There are many different other kinds of mortgage loans, along with interest-only mortgage loans, adjustable-price mortgages (ARM), and you may reverse mortgages, among others. Fixed-speed mortgages are still the most popular brand of home loan, by far, having 30-season fixed-speed programs as being the most well known style of all of them.

Action away from Trust

Specific You.S. claims do not use mortgage loans that often, if at all, and you may rather have fun with a confidence deed system, which a 3rd party, labeled as a trustee, will act as a kind of intermediary ranging from loan providers and you may individuals. More resources for the difference between mortgage loans and you can deeds from faith, get a hold of Deed Out of Believe against Home loan.

Financing versus. Financial Plans

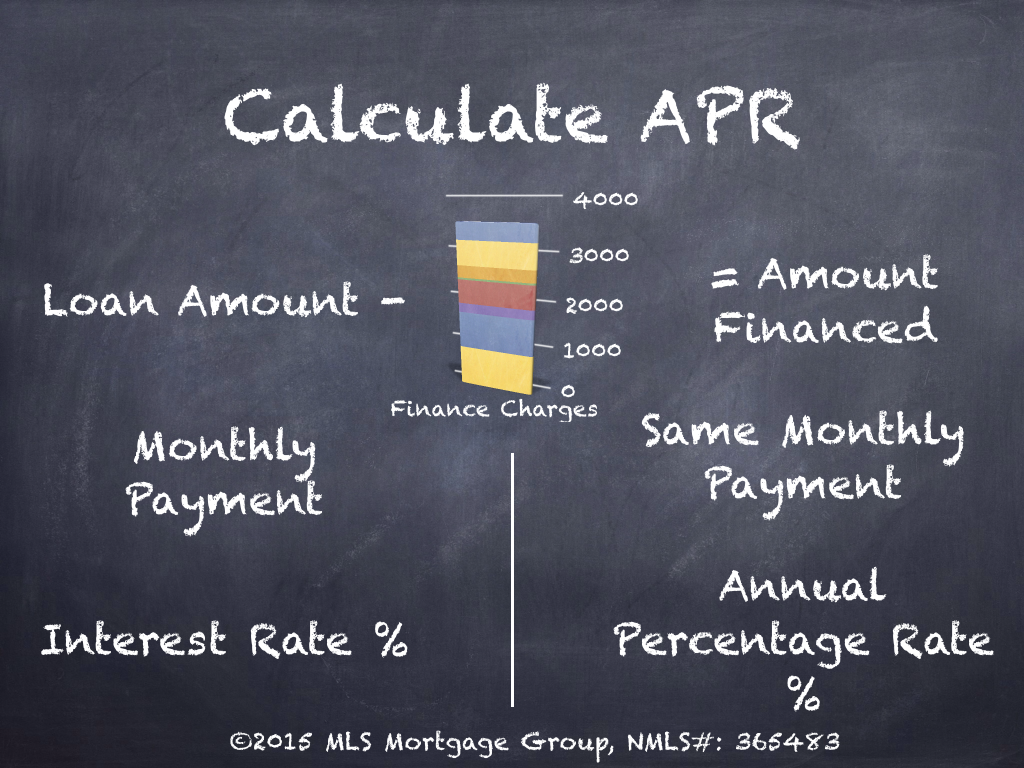

Mortgage and you will home mortgage plans are discussed also, but details are different considerably with respect to the sort of mortgage and their terms and conditions. Extremely preparations certainly explain just who the lending company(s) and you may borrower are, exactly what the interest otherwise Annual percentage rate are, exactly how much should be reduced and in case, and you will what the results are when your debtor doesn’t pay-off the loan throughout the agreed upon time. With regards to the guide The direction to go Your business Which have otherwise As opposed to Money, „A loan is payable to the request (a request loan), when you look at the equal monthly premiums (a fees loan), or it can be an excellent up to next see otherwise owed at readiness (a period of time mortgage).” Extremely federal securities laws do not connect with loans.

Bilateral mortgage plans happen ranging from a couple people (or around three regarding action of trust factors), this new debtor therefore the bank. They are typical types of financing agreement, as they are relatively easy to utilize. Syndicated mortgage agreements occur ranging from a borrower and you may numerous lenders, such as for instance multiple banks; this is actually the arrangement widely used to have a firm for taking out a highly highest loan. Numerous loan providers pond their funds to one another to make the loan, and so reducing individual risk.

Just how Loans and Mortgage loans Was Taxed

Financing commonly nonexempt income, but alternatively a variety of financial obligation, and so individuals shell out zero fees to your currency obtained regarding a loan, and dont subtract commission generated into the borrowed funds. At exactly the same time, loan providers aren’t permitted to deduct the degree of that loan using their fees, and you may costs away from a debtor are not considered gross income. With regards to interest, yet not, borrowers have the ability to subtract the interest these are generally charged from their taxation, and you will lenders need certainly to lose interest he has acquired as an element of their revenues.

The principles changes a bit whenever that loan obligations are canceled just before repayment. Up until now, the latest Internal revenue service considers the new borrower to possess money on mortgage. To find out more, get a hold of Termination out-of Loans (COD) Income.

Currently those with private mortgage insurance rates (PMI) are able to deduct its pricing using their fees. So it laws is decided to expire into the 2014, and there is currently zero signal you to definitely Congress often replace the latest deduction.

Predatory Lending

Those trying take-out that loan should become aware of predatory lending methods. These are high-risk, dishonest, or fraudulent methods accomplished by loan providers that harm consumers. Financial scam starred a button role throughout the 2008 subprime financial crisis.

References

- 43 An easy way to Money Your own Ability Flick by John W. Cones, third model, penned 2008.

- Common Sorts of Home loans –

- Loan Words Glossary – College away from Ca

- What is actually a guaranteed Financing? – Wells Fargo

- Wikipedia: Financing contract

- Wikipedia: Mortgage

- Wikipedia: Mortgage

Concerning Blogger

Nick Jasuja try an entrepreneur and you can buyer that have a love of personal loans. He achieved monetary independence https://paydayloanalabama.com/louisville/ because they build and you will getting numerous online retailers and you may investing a property. Which have an MBA into the Loans and you can bachelor’s education inside the Desktop Science, the guy will bring a separate mixture of technical and you can economic studies so you can his creating. His hand-on knowledge of taxation planning and you can estate government, together with their dedication to monetary literacy, allows your to provide standard knowledge to aid anyone else browse its monetary excursions.