Premier account also have totally free Atm use of most of the ATMs, including non-Webster ATMs. From the such ATMs, Webster pays one holder charges. Most other examining account has actually totally free supply simply to Webster ATMs, at which there are regarding three hundred, pass on during their claims regarding company.

In which Must i Discover Webster Financial?

Webster do business during the five claims: Connecticut, Massachusetts, Rhode Area and you will Ny. A good many their locations can be found in Connecticut. Its Ny and you will Massachusetts metropolitan areas try limited to quick portion. They don’t have people metropolises from inside the New york city or Boston.

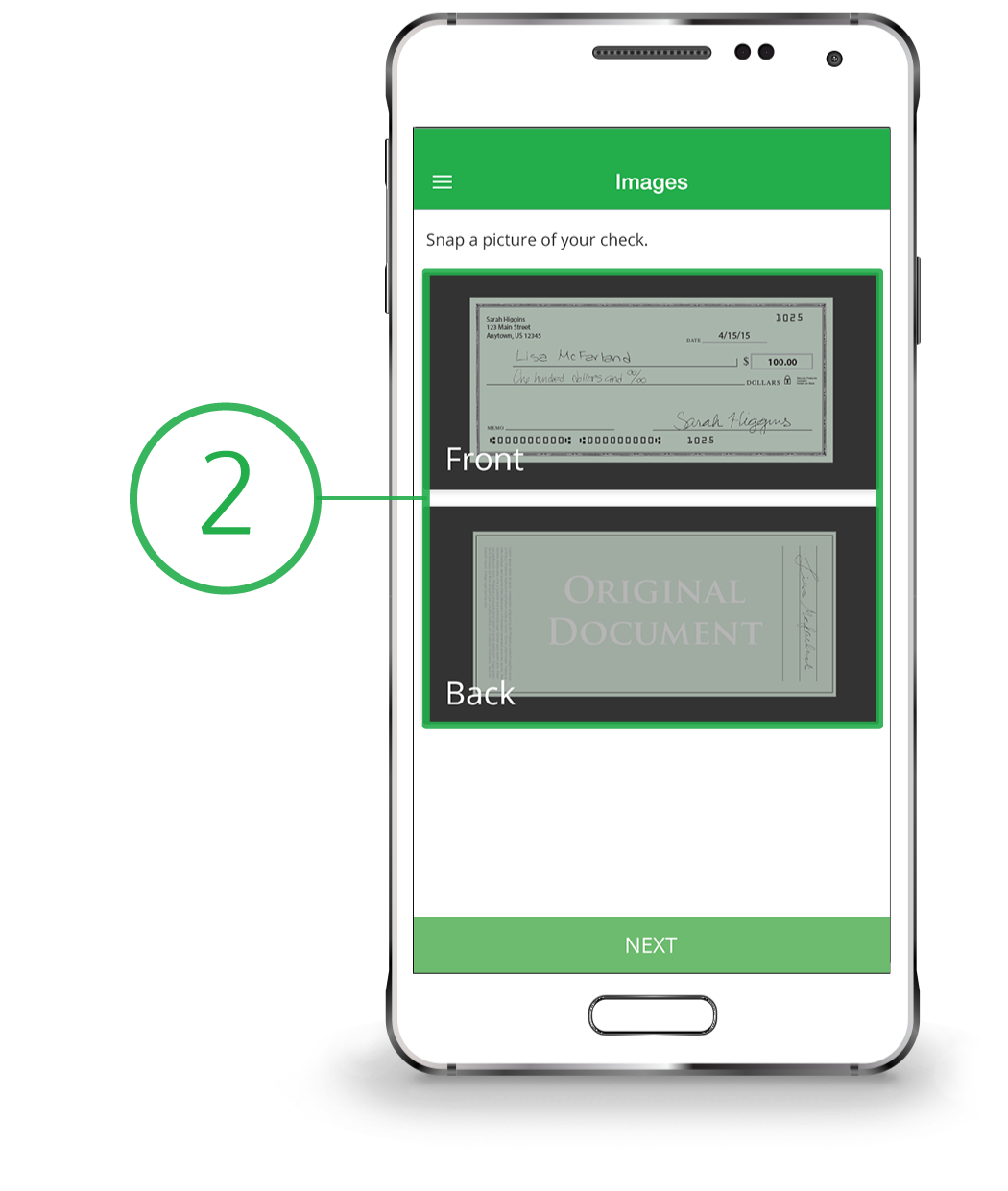

Webster now offers online and you may mobile banking with all of levels. Possess become cellular view deposit, digital costs percentage, transfers between profile and membership comments. You’ll be able to have a look at current purchases on debit and credit cards.

You want to note that Webster’s application try defectively rated on the Apple software store. It’s only 1.seven a-listers regarding five, with 76 product reviews.

How to Availableness My personal Currency?

If you need cash, you might withdraw currency for free during the a great Webster Automatic teller machine. The lending company has actually approximately 300 ATMs, many inside the Connecticut. Webster charges a great $2.fifty commission for most spends at the non-Webster ATMs, plus people Automatic teller machine holder costs, although some levels is exempt. You could examine account stability and import currency playing with Webster’s cellular application or webpages.

How to Cut More money Which have Webster Lender?

The best opportunity to increase offers with Webster Bank arrives compliment of the better rates the lending company proposes to people who have a premier or WebsterOne Family savings. For folks who unlock one of those profile, you gain use of Cd costs of up to 0.50% to own a-two-year Computer game.

Men and women levels enjoys pretty highest minimal balances, however. Such as for instance, to cease using an excellent $ ($ having head deposit) month-to-month service percentage towards the a WebsterOne Matchmaking account, you will want to maintain a balance of at least $cuatro,000 across the checking, discounts, and money market profile. Which means you’ll you prefer about $5,000 to start an effective Computer game towards higher prices (minimal equilibrium to have a great Cd is actually $step one,000).

What’s the Processes to own Beginning a merchant account That have Webster Bank?

You could potentially unlock a discount otherwise checking account through the Webster Lender website. To do so needed your own Social Coverage amount, license and a position advice. With this recommendations in hand, the process is pretty small, lasting below 20 minutes or so. Make sure to read the lowest account balance to avoid services costs (discussed more than), to be able to discover your bank account with sufficient loans.

What’s the Hook?

Webster keeps an extremely local footprint, restricted to Connecticut and you can regional servings of some states. Accessing your bank account outside of one footprint could well be problems if you don’t have a top Family savings (Webster talks about Automatic teller machine costs of these account).

Additionally, Webster’s cost for the coupons and money industry levels commonly such highest. These accounts generally speaking earn but a few fractions away from a %, a bit lower than federal averages. Higher prices is reserved for consumers whom unlock among Webster’s high-avoid checking levels, Largest and you will WebsterOne.

Conclusion

If you live and you may work in Connecticut, Webster Bank offers a reasonable local-option for the individual banking needs. It’s a complete selection of financial properties. Interest rates aren’t such as for instance at the top of really account, no matter if highest interest levels are available to customers just who unlock specific top-notch examining membership.

Unfortunately, we are currently struggling to select family savings that fit the standards. Excite alter your browse conditions and check out once again.

Sadly, our company is currently not able to see family savings that suit https://clickcashadvance.com/personal-loans-tx/victoria your own conditions. Please alter your browse criteria and try again.

Webster Worth levels provide a predetermined fee out-of 0.01% APY into the all of the dumps, however the other kinds of discounts membership possess an excellent tiered rates program, with you to membership having higher costs to have large deposits. Costs on these levels aren’t including high if you are perhaps not deposit six figures, nevertheless they perform defeat big federal banking companies.

The key reason Largest and you can WebsterOne account need larger stability try that they allows you to supply high rates toward Webster Dvds and you can coupons profile, together with particular coupons towards the fund such household collateral money and you will mortgage loans.