If you have already been your house loan lookup, a few home loan products have in all probability risen to the top of your list: FHA funds and you will conventional funds. Talking about several of the most common money, each features its benefits and drawbacks. However, which is ideal for your requirements?

You can aquire a complete scoop on the FHA funds right here. But today, we are going to end up being extracting the new (not) old-fashioned edge of so it debate. Very first things earliest: What is a traditional financial?

What is a traditional home loan?

Don’t allow title deceive your-a traditional financial isn’t as basic as you consider. And is the best thing! There’s really no you to-size-fits-the in terms of funding your home.

In the place of an enthusiastic FHA loan (which is insured from the Federal Casing Management), a traditional mortgage actually covered of the people authorities-supported service. There are two main brand of antique finance:

- Fixed-Rates

- Adjustable-Rates

For the a fixed-rate home loan, their payment will remain an identical every month, till your own financial is actually reduced or you re-finance your loan. If you are looking for one thing uniform and work out budgeting less complicated, this really is a selection for you.

During the a variable-price financial (ARM), their payment per month change through the years. You could start aside having all the way down payments to have a fixed period, however, after that windows your own interest will likely alter.

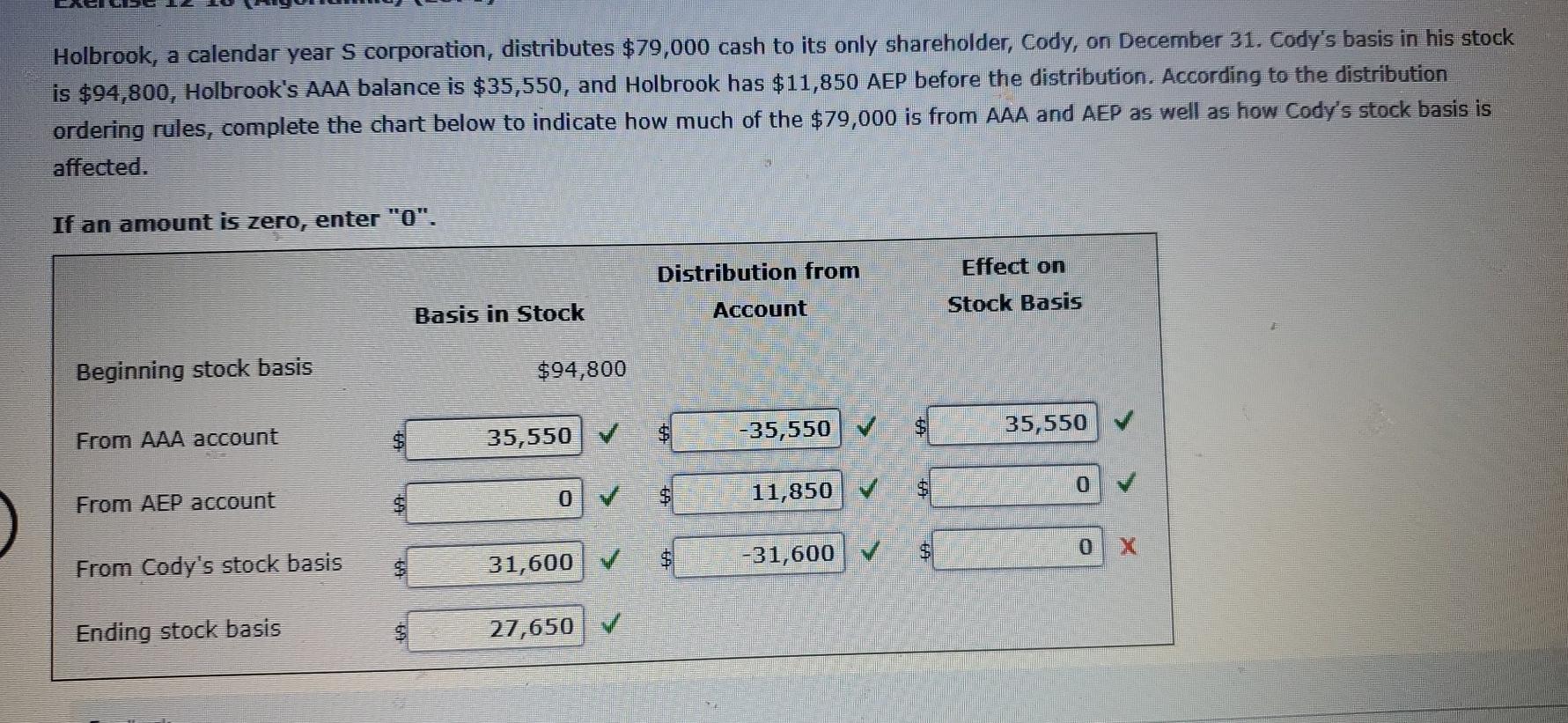

I currently oriented you to an FHA mortgage is actually authorities-insured whenever you are a normal financing is not. But there are some other key variations to consider on the FHA compared to. traditional mortgage debate. It is all concerning the certificates.

Assets Requirements

If you undertake a normal mortgage, you’ll not need meet with the possessions conditions needed for an FHA mortgage. Therefore if you have the attention towards the a great fixer-upper that might not citation an FHA review, a normal financial may be the route to take.

Get Constraints

A conventional financing normally undoubtedly be taken to suit your top home, you could and take you to definitely off to pick a secondary family or money spent. An FHA financing is only able to be taken for your no. 1 house.

Financial Insurance policies

When your down-payment is at least 20% of purchase price, no financial insurance policy is required for a conventional loan. Whether your downpayment is leaner, you will need personal financial insurance rates (PMI) up to you’ve paid back 80% of the residence’s value.

Down-payment

Minimal down payment for each particular depends on your own credit history, but with a keen FHA mortgage it can be as low as step 3.5% of your cost. Your down-payment on a conventional loan could be as lower as 3%, however you will more than likely have to set out way more to get rid of paying PMI.

Fico scores

So you’re able to be eligible for a traditional loan, you will want a credit history away from 620 or even more. Although you only need a rating away from 580 to possess an FHA financing, a diminished credit score mode a higher minimal down payment and you will speed for versions.

Debt-to-Income Proportion

Lenders want to know you are able to create your monthly costs. So if the debt-to-income proportion (DTI) are over fifty%, you’ll have a more challenging day bringing acknowledged for sort of mortgage. There is way more independency with traditional loans vs. FHA financing, but you will wish to have good DTI of 43% or shorter for your ideal chance at the getting accepted having a traditional mortgage.

FHA against. antique financing: Whenever is a normal home loan best?

Every person’s property trip varies, so what’s effectively for you depends on the money you owe, the homeownership needs, and that gut impact you to lets you know, This is basically the one.

Tip: If an FHA financing is the best match today, you might nevertheless re-finance so you can a normal home loan later on in the event the your circumstances transform.

- Your credit rating is 620 or more.

- Your debt-to-earnings ratio is actually 43% or quicker.

- You are to get a fixer-upper.

- You have adequate offers and make a higher down payment (thought 20% or more).

- You will be to order a holiday house or money spent.

- You prefer the flexibility towards the monthly obligations that an arm also provides.

- You don’t want to deal with stricter qualifications involved in a government-backed mortgage.

Very, if you would like far more freedom along with your finances are located in good figure, a traditional loan can work to your benefit (zero disrespect to help you FHA financing-you know we payday loan 250 dollars like you).

I do believe a traditional mortgage is the best personally. Exactly what are my personal next tips?

Now you be aware of the cure for practical question What is a conventional mortgage?’ and just how it stacks up facing an enthusiastic FHA financing. Before you go to obtain the ball going on software procedure, the next thing is in order to connect that have that loan maker. Our team is here now to greatly help every step of your own method.

If you like significantly more independency, your credit score was more than 620, and you’ve got sufficient in the savings and also make a high down commission, a conventional mortgage is a much better fit than an enthusiastic FHA financing.