Having a term financing, you receive an upfront lump sum payment, which you upcoming pay off based on an appartment schedule. Except for advanced schooling expenditures, USAA allows borrowers explore their financing each goal.

Popular reasons for taking out fully an unsecured loan become merging individual obligations, fulfilling emergency expenditures online payday loan Rhode Island otherwise carrying out remodels or big house solutions. If you find yourself USAA would not consolidate your fund to you, you can use the mortgage financing to individually pay back the a good expenses.

A personal bank loan also may help if you are confronted with an emergency bills. Play with our most readily useful emergency loan opinion to find the proper disaster loan provider for you.

USAA unsecured loans pricing

USAA even offers aggressive annual percentage rates (APRs) for personal loans, anywhere between 7.85% to help you %. These costs are a 0.25% auto-pay disregard. Although loan providers fees mortgage origination charge between step one% and you will 5% of total loan amount, USAA will not costs mortgage origination costs. Getting a beneficial $100,000 unsecured loan, it indicates you can rescue to $5,000 during the charge compared to most other loan providers.

Specific lenders also fees a good prepayment or early commission commission you to definitely lets loan providers recoup some of the money destroyed in order to very early loan costs. USAA cannot fees these types of prepayment penalties to repay the loan early in the place of adding to the overall price of borrowing from the bank. Having said that, USAA charge a later part of the payment equivalent to 5% of the skipped commission matter.

USAA personal loans economic balances

USAA is actually zero chance of heading significantly less than any time in the future – at least not based on credit score service In the morning Top. They has just verified USAA’s financial energy get out of A great++ (Superior). Am Best visited the get by examining USAA’s balance sheets, business methods and other facts linked to team resilience.

USAA personal bank loan access to

Obtaining a good USAA personal line of credit are a relatively easy process. In this area, we will break down their likelihood of qualifying to possess a consumer loan, USAA contact details and studies off earlier in the day borrowers.

Accessibility

USAA merely brings unsecured loans to effective USAA professionals. If you are USAA will not publish particular criteria to have loan qualification, you have a credit score of at least 640. USAA get accept lower credit ratings, but less-accredited consumers need to pay high APRs. Your ount need. Do not let a credit score prevent you from taking right out a consumer loan. Have fun with the guide to the best signature loans to have poor credit to find the correct lender for you.

USAA may also consider carefully your income and you may financial obligation-to-money (DTI) ratio whenever comparing the application. DTI simply splits all of your current monthly loan money by the month-to-month earnings. Such as for example, if you make $10,000 thirty days and your month-to-month personal debt money full $step 3,000, then you have an effective DTI of 29%. Lenders usually prefer individuals whom take care of a great DTI out-of below around 43% whenever providing financing.

Contact information

- A virtual broker chatbot

- A customer service range – 210-531-USAA (8722) – between 8 a beneficial.m. and you can 5 p.yards. CT Tuesday by way of Friday

- Postal mail during the USAA 9800 Fredericksburg Rd, San Antonio, Tx, 78288

USAA doesn’t record a customer service email address into the the contact page. But not, they keeps social media users on Myspace and you can Fb, each of that are obtainable by the simply clicking the correct icons at the base proper-give corner of one’s USAA web site.

Consumer experience

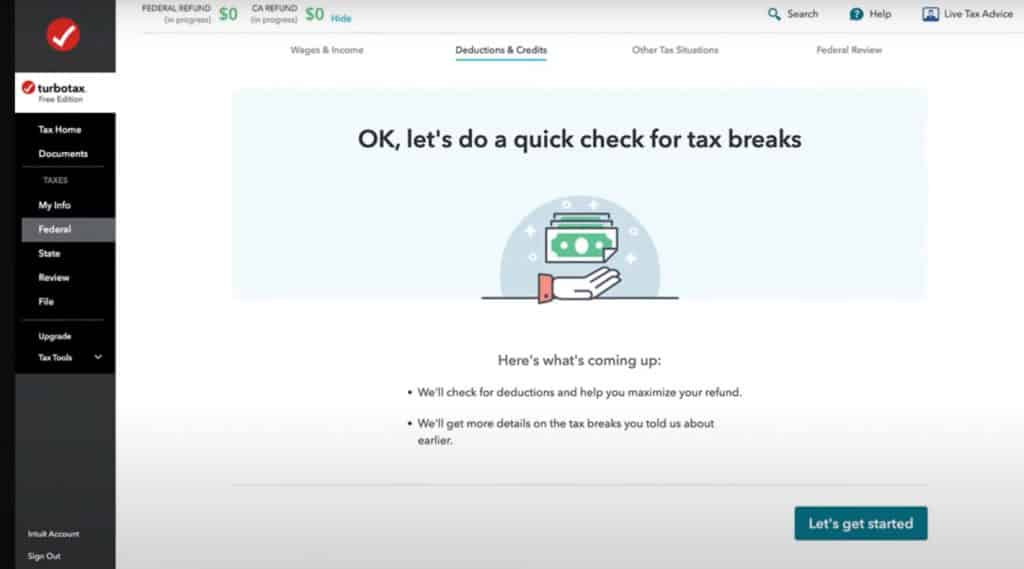

Applying for a personal loan are a comparatively quick and you will quick techniques. Get into your own USAA banking sign on advice for the financing web webpage using USAA on the internet and fill out the application form. According to USAA webpages, this course of action will be just take a few momemts.