Mortgage underwriting is the process through which your financial verifies the qualifications to have a mortgage. The fresh underwriter and ensures your residence fits the new loan’s conditions.

Underwriters is the ultimate decision-companies as to regardless if the loan is approved. They follow a pretty rigid protocol with little go room. However, waits can always occurs at the additional stages in the process.

Some tips about what can be expected during the financial underwriting, and what to do when your mortgage acceptance try getting extended than just asked.

- How long does underwriting capture?

- The new underwriting process

- Isn’t any development very good news?

- Underwriting having re-finance loans

- Ideas on how to speed up underwriting

How long do underwriting grab?

Lenders have some other turn times’ – the amount of time it takes from your own loan becoming recorded to own underwriting review to your concluding decision.

A full mortgage loan process typically takes ranging from thirty and you can forty five weeks from underwriting so you can closure. However, turn minutes is going to be influenced by a number of factors, like:

- Inner staffing formula

- Application for the loan volume (how many mortgage loans a lender try running at a time)

- The brand new difficulty of one’s mortgage reputation (like, anybody which have points in their credit history usually takes longer to help you approve than simply someone that have a super-brush credit report)

During the extreme issues, this action could take provided thirty days. Yet not, it is unlikely to take a long time if you do not possess an especially challenging loan file.

While you are looking home financing, inquire lenders just how long it’s currently bringing these to intimate to your property pick or refinance (according to your loan form of).

As well as shopping rates of interest and you will settlement costs, turn moments shall be one of many last factors on your own best selection of a loan provider.

Underwriters pay attention to your debts. They must ensure everything you offered on your own mortgage software because of the checking it facing their paperwork.

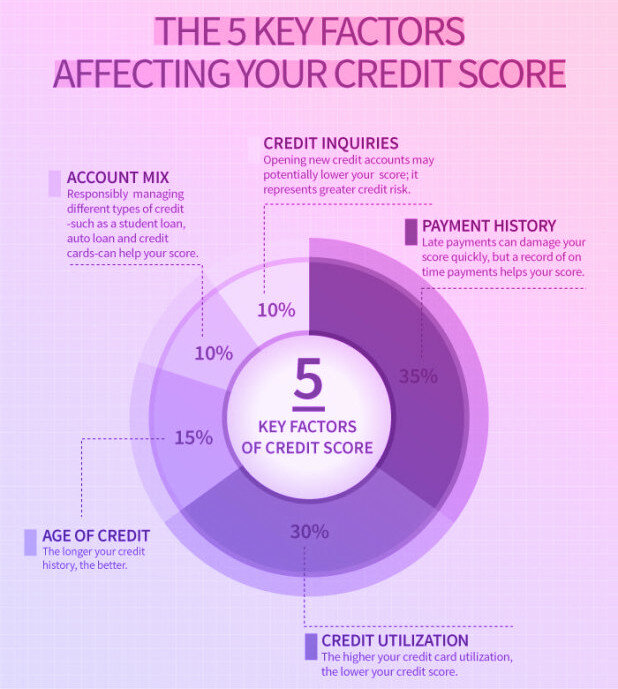

- Credit – Your own credit ratings and credit history is indicative of possibilities to repay their mortgage loan

Provided your money here are some plus the home appraises within otherwise over the purchase price, you are able to proceed to the next phase, that may be a great conditional approval.’

2. Conditional approval

Essentially, since terms of your own conditional recognition had been fulfilled, the newest underwriter tend to matter latest acceptance. It means you’re obvious to close.’

A mortgage will likely be denied should your regards to the fresh conditional approval are not satisfied, or if perhaps your financial advice has evolved because you were pre-acknowledged.

By way of example, if the credit history falls within pre-approval and you will final underwriting, you can also not any longer be eligible for the borrowed funds words otherwise financial speed you had been 1st considering.

Within these issues, the fresh new debtor may have to re-make an application for a different sort of financing or straight back out and hold back until the items raise before applying again.

Isn’t any development very good news?

.jpg)

Query how frequently you should anticipate to found standing, and also in what mode. By way of example, for anyone who is checking the email? Will your own financial share thru text? Or perhaps is indeed there an on-line portal otherwise application you can examine to follow along with their loan’s progress?

Uniform telecommunications is key. If at all possible, your own bank will reach out immediately when the discover people factors regarding the underwriting processes. In case you’ve been prepared longer than requested, bring it abreast of you to ultimately reach out and see exactly what was evoking the decelerate.

Do underwriting take longer to possess refinance financing?

But recall, closure minutes will vary by lender. The fresh new loan places Newville underwriting techniques you’ll disperse faster when the an excellent lender’s underwriting group is loaded with bandwidth, or slow to a spider when they bombarded that have loan requests.

When you are obtaining loans, you could inquire lenders regarding their most recent closure minutes to assist see which ones can agree your home mortgage quicker.

Ideas on how to automate the brand new underwriting processes

Since they’re an important aspect of your own home loan recognition procedure, you will need to anticipate to have most of the needed records that’s asked.

Points as simple as a missed signature is also extend underwriting and you can cause closing delays. Thus feel comprehensive when signing and you will evaluating the records.

And keep your own communication outlines unlock. In the event the underwriting is actually taking longer than asked, get in touch with the loan officer to see what is resulting in the reduce and you will whether some thing required away from you to maneuver the latest process along.