Navigating Virtual assistant Finance when you look at the Area Assets Says: Techniques for Maried people when you look at the Sonoma and River State, Ca

To get property are a monumental action, and you will protecting a Va mortgage is going to be an excellent option for veterans looking to make you to definitely fantasy a reality. not, residing in a community property condition such as for instance California contributes a sheet of difficulty, specially when you’re hitched plus spouse’s borrowing is not excellent. Contained in this post, we will explore how your own spouse’s obligations make a difference to your debt-to-income (DTI) ratio and you may just what actions you need to use in order to however qualify for your own Va financing inside Sonoma and River County.

Facts Community Possessions States

California was a community property state, for example both spouses are believed equally guilty of debts incurred inside the marriage. That it code affects exactly how loan providers view the Va loan application. Whether or not your wife actually listed on the financing, its costs continue to be factored into your DTI ratio. This may either lessen the number your qualify for, undertaking pressures to own potential homebuyers.

Brand new Effect of your Partner’s Borrowing and Loans

When applying for a great Virtual assistant financing, the lender tend to remove your partner’s credit file to evaluate their debt obligations. Let me reveal as to the reasons which things:

- Debt-to-Money Proportion: This new Va mortgage guidelines need loan providers to take on the obligations, including the ones from the non-borrowing from the bank partner. Highest levels of personal debt from your spouse can increase your own DTI ratio, probably decreasing the loan amount you might be eligible for.

- Credit history: While the partner’s credit rating cannot yourself effect the Virtual assistant loan eligibility, high debts or bad credit score is also indirectly influence brand new lender’s choice of the affecting your mutual economic profile.

Leveraging Your Partner’s Income

Luckily, you will find a silver liner. In case your spouse has income, this is certainly regularly counterbalance their obligations, efficiently balancing your DTI proportion. Here is how it works:

- Money vs. Debt: The financial institution commonly calculate your own combined income and obligations to decide a accurate DTI ratio. Whether your instant same day payday loans online Oregon spouse’s money is actually nice enough to protection the month-to-month financial obligation repayments, this can help decrease your complete DTI ratio, boosting your loan eligibility.

- As well as Spousal Income: To make use of their spouse’s money, you’ll want to include all of them about loan application. It means their credit history and you will financial history would-be scrutinized, but it also function the income may help mitigate the new perception of their obligations.

Important Measures in order to Qualify

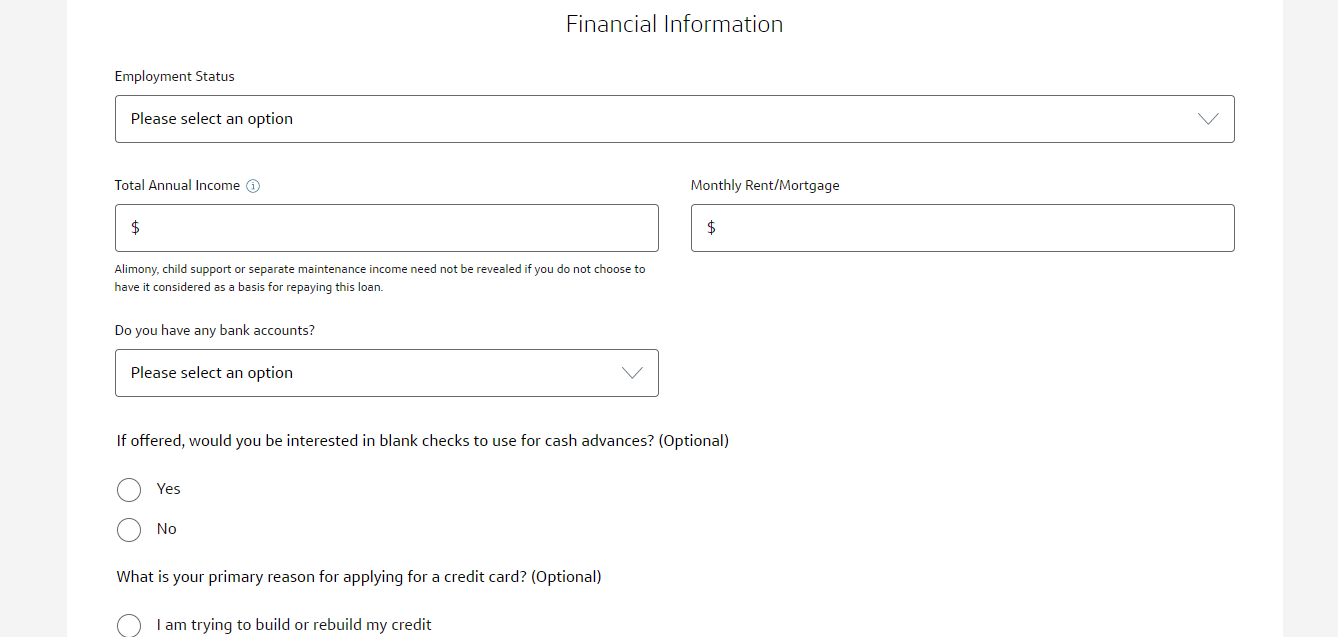

- Assess Your financial situation: Comment both your along with your spouse’s credit file and you can debt obligations. Wisdom debt status will assist you to strategize effectively.

- Speak with a home loan Elite: Dealing with a knowledgeable home mortgage manager also have insights tailored for the particular disease. Capable make suggestions from the subtleties out-of Va fund for the a residential area property state particularly Ca.

- Maximize your App: In the event your partner’s earnings normally rather offset their financial obligation, consider including all of them in the application for the loan. This consists of addressing people borrowing issues in advance to change their economic character.

Achievement

Navigating Virtual assistant financing from inside the a residential area possessions county instance California can be be difficult, specially when your spouse have borrowing things otherwise high debt. Yet not, by the understanding how these types of products impression your own DTI proportion and you can leveraging the spouse’s money, you could replace your possibility of being qualified to have good Va mortgage. If you’re looking to buy a property for the Sonoma or Lake County, getting hands-on actions and you may seeing a mortgage professional tends to make a big difference for the gaining the homeownership requirements.

At the end of a single day, to shop for a house concerns finding the optimum equilibrium and you will strategy. When you are advised and wishing, you could potentially overcome the problems posed by the community property rules and you may hold the Virtual assistant financing to help you along with your family generate a brighter upcoming.