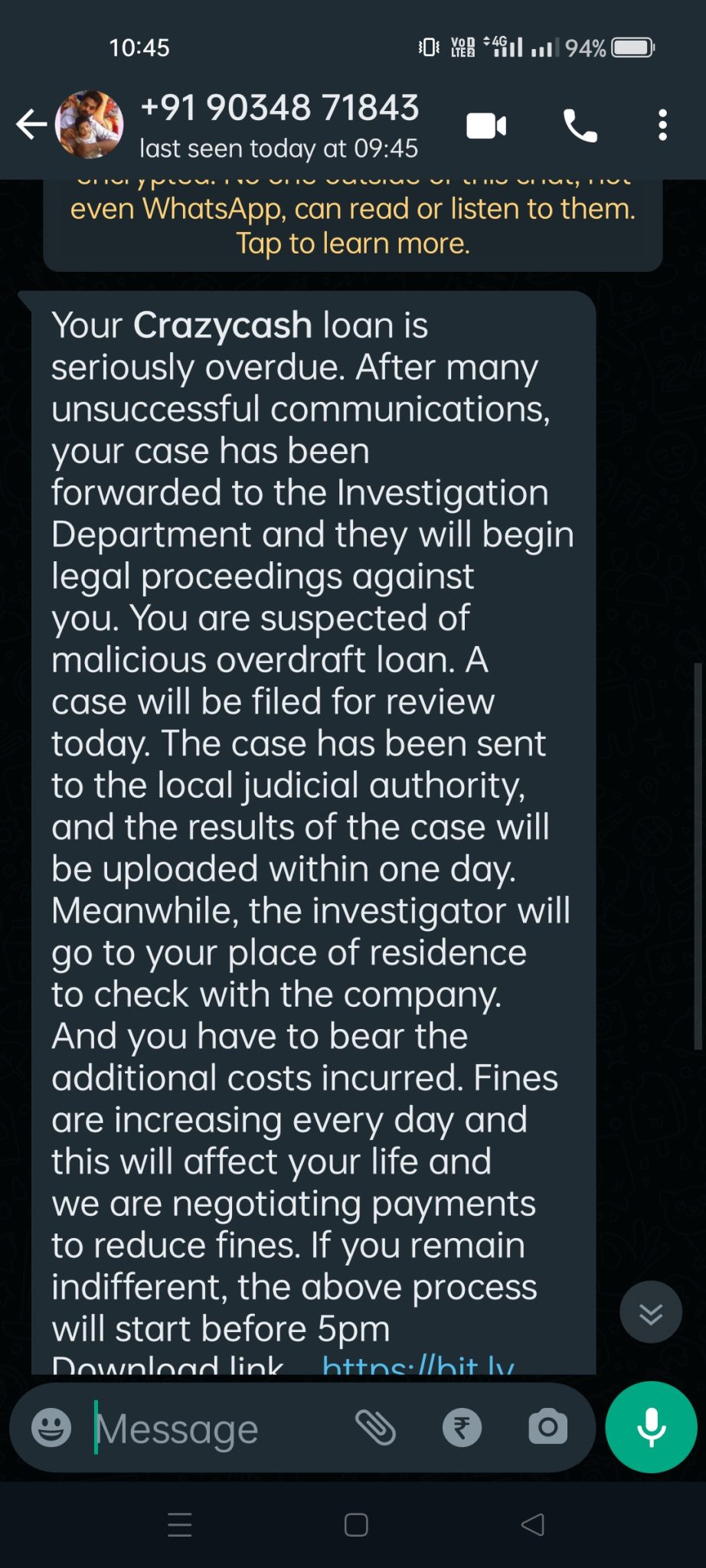

We now have redesigned all our money path prospective, also plenty of work to shore within the risk one is associated with the currency way and the actually ever-creative scammers nowadays, and there is done many works there in order to incorporate inside the a careful experience that enables the fresh advisor to activate the end visitors to ensure we’re once again protecting men and women property.

An enormous concern for Schwab overall was deploying resources and items that normally help the individuals ultra-high-net-really worth members out-of RIAs, she told you. We need to make sure that our company is appointment the needs of advisors while also certainly respecting the truth that the new RIA is the latest fiduciary throughout these things and should be opting for cash choices that actually work best for their clients.